March 2019 - Market Update

/Monthly Update || March 2019

“Several things go together for those who view the world as an uncertain place: healthy respect for risk; awareness that we don’t know what the future holds; an understanding that the best we can do is view the future as a probability distribution and invest accordingly; insistence on defensive investing; and emphasis on avoiding pitfalls. To me, that is what thoughtful investing is all about.”

OPENING REMARKS

Greetings from inside Ikigai Asset Management headquarters in Marina Del Rey, CA. We welcome the opportunity to bring to you our sixth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process. We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, we continue to examine a rapidly evolving crypto market from dozens of different angles. Up until this last month, the preponderance of evidence generated from those various angles led us to believe the bottom was highly unlikely to be in for this market. Over the last month, based on the signals we track, we believe the likelihood this market has already bottomed has increased, albeit from a previously low likelihood. A month ago, we were highly convicted this market had not yet bottomed. Today we are less convicted in that stance.

Over the last month we have developed new analytical tools to more clearly understand what has happened, what is happening and what may happen in the future in crypto markets. These tools, in conjunction with tools we already had, are currently generating mixed signals - which we will dive into in further detail here. When examining the crypto landscape, there are sound reasons to be both bullish and bearish over the next 1-3 months. That being said, our long-term, directional bullishness on this technology and asset class remains unwavering: crypto assets and Distributed Ledger Technology will be among the most important creations of our lifetimes. There are no mixed signals about that.

After speaking with dozens of crypto ecosystem participants in 2019, including the full spectrum of investor types, it is clear to us that in October 2018 there was hundreds of millions of dollars on the sidelines ready to be deployed into crypto. When the mid-November price crash occurred the overwhelming majority of that capital took a step back and essentially said “yeah we’ll check back in six months”. Those investors didn’t stop doing work on the space and many of them understand the value proposition for certain crypto assets more clearly today than they did four months ago, but they did push their timelines for capital deployment into the future. The global macro backdrop, which we discussed at length last month and will touch on again here, is meaningfully more supportive for crypto assets today than Q4-18. Specifically, the Fed’s actions January 29th were deeply bullish crypto – both in terms of being a risk asset, and by increasing the need to hedge against the largest monetary and fiscal policy experiment in human history. From what we’ve seen and heard over the last month, this backdrop is reaccelerating interest in crypto and it might very well put an end to this bear market. After all, if it wasn’t for Quantitative Easing, none of us would probably be here.

FEBRUARY HIGHLIGHTS

Jack Dorsey Endorses Bitcoin On Joe Rogan And Takes “Lightning Torch”

Elon Musk Endorses Bitcoin and Ethereum On ARK Invest Podcast

Morgan Creek Digital Fund Secures Investment From Two Public Pensions

Cambridge Associates Recommends Institutions Explore Crypto Investing

JPMorgan Announces Its Own Centralized Cryptocurrency For Intl Payments

Facebook Announced Cryptocurrency Launch For 1H-19

New Rakuten Payment App Supports Crypto

BTT Price Increases 7x From ICO; fetch.ai ICO Sells Out In 22 Seconds

Ethereum Constantinople Hard Fork Executed

MIXED SIGNALS, A.K.A. IS THIS TIME DIFFERENT?

A Market Regime can be defined as a combination of characteristics that lead to an overall direction, tone, risk and opportunity set of a given market. Market Regimes often generate dependable market actions and asset relationships. When one Market Regime ends and another begins, once-dependable market actions and consistent asset relationships break down. In traditional asset classes, this may happen once a year or even less. “Don’t fight the Fed” could be characterized as a Market Regime and has been in place for nearly a decade. In crypto, Market Regimes shift frequently, seemingly every quarter.

We believe this market may be shifting regimes, and the possibility that the bottom is in has increased meaningfully over the last month. There are a number of conflicting signals right now - reasons to be both bullish and bearish. While we maintain a bearish bias, we are currently seeing signs of a possible regime shift. One of main overriding difficulties in trying to interpret what the market is doing right now is answering the question - Is This Time Different? This Time Is Different has been a widow-making phrase in markets for a long time, but crypto is not like other markets. From legendary trader Peter Brandt on 2/22:

A measurable across-the-board rally has occurred in the crypto markets. Does this rally spell the end of the massive bear market that cut most crypto prices by 90%? Is it time to get back on board the “bull market train?” Of course anything is possible in the crypto markets. These markets have re-written the rules on what is possible. While any strong bounce is encouraging, the weight of the evidence from an objective technical analysis perspective is that the crypto rally is a dead-cat bounce at worst and just the early stages of a bottoming process at best.”

One of the primary lenses that might suggest that This Time Is Different is how small the market cap of the space is. On paper, BTC is ~$70bn but 54% of that BTC has not moved in a year or longer. So maybe you call that $40bn. On paper, Bottom 99 is ~$60bn but that number is deeply overstated due to a severe lack of liquidity. You cannot sell even a third of that market cap at that price. A “real” number is something much lower than that - likely less than half that. The entire crypto universe is a *tiny* amount of Market Cap. When taking into account the very high cross-coin correlation right now, the entire universe is literally one large-cap stock - not even a mega cap like XOM, or APPL.. more like Costco. Trading all of crypto is like trading Costco and Costco only. Of that $60bn in the Bottom 99, which probably acts more like $30bn or less, >$2.5bn is sitting in Stablecoins and we know that’s actually real money because it’s backed by USD. That Stablecoin AUM is the closest to the field from “the sidelines” - the most ready to push back into the market and buy. There are undoubtedly hundreds of millions of dollars more watching this market closely. In the context of global macro capital flows, it will take *a drop in the bucket* of capital inflows buying crypto to put a hard end to this bear market. Those are the makings of a regime shift.

We are seeing many indicators that flash bearish. To name a few:

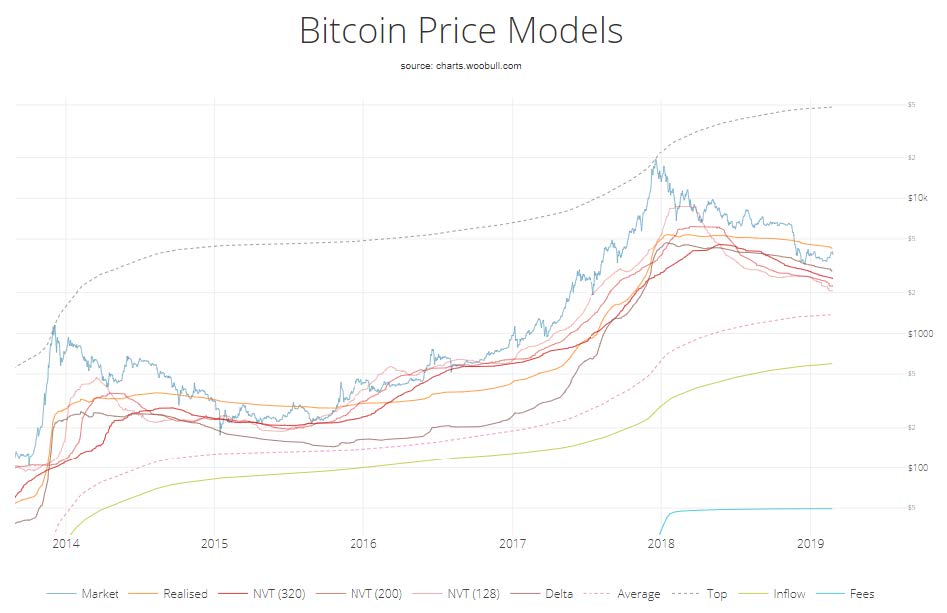

1) Broadly speaking, fundamental valuation based on on-chain metrics point to the late innings of a bear market, where price is closer to the bottom than the top, but not yet bottomed and not nearing a period of meaningful sustained price increases. The below is from Willy Woo and shows multiple valuation models. We have many other proprietary valuation models that broadly come to the same conclusion – a bull market is not close.

Source: Woobull.com.

2) Bitfinex Long/Short positioning. Historically, offsides shorts that are forced to cover have been fuel for pumps and offsides longs that are forced to sell have been fuel for dumps. When the ratio gets too lopsided one way or another, a large price move typically ensues. The below chart is Bitfinex BTC Longs-Shorts in red, BTC price in Blue, and periods of elevated long positioning vs shorts in yellow.

Source: TradingView.

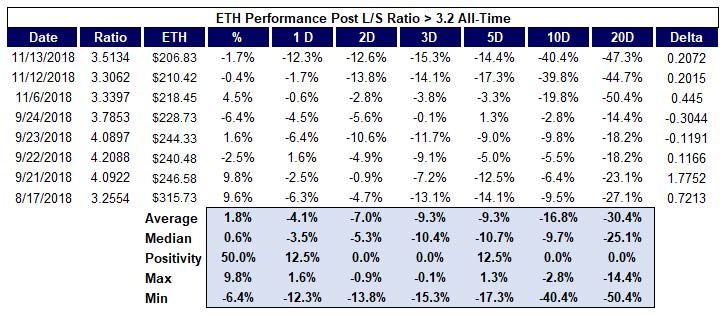

ETH L/S positioning is even more dangerous. The ratio of longs to shorts is shown in red, ETH price in blue and periods of elevated long positioning vs shorts in yellow.

Source: TradingView.

Source: twitter.com/Rptr45.

3) Fear & Greed Index. Historically, when the market gets too greedy and this index is elevated, a price decline ensues.

Source: https://alternative.me/crypto/fear-and-greed-index.

4) Completion of bearish high timeframe prior trend breaks. The below chart shows the two dominant patterns from the last year- a breakdown of a descending triangle and a failed inverse head & shoulders, both of which project to <$2500. Also note BTC’s inability to make a sustained higher high this last week, failing at the previous highs from January.

Source: TradingView.

The issue with the above list is that none these are an impediment to new flows coming into the space if they decide now is the time and price they want to buy. Since the space is so small now, just a couple hundred million dollars of new money can be enough to stop this bear market in its tracks - L/S Bitfinex and Fear & Greed be damned.

So how do you gauge that sort of new buying? On-exchange volume in big coins on reputable exchanges is some of the best empirical evidence we have. From that perspective, we’ve had real activity this month. LTC, ETH and BTC have all put in some very big volume, positive price action days in February. It is hard to say exactly how much “new money” has come into the space. What we likely know is that sophisticated market participants have taken notice of that incremental buy and followed suit.

Source: CoinMarketCap.

Source: CoinMarketCap.

Source: CoinMarketCap.

While we firmly believe the Cycle makes the News and the News doesn’t make the Cycle, the last several weeks has undoubtedly seen a net positive news flow of a magnitude that reached the “real world” – just read the February Highlights above. On top of that and likely even more importantly, the global macro environment is undoubtedly more supportive of risk assets today than it was in Q4-18. Bitcoin is undoubtedly a risk asset right now, and it behaves as such. But it is a risk asset with a specific set of investment characteristics, which become more attractive as insurance against global central bank and governments monetary and fiscal policy irresponsibility. The worse they act, the more the valuable insurance is.

Overwhelmingly the most important factor for risk assets is what the Fed/US Govt does, and in turn what other major global central banks and governments do. Here’s a chart to help illustrate that point. Nasdaq in red. BTC in blue.

Source: TradingView.

Over the last month, with the Fed clearing the way, we’ve seen other central banks fall in line.

However, members observed that if [housing] prices were to fall much further, consumption could be weaker than forecast, which would result in lower GDP growth, higher unemployment and lower inflation than forecast… it would be appropriate to hold the cash rate steady and for the Bank to be a source of stability and confidence while further progress unfolds.”

– Reserve Bank of Australia Minutes 2/19/19

If (currency moves) are having an impact on the economy and prices, and if we consider it necessary to achieve our price target, we'll consider easing policy,"

– Bank of Japan Governor Haruhiko Kuroda 2/19/19

“If things go very wrong, we can still resume other instruments in our toolbox”

– Mario Draghi 1/28/19

Politicians and pundits with little understanding of economic concepts are now trying to engineer support for the egregiously irresponsible fiscal policy decisions they want to continue making. These developments are deeply bullish crypto but in a scary sort of way.

Source: Google Trends.

As we have said many times before, we are in the midst of the largest monetary and fiscal policy experiment in human history and it is unlikely to end without significant stress on risk assets. A bet on BTC is a bet to opt out of that experiment – an insurance policy on the irresponsibility of central banks and governments around he world. To the extent those central banks and governments act increasingly irresponsibly, that is deeply bullish crypto. It’s bullish for risk assets and its bullish for a non-sovereign, hard-capped supply, global, immutable, decentralized, digital store of value.

We have consistently stated that we will not be in the business of catching falling knives. The risk-adjusted return proposition of knife catching is rarely compelling. BTC was up ~15% in February- the first positive month since July. BTC is approximately flat since Jan 1, flat since Dec 1 and ~25% off the absolute bottom in mid-Dec. So, we are still firmly in knife-catching territory in terms of being long here. That being said, the table is set for a potential regime shift and we are beginning to see signs of this shift occurring. If these signs persist or new signs emerge, we will be able to say with increasing confidence that the bottom is in for crypto. Currently, this is far from obviously true. We are getting mixed signals. If the bottom is in here for crypto, we will have rewrite our understanding of what bottom looks like in terms of on-chain valuation metrics. But this is crypto. For a hundred different reasons this asset class is not like other classes. So, This Time may very well Be Different.

| Symbol | MTD | YTD | % ATH |

|---|---|---|---|

| BTC | 11% | 3% | -81% |

| ETH | 28% | 3% | -90% |

| XRP | 2% | -11% | -92% |

| BCH | 12% | -15% | -95% |

| EOS | 53% | 38% | -84% |

| XLM | 3% | -24% | -91% |

| LTC | 46% | 52% | -88% |

| TRX | -6% | 27% | -91% |

| Aggregate Mkt Cap | 16% | 3% | -84% |

| Aggr Alts Mkt Cap | 21% | 3% | -89% |

Crypto prices increased in February, with BTC generating its first positive month since July and its second since April 2018. The rally emanated from LTC on 2/8, which put in a stunning +30% that day on the largest volume since December 2017 and inducing the largest “stop run” for LTC in BitMex history. ETH was able to rally meaningfully in advance of the Constantinople hard fork on 2/28.

Last month we stated- “a retest of the mid-December lows of ~$3150 appears likely to occur in February, and we believe it is likely only a matter of time before that support level breaks and we make new lows” . BTC price came within $200 of that mid-December low before rallying ~15% into month-end. We currently believe there is a lower-than-previously-estimated likelihood that we make new lows, but it is still entirely possible.

Shown below, the largest increases in tokens were event-driven in nature: 1) The Samsung Galaxy S10 was revealed to have a native Enjin wallet; 2) Theta Mainnet launch announcement March 15; and 3) Ontology launches development platform on Google Cloud. It is a sign of a healthy market that these price increases are occurring around fundamentally positive news events – whether they can hold those gains remains to be seen.

Source: OnchainFX and Ikigai.

One encouraging sign that we are paying close attention to is a decline in cross-coin correlation over the last three weeks. As we have stated many times before, a highly correlated crypto market is not a healthy sign. To that end, correlations declined as crypto prices increased in the back half of February, albeit from extremely elevated levels. If this trend continues, it will give us increased confidence that the market may have bottomed.

Source: Coinmetrics.io. As of 2/28/19.

Hash rate continues to trend upwards. This is a positive sign.

Source: Blockchain.com

The BTT ICO, released on Binance’s Launchpad platform, increased 10x in price the first 6 days of trading on Binance, before settling in at 7x from ICO price at month-end. At the end of the month Binance Launchpad launched their second ICO, fetch.ai, which raised its hardcap limit of $7mm in 22 seconds. The FET token traded publicly the last two days of February and closed out the month 5x from ICO price. The order book depth for both BTT and FET shows deep two-way liquidity, a sign of heavy market maker involvement.

The price action in BTT and FET is both encouraging and concerning. Encouraging because of the appetite - a willingness to deploy new capital - and the returns generated. But concerning because of the pump and potentially dump nature of these ICOs. Neither BTT nor FET are tokens that accrue value as currently structured. Both project whitepapers are entirely lacking in substance. Binance appears to be willing to support these new projects through the Launchpad and likely by giving market makers very attractive economics on “providing liquidity” to the ICOs once launched. This is not the sound foundation that we would ideally want to see as the basis for finding footing to climb out of this bear market. This is Binance CEO CZ’s way of “marketing”. He has deep pockets and is highly incentivized to stir up excitement in the crypto markets and put an end to this bear market. We are closely watching further market developments in this area.

The Bottom 99, which we have discussed at length previously, tried to make a higher high last week after putting in several higher lows, only to be rejected. The elevated volume over the last several weeks is also noteworthy, including some big volume on positive price days. It is worth mentioning that these volume numbers are from CoinMarketCap, which includes rampant wash trading, so it is impossible to know for sure how meaningful these volume numbers are. Regardless, this chart bears close watching, and a new high on elevated volume would be a positive sign.

Source: Coinmarketcap. As of 2/28/19.

BTC volumes on reputable exchanges, likely the most accurate measurement of volumes in the space as whole, increased M/M. The trailing 7-day avg volume at the end of February was ~23% higher than the end of January. This is encouraging, and a continuation of these increased volumes with flat-to-up prices would be a sign we may have seen the bottom.

Source: TradingView.

MARKET UPDATE – VENTURE CRYPTO ASSET INVESTING

As we have stated for months, we remain patient on venture investing in the crypto asset space. This is an incredibly dynamic landscape. Regime shifts occur multiple times a year and views held with high conviction just six months ago can be rendered obsolete today. Almost nothing is set in stone for this technology and asset class right now – even the most foundational pieces of this puzzle are still being established. As we stated last month:

There is a ‘primordial soup’ characteristic to the current market environment. We can see many exciting pieces floating around in this market, components that we believe have the characteristics to be part of projects that change the world forever. But a lightning bolt hasn’t quite struck yet to create the amino acids of compelling long-term value accrual.”

As such, we are fans of being able to change our mind. We believe the liquidity available for crypto assets is one of their most attractive investment characteristics. If you take away our ability to change our mind for 12+ months, as is the case in most venture investments, the bar for us making that investment decision is very high. In most cases we need a clear path to generating 10x returns, and a reasonable case for generating returns even higher than that. After all, an investment made into a venture deal has to compete against BTC or any other liquid token on a risk-adjusted basis and without liquidity. That’s a tall order.

Nevertheless, we are seeing interesting opportunities on the venture side. The quality of the deals has undoubtedly improved over the last several months. A renewed focus on product-market fit and go-to market strategies, two traits dangerously rare for much of 2017 and 2018, is emerging. That is refreshing. Many of these venture opportunities are in the form of equity rather than tokens. We think that’s fine for now, as the ecosystem iterates on token structures that can present compelling value accrual propositions. We may look to execute on our first venture investment in the coming months.

The secondary SAFT market, where contracts for the promise of future tokens related to projects not-yet-launched are traded, has continued to ramp up. The valuations seen in these secondary SAFT markets are still not compelling to us at present. Other market participants are currently willing to buy these SAFTs at higher prices than we will. If this crypto market has indeed bottomed, we may end up not executing on any SAFT purchases, as valuations may not reach compelling levels for us. If the market does make new lows, those valuations may very well decrease to levels we find compelling for certain projects. We are watching closely.

CLOSING REMARKS

In February, BTC generated its first monthly positive price performance since July. The relief felt by market participants was palpable. That positive price performance occurred on elevated volumes in large cap tokens and thus far those gains have largely held. Price gains occurred on the back of strongly positive news flow out of the crypto space in February and a supportive backdrop for risk assets from central bankers globally. The setup was there for prices to move higher in February and they did.

That being said, we aren’t out of the woods by any means yet. We are getting mixed signals at present. BTC price was unable to make a higher high this month and is still approximately flat YTD. On-metrics do not look poised for a bull run. Real world adoption is still anemic at present. An emerging view we have is that this market may not put in a new low but could chop around from $3.5k-$6k for six months or longer. We believe this would be a good backdrop for us to generate attractive risk-adjusted returns, profiting from that rangebound volatility.

Regardless of price action, the ecosystem continues to progress. Human and financial capital continue to pour into the space. New technology is being created and existing technology is being iterated upon. The pieces are being put in place for the next inevitable bull run. We can’t see exactly when or where that will be just yet, but we have front row seats to it all. The show has started, and the plot is coming along nicely.

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Timothy Lewis, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2019 Ikigai Asset Management, LLC. All Rights Reserved.

CONFIDENTIAL – NOT FOR FURTHER DISTRIBUTION

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS