August 2021 - Monthly Market Update

/Monthly Update || August 2021

“The real way to build wealth in the long run, is to find a limited number of things with a lot of potential, and not too much risk, and stay with them for the long term.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our thirty-fifth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, July brought a tale of two months for Bitcoin – 20 straight days of price grinding lower followed by a very rare 10 consecutive green days, driven by a short squeeze. The end result left Bitcoin up 19% in July and bears calling for a breakdown of this multi-month range in disbelief. The fundamental backdrop for this price action was a flurry of positive headlines and fundraises, juxtaposed against just as many worrying regulatory headlines. The regulatory headlines centered around Binance, which endured a barrage of global rebuttals from countries around the world in what was almost assuredly a coordinated move. BlockFi also came under scrutiny from banking three states in a manner that felt coordinated and likely led by industry lobbyists. July also saw numerous headlines and meetings about crypto from a range of US regulators and politicians.

The short squeeze occurred right as global Bitcoin trading volumes were hitting their lowest levels in the last year.

Source: TradingView. As of 8/1/21.

On July 20th, Bitcoin made its first daily close under $30k since January 1st, sucked in as many shorts as possible with a chorus of bears chanting for further downside, and then proceeded in classic Bitcoin fashion to rip faces off into month-end.

The turning point of the month was the live meeting Elon Musk held with Jack Dorsey and Cathie Wood at the B-Word Conference on July 21st. As discussed at length in prior Monthly Updates, Elon has firmly inserted himself near the top of the Bitcoin landscape with his $1.5bn BTC purchase in February and subsequent reversal to a stance of “Bitcoin mining is bad for the environment” and cancelling of Tesla purchases with Bitcoin in May. Since then we’ve had near-constant Twitter diarrhea from Elon, with all manner of positive, negative, trolling and indecipherable comments about BTC and DOGE. The B-word meeting served as his opportunity to clear up his stance on these topics and the key takeaways were as follows:

“I do own Bitcoin, Tesla owns Bitcoin, SpaceX owns Bitcoin, and I personally own a bit of Ethereum and Doge as well”

“If the price of Bitcoin goes down, I lose money. I might pump, but I don’t dump”

Bitcoin is the only significant thing he owns outside of TSLA and SpaceX

“There appears to be a positive trend in the energy usage of Bitcoin”

“Bitcoin doesn’t need to be as clean as snow but it just can’t be using the dirtiest coal either”

Not selling any Bitcoin, will resume accepting BTC for Tesla purchases when mining energy usage is 50% renewable

He needs to do a little more due diligence on mining energy usage, but if the current trends continue TSLA is likely to start accepting BTC payments again

He founded PayPal, so he’s been thinking about money for a long time

Bitcoin is evolving with Lightning

“I definitely do not believe in getting the price high and selling or anything like that. I would like to see bitcoin succeed.”

“In general, I am a supporter of Bitcoin and cryptocurrency”

“I think probably crypto will make the future much better”

Bitcoin mining without a battery doesn’t work very well for excess power supply for wind and solar

Bitcoin by itself cannot scale to a global monetary system at the base layer, but could with Layer 2

Looking for a crypto that has a higher max transaction rate and lower transaction cost

How does that read to you? Good for a 30% move up in a straight line? I could see that, although honestly without the short squeeze market structure that was in-place and subsequently capitalized upon, I doubt we would’ve had a move that aggressive. It was clear the live discussion was meant to be an opportunity for Elon to make amends with the Bitcoin community that had become so angered with him over the last several months. And it was clear the discussion was Elon’s opportunity to unpack to the world his specific stances on Bitcoin and crypto broadly.

So where does that leave us? Two months ago, I said the following regarding this situation:

My base case is the ESG narrative around Bitcoin will improve over the coming months. That could take any number of forms. The North American Bitcoin Mining Council could publish a study that shows coal usage isn’t that bad, and renewables usage is increasing. Elon could retweet this study and say something like “this looks good”. Perhaps new mining projects committed to clean energy or some sort of carbon credit purchase program from existing Bitcoin miners could be announced, and perhaps Elon could show public support for these. Less likely but still possible would be for one of Elon’s companies to announce a clean Bitcoin mining project or product of some sort. At this point, even a press release with a napkin sketch would be strongly positive. Most positive of all would be some or all of these events to occur, and then Tesla to buy more Bitcoin on the back of it. That would be a full send.

Undoubtedly many investors, both retail and institutional alike, are contemplating these range of outcomes in real time and making bets accordingly. Perhaps some have an information asymmetry - that would be a fair assumption. We should not downplay the significance of the problem Bitcoin currently has with being labeled environmentally unfriendly, regardless of the validity of that label. This was a material but workable problem before Elon flipped, but now with Elon calling out Bitcoin mining’s carbon emissions to his 56 million Twitter followers, the truth of matter is of little importance. It’s now a problem until Elon says it’s not anymore. You can hate that or love that, but it’s the state of things at the moment.

Institutional investors have no desire to run afoul of the ESG movement. It is a behemoth force, and many institutions will just cave to its pressures. Let’s be honest - many baby boomers at the helm of large pools of capital didn’t ACTUALLY want to buy Bitcoin anyway. They don’t like it. They don’t understand it. They think it’s drug dealer money. Bitcoin was in the process of forcing those hands to buy – the returns were too good and the narrative as a digital store of value was too strong. But that setup is called off for now. Those boomer CIOs have the cover they need to not have to deal with Bitcoin for now, and that’s a problem if BTC wants to get to $100k and beyond. There’s an argument to be made that if “number go up” hard enough, a lot of that ESG-wary capital will simply shrug off the ESG label and Elon debacle and buy anyway, but that’s a tough call to make. I think we will need material incrementally positive events to solve the problem we find ourselves in. TBD on if/when/how we get it.

That was a pretty good call, given how things have unfolded since then. But where does that leave us in light of the B-word discussion? Has Elon sufficiently told the world “ESG isn’t a problem for Bitcoin anymore”? If TSLA begins accepting BTC payments again between now and their Q3 earnings call, will THAT be sufficient signaling to the large pools of capital waiting on the sidelines, close to buying BTC but unwilling to step in front of the ESG freight train? If the North American Bitcoin Mining Council comes out with a new quarterly report in September that shows definitive evidence that Bitcoin mining is now more than half renewable, will THAT be sufficient?

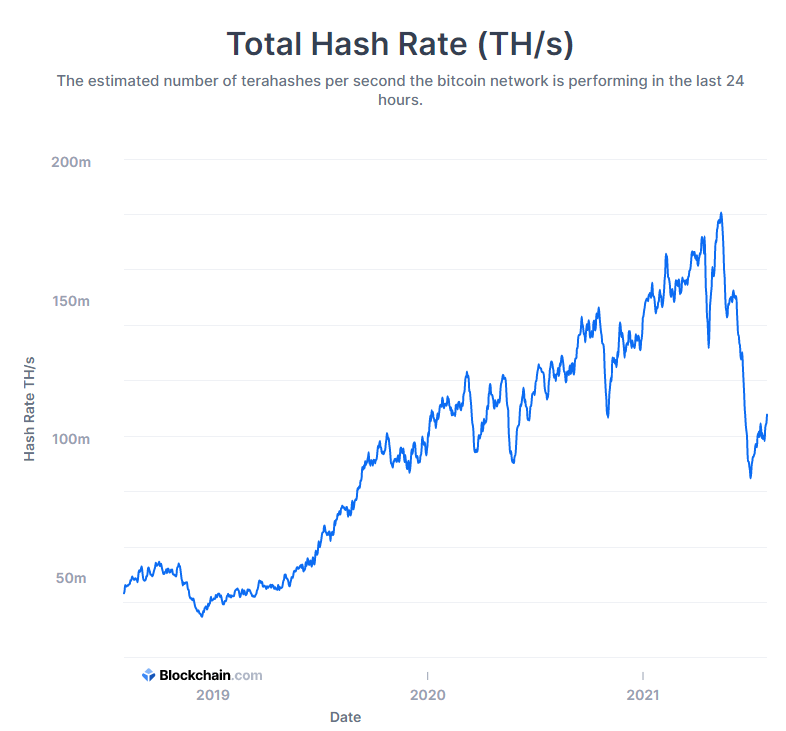

Frankly, I’m not sure. It probably depends in part on how well the information is communicated. This Bitcoin mining ESG issue is two-pronged: one is a communication issue, and the other is the actuality of the facts. The actuality of the facts were never as bad as those opposed to Bitcoin were communicating them to be, but that opposition was well-organized and vocal and proved to be at least temporarily effective in getting the world tied up in knots about Bitcoin’s energy usage. It is also unequivocal that the actuality of the facts have improved significantly in the last 90 days, ironically thanks to China. Because China banned Bitcoin mining, price collapsed and hashrate underwent its largest decline in history. The resulting current hashrate landscape is one with significantly less carbon emissions and a significantly higher renewable energy mix. If this information is effectively proven and communicated and the chorus of disingenuous Bitcoin haters can be drowned out by well-presented facts, this ESG issue may largely be cleaned up by year-end. That would be an impressive turnaround in such a short amount of time.

In the meantime, investors who were waiting to buy a nasty puke into the $20’s or even lower are looking at the chart right now wondering if they’ll ever get their chance. At what point do they capitulate and buy higher? After all, Bitcoin is actively crossing off the reasons people can come up with to not own it. That’s a beautiful thing.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

July Highlights

Elon Musk Has Live Discussion with Jack Dorsey and Cathie Wood, Supports Bitcoin, Owns Some ETH and DOGE, Says TSLA Will Likely Reinstate Tesla Purchases with BTC

FTX Raises Record $900mm on $18bn Valuation from Sequoia, Softbank, Lightspeed, Paul Tudor Jones and Others

Fireblocks Raises $310mm on $2bn Valuation

Paxos Raises $300mm From Bank of America and Others

Crypto Has Record Q2 for Private Funding – 497 VC Deals Totaling $6.2bn

USDC Provider Circle to Go Public at $4.5bn Valuation Via SPAC

NFT Platform Sorare Raises $532mm on $3.8bn Valuation

NFT Platform OpenSea Raises $100mm on $1.5bn Valuation

$2.3tn AUM Capital International Group Takes 12.3% Stake in MicroStrategy

ProFunds Launches First Ever Publicly Available BTC Mutual Fund

$41bn AUM GoldenTree Has Begun Purchasing Bitcoin

Galaxy Digital Launches Crypto Fund of Funds Backed by Franklin Templeton

Grayscale Launches DeFi Fund

JPM and Wells Fargo Private Wealth Management Both Begin Offering Crypto

Fidelity to Add 100 Employees to Crypto Business

Grayscale Enters into Agreement with BNY Mellon to Provide Asset Servicing and ETF Services for GBTC

Chinese Bitcoin Miner BIT Mining Raises $50mm to Move Overseas

Energy Harbor Corp Partners with Standard Power to Provide Nuclear-powered Bitcoin Mining in Ohio

Black Rock Petroleum Announces Large Bitcoin Mining Agreement to Move Mining Equipment from China to Alberta

Visa Says Crypto-linked Card Usage Topped $1bn in 1H-21

Swiss Bank Sygnum Becomes First Bank to Offer ETH 2.0 Staking

ECB Launches Official Investigation into Creating a CBDC

Square Is Building Decentralized Finance Business on Bitcoin

Reddit to Use Layer 2 Solution Arbitrum for Scaling Community Points Platform

Goldman Family Office Survey Finds Half of Investors Plan to Buy Crypto

July Regulatory Headlines

Senate Banking Committee Holds Hearing – “Cryptocurrencies – What Are They Good For?”

House Committee on Financial Services Holds Hearing on CBDCs

US Infrastructure Bill Proposes Increased Reporting Requirements for Crypto Brokers

New Jersey, Texas and Alabama Accuse BlockFi of Offering Unregistered Securities

Italy’s SEC States Binance Is Not Authorized to Conduct Activities

Hong Kong’s SEC States Binance Is Not Licensed to Conduct Activities

Malaysia’s SEC States Binance Is Illegally Operating a Digital Asset Exchange

Cayman Islands’ SEC States Binance Not Authorized to Operate

Thailand’s SEC Files Criminal Complaint Against Binance for Operating Without License

Clear Junction Stops Processing Payments for Binance

Barclays Blocks UK Clients from Sending Fund to Binance

Binance Suspends EUR Deposits Via SEPA

Binance Lowers Non-KYC Daily Withdrawals From 2 BTC/day to 0.06 BTC/day

Binance Introduces Tax Reporting API Tool

Binance to Cease Offering Futures and Derivatives in Europe

Yellen Convenes US Regulators to Discuss Stablecoin Regs

SEC Chair Says Tokens Priced Off Securities Must Adhere to Securities Laws

Uniswap Restricts Access to Certain Tokens, Bowing to Regulatory Pressures

FTX Completes GAAP Audit

EU to Tighten KYC/AML Regulations on Crypto Companies

Hong Kong Customs Shuts Down $155mm Money-laundering Syndicate Using Tether

UK Authorities Seize Record $249mm in Crypto Confiscation

Three Additional Provinces in China Ban Crypto Mining

TikTok Bans Influencers from Promoting Crypto

| Asset Class | July | June | May | April | Q2-21 | Q1-21 | YTD | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 19% | -6% | -35% | -2% | -41% | 103% | 44% | 303% | BTC |

| NASDAQ | 3% | 6% | -1% | 6% | 11% | 2% | 16% | 48% | QQQ |

| S&P 500 | 2% | 2% | 1% | 5% | 8% | 6% | 17% | 16% | SPX |

| Total World Equities | 1% | 1% | 2% | 3% | 6% | 6% | 13% | 14% | VT |

| Emerging Market Equity | -6% | 1% | 2% | 1% | 3% | 4% | 0% | 15% | EEM |

| Gold | 3% | -7% | 8% | 3% | 3% | -10% | -5% | 25% | GLD |

| High Yield | 0% | 1% | 0% | 1% | 1% | 0% | 1% | -1% | HYG |

| Emerging Market Debt | 0% | 1% | 1% | 2% | 3% | -6% | -3% | 1% | EMB |

| Bank Debt | -1% | 0% | 0% | 0% | 0% | -1% | -1% | -2% | BKLN |

| Industrial Materials | 3% | -4% | 5% | 8% | 8% | 8% | 20% | 16% | DBB |

| USD | 0% | 3% | -2% |

-2% |

-1% | 4% | 2% | -7% | DXY |

| Volatility Index | 15% | -6% | -10% |

-4% |

-18% | -15% | -20% | 66% | VIX |

| Oil | 2% | 10% | 5% | 7% | 23% | 23% | 53% | -68% | USO |

Source: TradingView. As of 7/31/21.

Follow The Money

Aggregate crypto market cap declined 56% from its peak of $2.6tn in mid-May to $1.1tn in late June. This price action left many investors wondering where we are in “the cycle”. By “the cycle”, I mean Bitcoin price’s tendency to move in specific patterns centered around the halving event every four years. It basically looks like this-

Source: Pladizow. As of 7/31/21.

As I’ve stated in the last two Monthly Updates, we’re in unchartered territory here. If that was indeed a cyclical top for Bitcoin and new ATH’s are years away, we’ve never had a top like that before. If this was just a pullback on the way to ATH’s soon, we’ve never had a pullback look like that. And it’s fine to be faced with unprecedented occurrences in crypto - everything about crypto is by its very nature unprecedented. But we all want to know “what happens next?”

One of the largest factors that has been stuck in my mind over the last several months when evaluating whether this cycle is over is the depth, breadth, and quality of capital pouring into the space via crypto company equity raises. It’s easy to lose track of just how much ground has been covered here YTD, including what’s happened during and after the price crash. Put simply, it’s hard to imagine price moving from the expansionary green box phase it currently finds itself in on the chart above, directly to a distributary red box phase and then crashing blue box phase with this much going on in the space. Allow me to prove my point.

Q2-21 was a record-breaking quarter for crypto venture capital funding at $6.2bn, nearly doubling that of Q1-21.

Source: The Block. As of 7/11/21.

6% of ALL venture capital funding on any sort in 1H-21 went to crypto companies.

The number of crypto deals in Q2-21 increased 64% Y/Y

Source: CBInsights. As of July 2021. Note methodology differs from The Block.

10 of the 18 largest crypto deals ever have happened this year.

Source: The Block. As of 7/11/21.

In 1H-21, there was a wide dispersion of subsectors that received significant funding.

Source: The Block. As of 7/11/21.

A couple subsectors are particularly noteworthy. Chainalysis is a blockchain analytics company primarily used by governments and exchanges for AML and fraud detection purposes. They raised $100mm at >$1bn valuation in November 2020. Then raised another $100mm at >$2bn in March 2021. Then raised ANOTHER $100mm at $4.2bn in June 2021…Wait, what?

How about crypto infrastructure companies? Check the Top 5 list for Q2-21.

Source: CBInsights. As of July 2021. Note methodology differs from The Block.

Fireblocks raised $30mm in November 2020, raised another $133mm in March, then raised ANOTHER $310mm on a $2bn valuation in July. Sheesh. What is the ferociousness of that capital raising timeline telling you about the near-term actionable opportunity set for Fireblocks?

NYDIG has been on a tear too. As a company tailored specifically to bringing traditional institutional capital into (mostly) Bitcoin, private equity capital investing in NYDIG is making the bet that more traditional investors will come to Bitcoin. NYDIG raised $50mm in October 2020, another $200mm in March and ANOTHER $100mm in April. It’s rumored to be valued in the billions.

On the back of China’s Bitcoin mining ban, hashrate saw its largest drop in history. The capital markets have responded resoundingly. Genesis Digital. BIT Mining. Argo Blockchain. Blockware Mining. Stronghold. Energy Harbor Corp. Black Rock Petroleum. Square. Crusoe Energy. Core Scientific. Iris Energy. These are all Bitcoin mining financing deals announced in last 90 days, and I probably missed a few. The financing structures range from private equity investment to debt to IPO to SPAC. What is the market telling you about its appetite for Bitcoin mining? What does that say about the outlook for Bitcoin mining?

Crypto exchanges are one of the oldest business lines in the industry and there have been literally hundreds stood up over the last decade. It’s one of the few highly profitable business lines in crypto even with relatively small market share, and the largest ones are some of the biggest cash cows imaginable. Despite its relative “maturity”, the crypto exchange landscape continues to be a dynamic one and investors are making bets. LatAm crypto exchange Bitso raised $62mm in December 2020 and then raised another $250mm at a $2.2bn valuation in May, making it one of the most valuable fintech companies in the entire region. What does this say about the outlook for crypto adoption in LatAm?

Crypto exchange FTX, led by the imitable Sam Bankman-Fried, has gained significant market share since launching in 2019. It is the exchange of choice for many sophisticated crypto investors and is currently making a massive push towards attracting more retail investors. YTD FTX has spent more than $500mm on sponsorship deals with MLB, the Miami Heat, eSports team TMS, and more. So less than two weeks ago, when FTX announced a jaw dropping $900mm raise on an $18bn valuation, the market just may have taken that as a signal. After all, it was the largest fundraise ever for a crypto exchange and one of the largest Series B fundraises for anything, ever.

Source: TradingView. As of 8/1/21.

NFT’s are another white-hot sector that has seen incredible amounts of capital pour in. It’s a sector that has grown from total obscurity a year ago to one of the most well-funded areas in all of crypto. Sorare raised $532mm on a $3.8bn valuation. Opensea raised $100mm on $1.5bn. Animoca Brands raised $139mm on $1bn. All three of those deals happened in the last 90 days, while crypto prices crashed. The total venture capital raised for NFT’s in the last 12 months is well over $1bn, which shouldn’t come as a surprise, given 1H-21 NFT sales totaled $2.5bn up from $14mm in 1H-20. How likely is it that NFT’s would be booming to such a degree right before crypto goes into a prolonged bear market? Possible? Sure, but maybe not likely.

Equity isn’t the only form of capital raising going on. There are big tickets going directly into protocol tokens as well. The headline deal in 1H-21 was Solana – which raised $314mm in June through its native token SOL. But dozens more smaller token offerings have also occurred so far this year, totaling hundreds of millions of dollars.

It’s not just the depth and breadth of YTD fundraising in crypto that is enamoring. The investors themselves deploying large amounts of capital directly into crypto deals bodes well for the industry’s future over any timeframe. Sure you have the usual suspects of crypto VC funds that have raised large new funds this year – A16Z at $2.2bn, Blockchain Capital at $300mm, Framework Ventures at $100mm, CoinFund at $83mm, Castle Island Ventures at $50mm. What is perhaps most noteworthy are the non-crypto native organizations deploying capital directly into crypto companies- MassMutual. New York Life. Softbank. Singapore Sovereign Wealth Fund. Morgan Stanley. Bank of America. BNY Mellon. FS Investments. S&P Global. State Street. Bloomberg family office. Soros. Visa. PayPal. Tiger Global. Coatue. Ribbit. Bain Capital. Sequoia. Thoma Bravo. Baillie Gifford. Mark Cuban. Jay-Z. Will Smith. Tom Brady. Michael Jordan. Literally dozens more.

What is all this telling us? There is tremendous appetite from all types of capital to get exposure to crypto. Equity investing in crypto companies is the most comfortable avenue for the widest array of capital to get that exposure. These are large capital raises on large valuations. The >50% slide in crypto prices over the last three months did nothing to slow down the pace of venture capital flowing into crypto – many of the largest fundraises ever happened during this period. Critically, NONE of these investments will pay off if number doesn’t go up. Let me repeat that- nearly all of these investments will not be profitable if crypto prices languish. If BTC crashes to $10k and stays there. If ETH crashes to $500 and stays there. If DeFi is a flash in the pan. If NFT’s are a flash in the pan. Then the world doesn’t need Fireblocks. Or Circle. Or BlockFi. Or OpenSea. It’s ALL dependent on number go up. A picks and shovels approach only works if people are mining for gold, and people are only mining for gold if its worth a lot. So follow the money. What’s it saying about the outlook for crypto? What’s it saying about the risk-adjusted return opportunity?

Market Update – Liquid Crypto Asset Investing

| Symbol | July | June | May | April | Q2-21 | Q1-21 | YTD | 2020 | 2019 |

|---|---|---|---|---|---|---|---|---|---|

| BTC | 19% | -6% | -35% | -2% | -41% | 103% | 44% | 303% | 92% |

| ETH | 12% | -16% | -2% | 45% | 19% | 160% | 244% | 469% | -3% |

| XRP | 6% | -32% | -34% | 177% | 24% | 161% | 240% | 14% | -45% |

| BCH* | 2% | -23% | -33% | 73% | -11% | 45% | 32% | 71% | 30% |

| EOS | -1% | -38% | 3% | 34% | -14% | 85% | 57% | 1% | 0% |

| BNB | 10% | -14% | -43% | 107% | 0% | 708% | 793% | 172% | 123% |

| XTZ | 0% | -16% | -36% | 15% | -37% | 142% | 51% | 49% | 192% |

| XLM | 1% | -30% | -24% | 29% | -32% | 220% | 123% | 184% | -60% |

| LTC | 1% | -23% | -31% | 37% | -27% | 58% | 16% | 202% | 36% |

| TRX | -6% | -13% | -39% | 43% | -24% | 244% | 139% | 101% | -29% |

| Aggregate Mkt Cap | 14% | -13% | -25% | 17% | -24% | 146% | 116% | 301% | 51% |

| Aggregate DeFi* | 32% | -16% | -35% | 34% | -27% | 339% | 326% | 1177% | 77% |

| Aggr Alts Mkt Cap | 9% | -18% | -14% | 43% | 0% | 246% | 281% | 274% | -1% |

Source: CoinMarketCap. As of 7/31/21. BCH includes SV. Aggregate DeFi from Coingecko.

As mentioned previously, Bitcoin’s performance in July was a tale of two months- 20 days of grinding lower followed by 40% up in a straight line to close out the month +19%. The turning point was Elon’s discussion at the B Word conference. Or was it $900mm into FTX equity? Or was it a short squeeze? Turns out that’s probably indecipherable.

Source: TradingView. As of 8/1/21.

Because it was all three. At the same time. Into the lowest trading volumes of the year. In July we were reminded that from time to time, Bitcoin price action more closely resembles a street fight than how GOOG trades. You might have thought Bitcoin would trade a little more maturely by this point, but July was a reminder that there is still WIDE dispersion amongst capital globally about what the fair value of a Bitcoin is- over both short and longer timeframes. And that can get choppy in both directions.

Where does that put us with BTC at the moment? Unfortunately, with a lot of resistance overhead.

Source: TradingView. As of 8/1/21.

The point here is this is unprecedented price action. Those wicks are ~15% and there are five of them. Never seen something like that before. The prior section of this Monthly Update is instructive in understanding why such violent price action has occurred – China and before that, Elon/ESG. The result of which has been an epic battle of aggressive, price agnostic, sellers alongside predatory shorts meeting a wall of massive demand that to-date has held the $30k line.

Bitcoin is in no way out of the woods yet, neither from a fundamental perspective nor a TA perspective. The fundamental backdrop has been discussed at length in this Monthly Update and the last. And the TA, unfortunately, shows a rather damaged chart.

Source: TradingView. As of 8/1/21.

We cleanly pierced the 50DMA and even the 100DMA and are currently retesting the 100DMA and prior range high as support levels. There’s also the big round number of $40k right here, which is a spot we haven’t spent much time at all YTD but it’s been an important level. Should we head higher from here, BTC faces resistance overhead pretty much all the way through the $40’s including the 200DMA, downtrend from the top, various Fibs and multiple points of control.

My gut says we can’t get all the way through that resistance solely on a continued short squeeze. We need new market participants on the long side, and we need to scare off additional selling and shorting that would otherwise show up above current price. One of the challenging aspects in assessing the likelihood of this outcome – that significant new capital will come in to buy higher - is how much the number of total market participants has declined in the last 90 days. Certainly many US investors, both retail and institutional, sold on the Elon/China one-two combo. China retail got rekt courtesy of the Chinese government. Many Binance traders were sellers on the global regulatory actions taken over the last six weeks. So that’s just all kinds of selling going on, not to mention everyone is still in the middle of summer vacation. Just look at the volume profile by price level below, we traded a LOT in the low $30’s and for every buyer there was a seller.

Source: TradingView. As of 8/1/21.

What is the setup that forces those sellers to buy back in, likely higher than where they sold? What’s the size of that capital on the sidelines? When it comes to China flow, how much left the market and is never coming back, or not any time soon? It’s a tough bet to calculate. As explained above, the ESG situation needs to get sufficiently cleaned up for BTC to attract more large pools of US institutional capital and its not clear if what has occurred recently on that front was “enough”. I think there’s a potential path in front of us where enough does get done to clean up the ESG problem for institutions. TBD on whether we’ll get that.

If we just take BTC’s 10 green daily candles in a row in a vacuum and assume the past is like the present, you get max long now and close your eyes for two months.

Source: JohnStCapital. As of 7/31/21.

The manner in which Bitcoin arrives at its price every day is a dynamic landscape. Micro market structure shifts happen constantly, while macro market structure shifts happen a few times a year. We're experiencing a big one right now, courtesy of China.

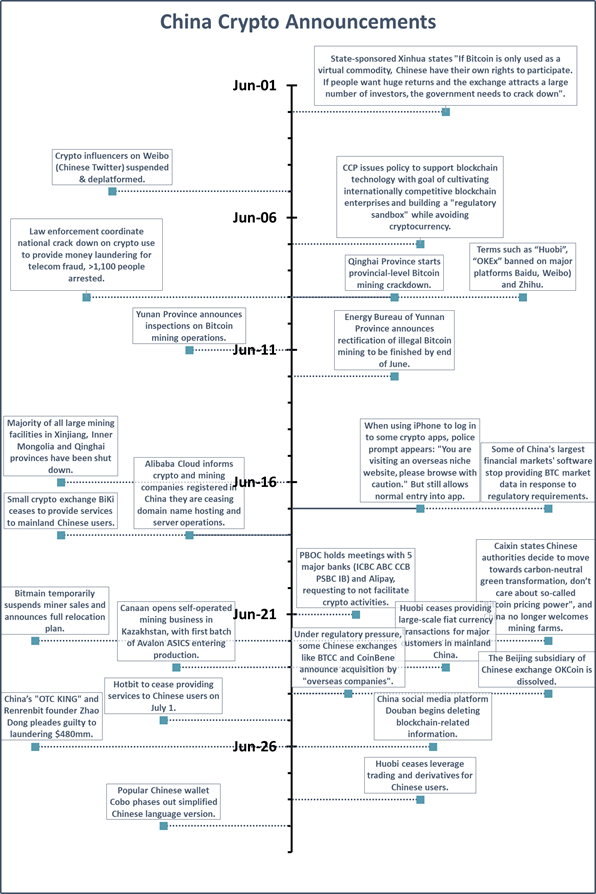

As a reminder, China just did this-

That crackdown had major ramifications. The vast majority of hashrate located in China 90 days ago has now left the country. There have been major structural shifts on the trading side as well. Huobi and OKEx were the dominate China exchanges. Their derivative instruments, namely Perps and Quarterly futures, were some of, if not the most important instruments in Bitcoin price discovery.

A year ago, their combined Open Interest accounted for 38% of total OI on BTC Futures-

Source: bybt. As of 7/30/21.

Huobi and OKEx began losing market share and prominence in Bitcoin price discovery in October 2020 when OKEx froze withdrawals and Huobi was rumored to be doing the same (although never did).

By the time OKEx resumed withdrawals five weeks later, the damage was done. By YE-20, their OI share fell to 28%-

Source: bybt. As of 7/30/21.

The China crackdown over the last several months has greatly exacerbated the migration away from Huobi and OK. Currently, their combined OI accounts for only 17% of total OI. That's a big shift.

Source: bybt. As of 7/30/21.

We’ve seen this type of market structure shift before, namely with BitMEX. Before Black Thursday (March 12, 2020), Mex accounted for nearly 40% of total OI and played an integral role in BTC price discovery. By YE-2020, that number had slipped to 9% and currently stands at 6%. As it currently stands, BitMEX’s role in the market is a small fraction of what it once was.

The rise and fall of Huobi and OKEx can be seen even more clearly when viewed through the lens of Bitcoin supply on exchange. BTC on Huobi peaked at a stunning 405k immediately prior to Black Thurs. Then began declining and then fell precipitously on the OKEx withdrawal freeze last fall. Then look at the last 2 ½ months – cut in half.

Source: Glassnode. As of 7/30/21.

OKex shows a similar pattern, albeit on lower total Bitcoin. Supply on OKex went from 160k right before the withdrawal freeze to 80k currently, more or less in a straight line.

Source: Glassnode. As of 7/30/21.

So where did all that Bitcoin go? The overwhelmingly dominant answer is Binance. Just check the chart. Although given their recent regulatory headaches, the drop we’ve seen in the last month is certainly noteworthy. Pretty stunning chart.

Source: Glassnode. As of 7/30/21.

At the peak of the market in April, Binance accounted for 19% of total OI and that has grown to 24% currently. For as much scrutiny as they’ve come under in the last month or two, Binance is still the behemoth in the market. TBD on whether they can hang on to that.

Who else has benefited? FTX and Bybit. A year ago, FTX and Bybit accounted for only 4% and 7% of total OI. Today, FTX and Bybit OI shares stand at 16% and 12%. Impressive.

Source: bybt. As of 7/30/21.

What are implications of a Bitcoin market structure significantly less dominated by China? I believe it’s bullish for Bitcoin. No one ever labeled China traders broadly as “good actors” in the space. They have a reputation for gambling wildly on high leverage. They love worthless Alts that pump hard. Information on crypto in China is difficult to ascertain and often muddled. In short, China is “scary” to US crypto investors. Unequivocally, a BTC market with China’s role massively diminished is MORE investable for US institutions. It increases the likelihood that large pools of US AUM will buy. It increases the likelihood of an ETF being approved. It sets up for an exciting end to 2021 and beyond.

Hashrate is quietly 27% off the bottom from a month ago. These types of bottoms after large declines have historically been good buying opportunities.

Source: Blockchain.com. As of 8/1/21.

ETH likely has even more fireworks in store than BTC. With the long-awaited, much-discussed London hard fork (aka EIP-1559) scheduled to occur on August 4th, many investors will be watching ETH’s price action extra closely in the coming days and weeks. The setup going into this event is not the consensus expectation from a couple months ago. After massive outperformance in the first 5 months of the year, the expectation was for ETHBTC to continue outperforming into the catalyst event date. Instead, what we got was a potential topping pattern and two consecutive months of ETHBTC underperformance.

Source: TradingView. As of 8/1/21.

ETH currently finds itself in the same situation as BTC - with significantly less market participants than a couple months ago. Except in this setup, I believe ETH has many more trapped longs than BTC. The ETH trade became a strong consensus favorite, and then ETH went from $4k to $1800. There is certainly a chance that large pools of institutional capital are on the sideline waiting to buy ETH. The EIP-1559 and DeFi narratives are strong ones and ETH has managed to mostly dodge the ESG narrative because it has a path to move to Proof of Stake. Now that Bitcoin has stepped back away from the abyss of $30k, that sidelined capital may feel safe to deploy into ETH. It’s possible. But it will likely be necessary for ETH to reclaim $3k and beyond, because the majority of crypto native capital is already long there.

Should ETHBTC resume its outperformance, it would be my base case that select DeFi names will in turn outperform ETH. It’s been a rough ride for the DeFi sector, which declined by more than 2/3rd from its early May peak, before rallying strongly into month-end.

Source: TradingView. As of 8/1/21.

DeFi/ETH has been an even rougher ride than DeFi/USD, with DeFi underperforming ETH by more than 50% since late March, and currently barely off its low. Is this simply a great buy here, or is the market telling you something about where in the stack value is being assigned?

Source: TradingView. As of 8/1/21.

The other primary concern for DeFi is the same concern we’ve now discussed for both BTC and ETH – a lack of market participants. Indisputably, China was a big user of DeFi and a lot of those users are now gone. Couple that with the stunning reflexivity of DeFi price action, and we find ourselves in a precarious position. There is a good chance that over time, the China crackdown will lead to increased volumes on DEX’s, but that may not be right now.

Source: Token Terminal. As of 8/1/21.

Closing Remarks

Contrary to numerous reports, as of August 1st Bitcoin is indeed, not dead. That in itself is cause for celebration, never mind the >$700bn of market cap currently attributed to this wild thing. One aspect that has continued to strike me throughout the occurrences of the last several months is a topic I discuss constantly here but deserves additional attention nevertheless in light of recent actions- Bitcoin’s antifragility.

Almost certainly, if you tried to draw a parallel of recent events in Bitcoin to another asset class, say equities, your assumption would be that the entire global financial system would collapse, and the world would spin into a deep depression worse than 2008. Imagine if say, FAANG stocks somehow took the kind of beating Bitcoin just took all at once. How many trillions of QE would that engender? How much support would regulators and politicians be giving FAANG stocks if they got cut in half in a couple months? How big would the “Bald Eagle Save FAANG” bill that Congress would unanimously pass be? Instead, not only does Bitcoin get nothing, but it is also the target for coordinated, global, direct attacks from multiple angles. And yet…

90% of hashrate leaves China. Goes all over the world or gets laid down. Hashrate gets cut in half and begins rebounding. The NAM Bitcoin Mining Council is formed. They begin publishing statistics and pledge to publish more quarterly. Cambridge Center for Alternative Finance publishes new statistics. Bitcoiners get REALLY angry with Elon Musk. Important Bitcoiners immediately begin talking to him behind the scenes and then convince him to change his stance again publicly. Bitcoin moves off Chinese crypto exchanges. Open Interest on Chinese crypto exchanges drops. Crypto VC funds raise billions. Investors deploy billions into crypto VC deals. Deep pockets hold the line at $30k, buying all the Bitcoin anyone was in the mood to sell down there. Influential Bitcoiners fight for Bitcoin in closed-door meetings in Washington. When there is damaging language included in the infrastructure bill, crypto supporters give as much feedback on those few sentences as the entire rest of the bill received COMBINED.

In the meantime, this crazy thing just keeps making blocks. While the world works through risk factor after risk factor and makes changes accordingly. Nothing ever actually changes with the Bitcoin blockchain itself (or very rarely). It’s just how the world perceives this blockchain’s value that changes as exogenous factors change. So now Bitcoin is way less dominated by China and has way less carbon emissions and those trajectories both look positive. The world is in the process of assigning value accordingly.

“A single arrow is easily broken, but not ten in a bundle”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS