December 2023 - Monthly Market Update

/Monthly Update || December 2023

“Every once in a while, someone makes a risky bet on an improbable or uncertain outcome and ends up looking like a genius. But we should recognize that it happened because of luck and boldness, not skill.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our sixty-third Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that already has and will continue to fundamentally change the world – continuing to create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, the Binance saga reached a crescendo in November, with Binance settling for $4.3bn with OFAC, FinCEN and the CFTC (and importantly NOT settling with the SEC). We will unpack the event and its implications in detail here, but it is the most significant crypto event of 2023 and the largest enforcement action ever taken against a crypto exchange. It’s been a long time coming and it’s a big deal.

If you’ve been reading these letters or following me on Twitter, you know I find myself right in the middle of this situation, as one of Binance’s most outspoken critics. That’s been a new experience for me, because I’ve never spoken out so harshly, acutely and loudly about anything or anyone before in my life. I wouldn’t call it a “fun” ride per se, but it’s certainly been a worthwhile one. And this outcome that’s unfolded (and continues to unfold) with Binance has been vindicating and reinforcing for me to continue these sorts of efforts going forward. It has taken some amount of personal resolve over the past year to continue harping on Binance in the face of a very small, vocal minority of folks who disagreed with my stance. But if you’re talking to say, 100,000 people, even 1% is 1,000 people, so at a certain scale you’re bound to encounter some amount of pushback.

That pushback from Binance supporters doesn’t amount to much of anything to me in light of the US govt’s actions against Binance and Changpeng this month. The US govt is now in charge of Binance’s compliance department for the next five years, and it looks like Changpeng may do some jail time. Binance helped finance many thousands of truly evil actors, from Hamas to human trafficking. Actual child pornography. Binance admits to this. To those that choose to defend Binance’s actions even in light of these admissions, I don’t know what to tell you. Go look in a mirror.

This November brought the one-year anniversary of the collapse of FTX. Pretty choppy lap around the track for sure! But we’re still here. One the one year anniversary, I wrote a tweet thread sharing some of my thoughts that got a lot of traction, and I want to highlight this part in particular-

If you’ve been reading these letters, the above message will come as no surprise to you. I’ve been harping on this incessantly over the last year. It seems to have actually made a difference.

At time of writing, we’re ~10 days into this Binance news. Thus far, Binance has been processing withdrawals fine and those withdrawals have been smaller than you would have expected under the circumstances, ~$2.5bn. So far there has been no FTX-style collapse with Binance, and I am very glad for that. The US govt is going to give Binance a five-year long proctology exam and I am glad for that too. Changpeng has to sit out at least three years. I certainly wish it were longer (forever), but hopefully we as an industry can relegate his influence enough over that period so as to be out from under the thumb of so much power granted to a man who is so unworthy of wielding it. I hope we can accomplish that together.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

November Highlights

Binance Pleads Guilty to Violating Anti-Money Laundering Laws, Settles with DOJ, Treasury and CFTC for $4.3bn, Agrees to Full Monitorship by US Government for Five Years

Changpeng Zhao Pleads Guilty to Felony, Steps Down as CEO, Faces Potential Jail Time, Sentencing in February, Unable to Leave the US, Retains Majority Ownership

Richard Teng Appointed CEO of Binance

Sam Bankman-Fried Found Guilty of All Seven Charges After <5 Hours of Deliberation, Sentencing Scheduled for March

SEC Sues Kraken for Not Registering as A Securities Exchange

SEC Holds Closed-Door Discussions with Numerous ETF Filers, Public Filings Updated, Several Spot ETFs Are Delayed

BlackRock Files for Spot ETH ETF

MSTR Purchases 16,130 BTC for $593mm at Average Price of $36,785

Treasury Asks Congress for Greatly Increased Powers to Regulate Crypto

Genesis Sues Gemini to Recover $689mm in Preferential Transfers

DCG and Genesis Agree to New Repayment Deal, Settling $620mm Suit

CME Bitcoin Open Interest Surpasses Binance for the First Time57 Congressmen Write Letter to White House Highlighting Binance’s Involvement with Hamas

Jennifer Hicks, Senior Counter-Terrorism Officer, Quits Binance

Philippines SEC Kicks Binance Out

Binance Ends Partnership with Advcash That Facilitated Sanctions Evasions in Russia

Tether Freezes $225mm in DOJ Investigation of International Crime Syndicate

SafeMoon Founders Arrested in US for Fraud

FTX Estate Sells Hundreds of Millions of Dollars of Crypto

FTX Estate Approved to Sell $744mm of Grayscale Assets

FTX Estate Narrows Down FTX 2.0 Bidders to Bullish, Figure and Proof Group, Winner to Be Picked in December

FTX Estate Sues Bybit to Recover $953mm of Assets

Crypto VC Fund Faction Ventures Raises $285mm Inaugural Fund

Wormhole Raises $225mm at $2.5bn Valuation from Brevan, Coinbase, Multicoin, et al

Blockchain.com Raises $110mm Series E Led by Kingsway Capital

Foresight Ventures Acquires Controlling Stake in The Block at $70mm Valuation

Crypto Exchange Bullish Acquires 100% of CoinDesk

Copper Acquires Securrency

Bitcoin Ordinals Startup Taproot Wizards Raises $7.5mm Seed Round

NYDFS Introduces Stricter Guidelines for Asset Listings, De-listings

CoinShares Receives Option to Acquire Valkyrie ETFs

Celsius Cleared to Exit Bankruptcy, Could Begin Repaying Customers in January

Mt Gox Announces Redemption of $47mm of Bankruptcy Estate Assets

Bittrex Global to Wind Down Operations

Wormhole Spins Off from Jump Trading

| Asset Class | Nov | Oct | Q3-23 | Q2-23 | Q1-23 | YTD | 2022 | 2021 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 9% | 29% | -12% | 7% | 72% | 128% | -64% | 60% | 303% | BTC |

| NASDAQ | 11% | -2% | -3% | 15% | 21% | 46% | -33% | 27% | 48% | QQQ |

| S&P 500 | 9% | -2% | -4% | 8% | 7% | 19% | -19% | 27% | 16% | SPX |

| Total World Equities | 9% | -3% | -4% | 5% | 7% | 14% | -20% | 16% | 14% | VT |

| Emerging Market Equity | 8% | -3% | -4% | 0% | 4% | 4% | -22% | -5% | 15% | EEM |

| Gold | 3% | 8% | -4% | -3% | 8% | 11% | -1% | -4% | 25% | GLD |

| High Yield | 4% | -2% | -2% | -1% | 3% | 3% | -15% | 0% | -1% | HYG |

| Emerging Market Debt | 6% | -2% | -5% | 0% | 2% | 2% | -22% | -6% | 1% | EMB |

| Bank Debt | 0% | -1% | 0% | 1% | 1% | 2% | -7% | -1% | -2% | BKLN |

| Industrial Materials | 2% | -4% | 7% | -11% | 4% | -4% | -13% | 29% | 16% | DBB |

| USD | -3% | 0% | 3% | 0% | 0% | 0% | 8% | 6% | -7% | DXY |

| Volatility Index | -29% | 3% | 29% | -27% | -14% | -40% | 26% | -24% | 66% | VIX |

| Oil | -7% | -7% | 27% | -4% | -5% | 0% | 29% | 65% | -68% | USO |

Source: TradingView. As of 11/30/23.

What Is To Come Of Binance And Changpeng?

Certainly a pressing question. I’ll try to be concise.

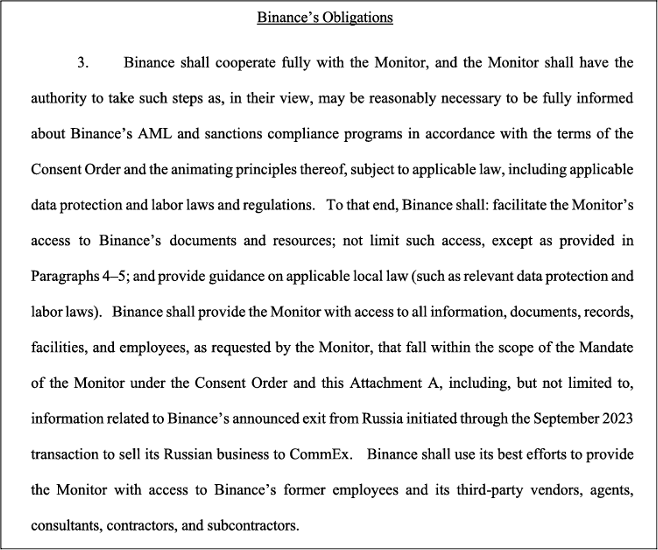

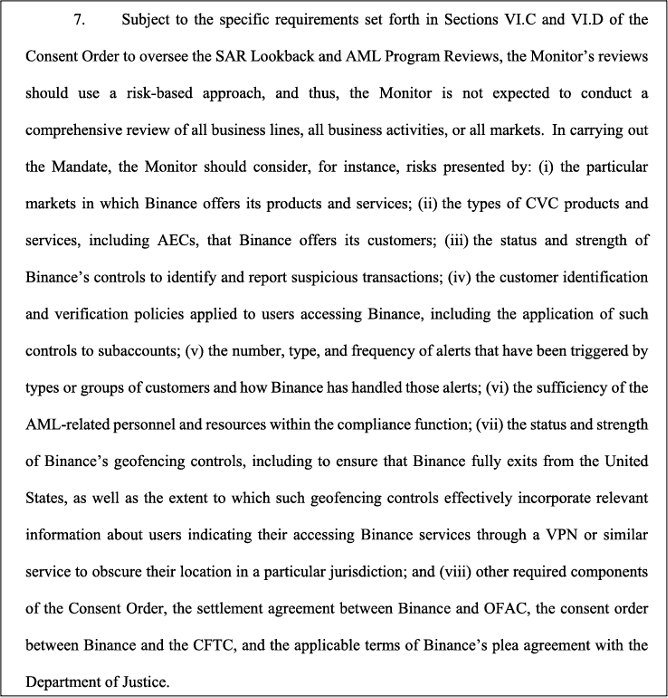

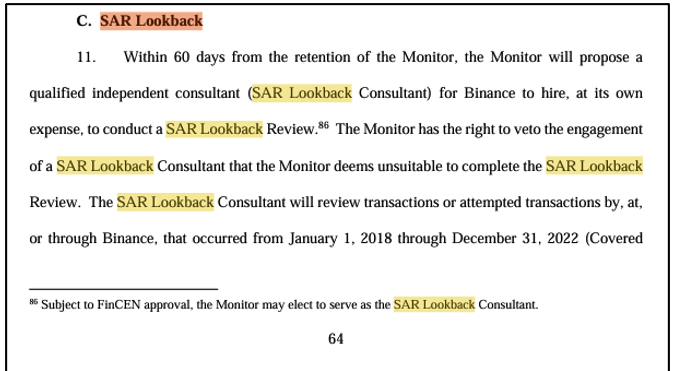

One of the most crucial aspects of this is- will the monitorship push Binance into obscurity? The monitorship is a big deal. The monitor has to be approved by the US govt. It’s set to last five years and could last six. The terms are heavy handed. I’ve included a couple of screenshots below to give you a flavor-

I could keep going. You can read the whole thing here. It’s worth the read if you’re so inclined. The point I want to make here is that the US govt now effectively runs Binance’s compliance department for the next five years. Illicit activity on Binance going forward will never be zero but it will probably be pretty close. And we know that’s a big change relative to the last five years.

Additionally, there is a lookback period going back to Jan 1, 2018. So the US govt will get a full look at everything that happened historically and will likely be going after a lot of Binance customers based on access to all that Binance information.

What does that mean for Binance’s future? It depends on how much of their total activity was illicit or at least unwilling to KYC, and that’s a hard thing to estimate. You also have to assess the rest of the crypto market – if those illicit/un-KYC’d accounts leave Binance, where will they go? “Some other exchange that doesn’t KYC” is a natural response to that, based on history. Except this time looks like it might be different. The enforcement actions taken against Binance have likely marked the end of an era where CEX KYC was loose enough to be a major avenue for illicit finance. That will still go on to an extent, sure. That cat-and-mouse game will always be played. But the pervasiveness of illicit/un-KYC’d flows through CEX’s has likely peaked.

You might say, “well if illicit/un-KYC’d flows can’t go through CEXs they’ll go through DeFi and DEXs.” That’s certainly already true to an extent and it’s likely to increase from here. But the US govt seems pretty hell bent on getting as much KYC into DeFi as possible. It remains to be seen exactly how successful they’ll be in that endeavor, but the outcome where the US govt just says, “code is free speech and we can’t do anything about all these DeFi protocols facilitating illicit activities”… seems pretty unlikely to me. There will be an ongoing cat-and-mouse game here too with DeFi, just as there is with CEXs.

A BitMEX comparison is somewhat instructive here, but it’s certainly not apples to apples. A big reason BitMEX faded into obscurity is because they didn’t offer stablecoin collateral and their direct competitors (mostly Binance and FTX) did. BitMEX also smoked a ton of traders on the Black Thursday decouple, which added to customers’ discontent. By the time BitMEX got around to getting busted by the DOJ and then implementing real KYC and actually keeping US traders off the platform, it was already a done deal – BitMEX was effectively toast.

That’s not the same setup we have here with Binance. There’s likely not an immediate substitute for illicit/un-KYC’d flows to migrate to, whether a CEX or DEX. Does that mean all the legitimate, KYC’d flow just stays at Binance, and their market share remains relatively unchanged? I kind of doubt it. At the least, Binance will kick off (freeze?) illicit/un-KYC’d accounts and also stop wash trading. Those two factors alone will ding Binance’s market share meaningfully, which had already declined from 64% in January to 44% in September.

In the coming months, I would expect that 44% market share to head towards 30% and probably lower. Just this week its already ~35%. If Binance market share slides into the teens, its influence over price discovery should wane significantly, as it will be more-or-less “just another crypto exchange”, without the majorly outsized influence that it’s had for years.

So I think that’s my base case with Binance - the monitorship will push Binance towards obscurity as the entire industry moves away from CEXs being a major avenue for illicit/un-KYC’d flows. What about Changpeng Zhao?

Right out of the gate, there was a weird deal where Changpeng went to Seattle to face charges and plead guilty. His bond was $175mm. His sentencing was set for February 23rd, and the judge said it was a “very close call”, but he would allow Changpeng to go back to the UAE between now and sentencing. Then, a couple days later, the judge reversed course and said Changpeng could not return to the UAE and had to stay in the US until sentencing. There was not an explanation given for the judge’s reversal on this decision.

Changpeng will likely do a little jail time. He agreed to accept a sentence that included up to 18 months in prison without an appeal. Technically he can be given up to 10 years, but my guess is it will be somewhere around 12-18 months. Changpeng has already stepped down as CEO of Binance and will have no involvement in the business for three years. If things go well with Binance during that time, Changpeng can come back after three years. He retained his majority ownership of Binance.

Changpeng was replaced as CEO by Richard Teng. Teng has been with Binance since August 2021 and previously was the CEO of Abu Dhabi’s financial regulator and Chief Regulatory Officer of the Singapore Exchange, so he comes with a long tenure of international markets compliance work. Teng has already been making a lot of noise, seeking to fill the void left by his Tweet-happy predecessor. Whether he does a great job or a bad job or somewhere in between, I’m not sure how much of a difference it’s going to make. Binance is being forced into total compliance, and that fact will likely be the deciding factor of Binance’s fate.

There are a few other loose ends related to this saga. It remains to be seen what will happen with BNB token. To be fair, it has traded much better than you would’ve expected since the DOJ charges came out.

Source: TradingView. As of 11/30/23.

You see a big spike up in price as the news was first being reported, then the crash lower as the whole story unfolded. But BNB is currently trading at the same price it was at the beginning of the month and still 10% above its recent low of $205. BNB currently has a $35bn market cap. What’s to come of BNB token? I struggle to see how it doesn’t trend meaningfully lower through next year, but it has always traded very strangely/manipulated and it is not liquid anywhere but Binance. The fundamentals of BNB are seriously impaired for all the reasons we’ve been talking about today. Does Changpeng have all the cash to pay the $4.3bn in fines without having to sell BNB? Can he ALSO buy all the BNB that holders will likely want to sell in the next year? Possible, but I doubt it. My guess is BNB does a slow bleed over the next year, but I would advise against shorting it. You never know with these guys.

An additional loose end is what’s to come of Justin Sun, Tron, TUSD and Huobi. Justin has been “hacked” four times in the last two months. He is facing a legal battle with the SEC and is highly likely to be under investigation by the DOJ. Huobi almost certainly has a hole in its balance sheet. I believe his days are numbered, although he likely has connections to the Chinese government that may allow him to continue operating in a position of such prominence within crypto.

I believe Tether may be a loose end as well. Tether is more difficult to get a read on than Binance ever was. To be clear, I believe Tether has all the reserves. I don’t think there’s a hole in their balance sheet. But their regulatory status in the US continues to be precarious. I’ve long said that Tether operates with the implicit permission of the US govt. If the US govt wanted Tether shut down, it would have happened a long time ago. Tether has frozen 1500+ addresses. Some large amount of those have been at the request of the US govt. To date, the US govt appears to have sufficient enough oversight of Tether to allow it to grow into owning $72.5bn in US treasuries. The US govt could decide at a moment’s notice to freeze Tether’s assets on the back of OFAC violations. The evidence for that is abundantly clear. I don’t know how to gauge the likelihood or timing of that occurring. I think you would look for signs that Tether’s relationship with the US govt is unraveling. In October, Cynthia Lummis wrote a letter to the Attorney General demanding for legal actions against Binance and Tether. The next month charges were brought against Binance, so...Like I said, I think it’s a loose end.

So What?

I think Binance will likely fade into relative obscurity. Changpeng will sit out for three years and may or may not retain significant prominence in crypto. The US govt will continue dropping the regulatory hammer on crypto worldwide in a way that will shape the entire industry. In July, I wrote this –

In the wake of Binance, my conviction has increased that we’re heading in this general direction, and probably pretty quickly.

Market Update – Liquid Crypto Asset Investing

| Symbol | Nov | Oct | Q3-23 | Q2-23 | Q1-23 | YTD | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|

| BTC | 9% | 29% | -12% | 7% | 72% | 128% | -64% | 60% | 303% |

| ETH | 13% | 9% | -14% | 6% | 52% | 72% | -67% | 399% | 469% |

| XRP | 1% | 16% | 9% | -12% | 58% | 78% | -59% | 278% | 14% |

| BCH* | -9% | 11% | -24% | 117% | 16% | 94% | -75% | 6% | 71% |

| EOS | 7% | 9% | -22% | -37% | 38% | -21% | -72% | 17% | 1% |

| BNB | 1% | 5% | -10% | -24% | 29% | -7% | -52% | 1269% | 172% |

| XTZ | 10% | 11% | -15% | -28% | 56% | 16% | -84% | 116% | 49% |

| XLM | -2% | 8% | 1% | 1% | 55% | 66% | -73% | 108% | 184% |

| LTC | 1% | 4% | -39% | 21% | 28% | -1% | -52% | 17% | 202% |

| TRX | 7% | 10% | 16% | 27% | 10% | 90% | -28% | 181% | 101% |

| Aggregate Mkt Cap | 12% | 15% | -6% | 1% | 49% | 87% | -64% | 186% | 301% |

| Aggregate DeFi* | 29% | 13% | -5% | -5% | 50% | 97% | -77% | 581% | 1177% |

| Aggr Alts Mkt Cap | 15% | 11% | -2% | -5% | 33% | 58% | -64% | 479% | 274% |

Source: CoinMarketCap and CoinGecko. As of 11/30/23. BCH includes SV.

Bitcoin was up 9% in November, closing at its highest level since March 2022. I’ve shown the below chart here for months now. Played out pretty close-

source: TradingView. As of 11/30/23.

We are at a significant resistance level right now. It’s why I put the X there in the first place. Last month I wrote this –

“Price action in the coming weeks/months as spot BTC ETFs assumedly get approved is going to be driven largely by how much we pump in the run-up to the actual approval and in the days between approval and actual launch. At current prices of ~$34,500, I don’t think we’re set up for a “fade the news” situation where price dumps upon actual ETF launch. Now, let’s say we ran to $40k this month, get approval at month-end and start trading ETFs in early December. And let’s say price goes from $40k to $47k in the days after approval before launch. At that point, I would be more worried about a “fade the news” scenario where initial inflows into the ETF disappoint and price trades off sharply.”

One month later and market expectations seem to be getting dialed in for the second week of January approval of multiple ETFs. My base case is a January ETF approval will push us well into the $40’s. There’s still a chance for a sell the news event as described above, but I kinda doubt inflows will be that weak, and I think any kneejerk selloff would be relatively short-lived. The halving and Fed rate cuts are around the corner – it seems pretty straightforward that 2024 should be a good year for Bitcoin.

Last month we discussed ETHBTC for a while, and the potential for a spot BTC ETF approval to put the bottom in on ETHBTC, as money flows to get long an inevitable spot ETH ETF (there would be very little ground for the SEC to stand on to approve a spot BTC ETF and not a spot ETH ETF).

Now that Blackrock has filed for a spot ETH ETF, this ETHBTC trade is probably pretty primed. As a reminder, ETH’s market cap is 31% of BTC and its trading volumes are less than half. It takes less money to get ETH ripping than it does BTC. The below scenario is not hard to imagine-

Source: TradingView. As of 11/30/23.

If you’re interested in Alts price action generally, you need to understand that the Binance charges are the single biggest thing to happen to Alts market structure since FTX collapsed. Honestly it’s going to be fascinating to watch what happens with Alts over the next year. Based on everything I wrote about earlier here, I think Binance is going to wither and that’s going to fragment/decrease Alts liquidity. Imagine a world where there is zero wash trading on Binance? That is a very different world than where we’ve been living.

It seems like KYC requirements across CEXs globally are going to incrementally choke out illicit/un-KYC’d flows relative to prior years. Sure, there will always be new CEXs that pop up with limited KYC, but that goes to my point about fragmented liquidity.

It would be easy for me to imagine a whole slew of Alts from the previous cycle just being more-or-less left for dead in 2024. Alts traders are always looking for the next new thing, so if the narrative/use case/adoption isn’t compelling to an even greater degree than previous bull cycles, I wouldn’t expect the tokens to get much sustainable interest.

If you wanted to boil all the fundamentals down to a chart, it would be the aggregate Alt Mkt Cap chart. Last month I said -

“If the Binance situation resolves in an ugly way (e.g., DOJ seizure; FTX-style collapse), I think this range breaks down. If the Binance situation turns out ok (e.g., big fine but continues operating), I think this range eventually breaks up. It might take into 2H-24, but eventually I think the inflows would arrive to carry this back towards ATH and beyond.”

A month later, we got something closer to the latter scenario, and now we’re +19% on the month and back at the top of the range-

Source: TradingView. As of 11/30/23.

Although it’s hard to say for sure this early on, the Binance situation has the potential to unfold in a way where aggregate Alt Mkt Cap struggles in the coming months. That said, I do think this range will break up, not down. The SEC looks like it’s going to eventually lose its case against Coinbase. Alts are going to be a part of Americans’ lives. The shitcoining will live on for another cycle.

Solana in particular has had an incredible run these last two months – it’s gone from $20 to $60. Even more impressive is that performance in light of the FTX estate selling millions of SOL. Last month we talked about SOL’s performance being driven by a short squeeze. Fast forward a month and SOL doubled. That was more than a short squeeze.

Source: TradingView. As of 11/30/23.

SOL looks like it wants higher. Those volume trends show real buying through the 30’s and into the 40’s. It’s pretty overheated at the moment and I could see consolidation around here for a bit longer, but directionally SOL is probably a long into 2024. SOL’s market cap is currently 10% of ETH’s and I would expect that to be higher a year from now.

SOL is up ~500% YTD and that is absolutely the best performing large cap in 2023 by far. Very few names did better in 2023. One is Injective, INJ. +1,300% YTD. It’s an “ETH killer”. $1.3bn valuation. TBD on whether it’s a legit project. Chart is strong though-

Source: TradingView. As of 11/30/23.

Another rare name that’s outperformed SOL YTD is RNDR, +775% YTD. RNDR is like Helium for GPUs. That’s an interesting idea. $1.3bn market cap. Not sure on token design. Chart looks good though-

Source: TradingView. As of 11/30/23.

BTC Dominance is an imperfect measurement, but it’s helpful to get your bearings nevertheless. Dominance (white) is at about the mid-point of a 6 ½ year range from 39%-71%. You can see BTC price (orange), and notice the relationship between the two.

Source: TradingView. As of 11/30/23.

It wouldn’t surprise me if Dominance gets most of the way back up to the top of that range before a raging bull market for Alts truly starts. My guess is Dominance is higher a year from now, but it may well be well off it’s 2024 highs by YE-24.

Closing Remarks

2024 is shaping up to be a good year for crypto broadly and a notable improvement from 2023. In November, we (mostly) removed a major risk factor – the uncertainty around the fate of Binance. That likely opens the door for spot ETFs early next year and we should be off to the races.

Crypto is entering a new bull cycle with a glaring leadership vacuum. No one paying attention would tell you any different. Changpeng. Sam. Barry. The Winklevii. Su Zhu. Do Kwon. Justin Sun. Celsius. BlockFi. Genesis. Lots of downfalls. Within that vacuum lies a clear opportunity. Crypto is not going anywhere. The world is giving this technology, this ecosystem, this experiment, another chance to make a positive impact on the world. Despite all of our shortcomings that have been put on display over the last two years, crypto still finds itself today with tremendous potential.

A year ago was an incredibly grim period for this industry, for Ikigai and for myself personally. I’ve gone back and read the monthly from Dec 1st, 2022 a number of times over the last year. It’s pretty raw. A year ago it seemed like a long shot that Ikigai was going to continue operating. Today we have a clear path forward as a business, and the makings of a new bull market right in front of us. That’s tremendous potential too.

If you’ve been reading these, you’re all too aware of my concerns with the foundations of this industry. Been harping on it all year. That’s still true today, but it’s a lot less true with the blow that Binance just took. Ikigai will continue being here as positive, active participants in the ecosystem. This is more than just building a hedge fund for us, it always has been. That’s why we named it Ikigai. The biggest risk to this ecosystem is…the ecosystem. It’s ourselves. Bad actors are the biggest risk to the technology fulfilling its potential to make the world a better place. So if we can get this whole thing just a little more cleaned up from here, crypto will be on much better footing to try and build something sustainable in the coming years. Like I said, tremendous potential.

“The smallest good deed is better than the grandest good intention.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS