February 2020 - Market Update

/Monthly Update || February 2020

“Everything you needed to know in the years leading up to the crash could be discerned through awareness of what was going on in the present.”

Opening Remarks

Greetings from inside Ikigai Asset Management1 headquarters in Marina Del Rey, CA. We welcome the opportunity to bring to you our seventeeth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, we are firmly back in a bull market and the pieces are in place for this asset class to have an explosive 2020. After making a low on December 18th at $6425, Bitcoin put in a monstrous +30% in January and we believe it’s just getting started. More on that below.

January brought major global events. Soleimani assassination and subsequent retaliation. Coronavirus. Trump impeachment. These events swung all asset classes. While the manner in which these events effected specific asset classes varied, an interesting correlation did emerge for a period of time. Below is Gold (red), Crude (orange) and Bitcoin (blue) for the first 20 days of January.

Note the similarities in movements across the assets, oftentimes down to the hour. This is an important situation we’ve been talking about for many months – Bitcoin becoming a global macro asset with a commonly accepted set of investment characteristics. While Bitcoin’s statistically uncorrelated historical returns are an attractive feature from a cross-asset portfolio construction perspective, it is not a reasonable expectation that BTC’s value will continue growing forever while maintaining entirely uncorrelated returns. Eventually, if BTC is successful enough, it will begin having defined relationships relative to other assets, and its price will begin moving in predictable ways relative to major global events. We believe BTC will become a store of value, safe haven asset, and will trade as such, because it has the characteristics to be a good store of value and safe haven within a well understood and commonly accepted framework for evaluating potential stores of value. BTC may very well be better at being gold than gold, so to the extent they begin trading in line with one another, that is noteworthy. I dive into this topic in more depth here and here. As a reminder, BTC’s market value is currently <2% of gold.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international and qualified accredited U.S. investors. Contact us to see if you qualify.

January Highlights

CME Launches Regulated Bitcoin Options

Former CFTC Chair Creates Nonprofit to Promote Digital Dollar Creation

World Economic Forum Announces Mission to Focus on Innovation & Governance of Stablecoins

Genesis Capital Announces $3.1bn In Crypto Loans in 2019

WisdomTree Leads $18m Series A for Security Token Platform Securrency

WisdomTree Announces Plans to Launch Regulated US Stablecoin

SEC Highlights Crypto Priorities For 2020

Libra Forms Five Member Technical Committee to Oversee Development

Square Awarded Patent For Fiat-To-Crypto Payments Network

Telegram Refuses to Show Bank Records in Case Against SEC

Qatar Bans Crypto Trading

| Symbol | January | Q4-19 | Q3-19 | Q2-19 | Q1-19 | 2019 | % ATH | % Off Low |

|---|---|---|---|---|---|---|---|---|

| BTC | 30% | -13% | -23% | 164% | 10% | 92% | -53% | 124% |

| ETH | 39% | -28% | -38% | 105% | 6% | -3% | -87% | 55% |

| XRP | 24% | -25% | -35% | 28% | -12% | -45% | -94% | -25% |

| BCH | 111% | -3% | -47% | 154% | -1% | 30% | -85% | 170% |

| EOS | 60% | -13% | -49% | 38% | 63% | 0% | -82% | 62% |

| BNB | 33% | -13% | -51% | 86% | 182% | 123% | -26% | 223% |

| XLM | 36% | -26% | -41% | -3% | -5% | -60% | -93% | -39% |

| LTC | 64% | -26% | -54% | 101% | 99% | 36% | -82% | 80% |

| TRX | 40% | -8% | -55% | 36% | 25% | -29% | -93% | 21% |

| Aggregate Mkt Cap | 35% | -14% | -29% | 117% | 14% | 51% | -69% | 88% |

| Aggr Alts Mkt Cap | 44% | -16% | -40% | 68% | 18% | -1% | -84% | 34% |

Reflexivity & The Most Highly Anticipated Event In Bitcoin’s History

On May 12th, 100 days from today, Bitcoin’s block reward will be cut in half from 12.5 BTC to 6.25. A tremendous amount of discussion is already occurring within this ecosystem as to whether this event is “priced in”, given the software code that dictates this block reward reduction is open-source and has been publicly available for 11 years. People have been asking me this question a lot over the last several months. Our view on the subject, which we shared in a recent Bloomberg article, is as follows –

“Many market participants have been asking the question -- is the Bitcoin halving priced in? That’s the wrong way to frame it. A small single digit percentage of the world currently owns Bitcoin. For those that currently own Bitcoin, a large portion of them understand that Bitcoin’s newly issued supply is cut in half every four years. This is likely a significant reason why they own it -- because of Bitcoin’s provable scarcity. For the many billions of people around the world that do not own Bitcoin, few understand this provable scarcity characteristic. So for those billions, it cannot be priced in. To the extent those billions of people discover Bitcoin in the future and decide to buy some, there will be less new available supply to satisfy that increased demand to purchase Bitcoin.”

To unpack this stance a bit more, for all catalysts like this you need to separate the potential impact on price due to the narrative and the potential impact on price due to the logistics. The narrative has the potential to run wild in crypto. Narratives turn a mole hill into a mountain and mountain into a planet. Narratives and reflexivity go hand in hand. It’s about the breadth of information dissemination. The hype of an event. Does my mom know about the halving? Does someone at her office ask her about it because they read something somewhere and remember her son is into Bitcoin? Google Trends is a great barometer for narrative measurement.

Then you have the logistics of an event – what the thing ACTUALLY causes to happen. Currently, ~1,800 new Bitcoin are created every day. At $9k prices, that’s $16.2mm of Bitcoin that needs to be bought every day to keep price flat (assuming new Bitcoin created are immediately sold, which isn’t true, but the analysis is directionally valid). On May 12th, that 1,800 will programmatically move to 900, and only $8.1mm of cash needs to show up every day to buy Bitcoin to keep prices flat at $9k. Importantly, if demand to buy Bitcoin increases – say $50mm of new capital shows up today to buy Bitcoin, price would need to rise a bit from today’s levels to meet that demand. On May 12th, prices would need to rise a bit more than before because new supply has been reduced by half.

The narrative and logistics of the halving are intimately intertwined with reflexivity. Reflexivity is a topic we’ve discussed many times in past, and rightfully so. It’s hugely important to crypto. We did our first deep dive into the subject in our April 1st Monthly Update, which to this day is probably the writing I’m most proud of. Risky Whales, another subject we’ve written about many times, have the willingness and ability to “manufacture” reflexivity. Risky Whales manufacture reflexivity by running BTC’s price up, which they have done this month (BTC +30%). They support this run up by pumping illiquid, easily manipulatable names alongside BTC, which they have done this month (LTC +64%; BCH +79%; BSV +180%; ETC +151%). This upward BTC price movement grabs the attention of additional capital sitting on the sidelines looking to buy on momentum. Numerous important momentum TA indicators flipped bullish in January. The weekly MACD turned bullish. Green doji candle on the monthly Heikin-Ashi. Price crossed above the 50D, 100D and 200D moving averages. A golden cross is likely on deck for February. Momentum traders that have been out of BTC since July see these and many other bullish factors, in conjunction with the halving narrative, and they buy. Buying begets more buying. Manufactured reflexivity.

This setup, while undoubtedly bullish over the next 100 days, will face a major test on the back side of the halving. Put differently, given this setup - who is selling in the next 100 days? Probably not many folks. So number go up. However, who is NOT buying in the next 100 days but IS buying in June, July or August? Or December? Or May 2021? “Buy the rumor sell the news” is a time-tested adage in investing. It’s probably truer in crypto than any other asset class. Crypto LOVES buying the run-up to an event and fading the actual event. The 2020 halving is the most anticipated event in BTC history. The last halving in 2016 had many many millions less eyes on it, mine included. The logistics of the halving remain in place, but the narrative fades the day it happens.

There is a significant possibility we see a large pullback in price after the halving. That pullback is likely to occur from levels significantly higher than today. Risky Whales will likely take all that positive reflexivity built up in the first part of 2020 and distribute BTC supply into it sometime after the halving. Not only will they distribute BTC, but they will also short – forcing the market’s hand as to the true strength of demand once the next halving is 3 ½ years away. There will likely be FOMO-induced price discovery going into the halving and a whole different type of price discovery on the back of it. This will be a major test for BTC and the manner in which it responds will be critically important for its future. It is our base case (subject to change of course) that sometime in the back part of 2020 or the first part of 2021, after a significant decline off the highs, BTC finds price support. Do we run to $14k and retrace to $8k? Do we run to $20k and retrace to $10k? Do we run to $30k and retrace to $14k? Is Stock-To-Flow right and we run to $100k and retrace to $70k? We’re not making a call on that. We have an investment process and tools to allow us to take it level by level – capturing the meat of whatever big moves may come. But that post-halving bottom, whenever/wherever it may occur, could very well end up being THE generational buying opportunity.

Where will that post-halving demand for BTC come from? All is certainly not lost. Far from it. The halving is just a big “buy the rumor sell the news event” that we believe presents significant opportunity and risk, so we wanted to highlight the setup here. But with or without the halving, the backdrop is still wildly bullish.

The whole world is still cutting rates and juicing QE.

The U.S. is projected to have >$1 trillion, with a T, deficit every year, forever. Forever ever? Forever ever? And the Fed’s balance sheet is still in better shape than the ECB or BoJ.

Global Macro indicators are sniffing out what’s coming. Below is aggregate negative yielding sovereign debt (white); inverted 10-year inflation expectations (green); gold/copper ratio (orange) and BTC (purple). What does this chart show? 1) Global growth is slowing down, 2) central bankers are doing anything possible to prevent it, and 3) that recklessness is driving the demand for stores of value.

Central bankers are hedging their own policies too – buying more gold than ever before.

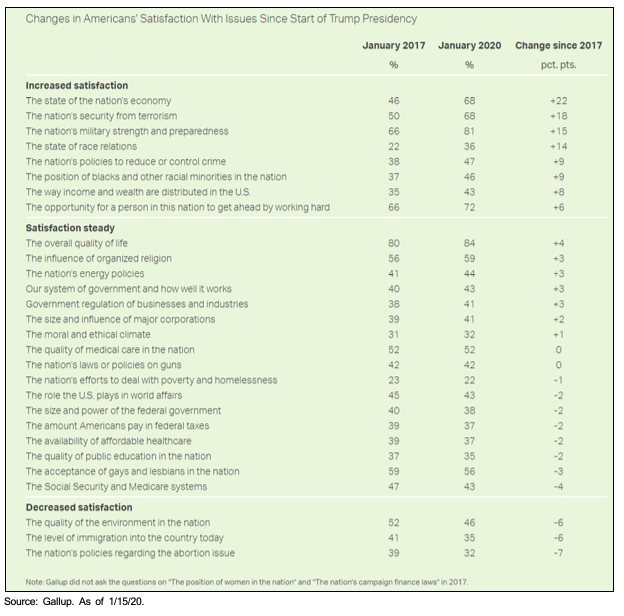

Trump will likely win the Presidential election in 2020. SPX at ATH’s and unemployment at ATL’s. People generally feel better about life than they did a few years ago. Pretty straightforward situation.

If Trump wins this is great for risk assets, including BTC. Trump’s administration is spending like crazy and the current Fed/Legislature show no signs of implementing even a modicum of restraint towards monetary and fiscal policies. In terms of Trump’s Democratic competition, Bernie has been rising in popularity as of late. I think there’s a good chance he wins the nomination and I’ve heard other folks much more knowledgeable about the situation than me say the same thing. This is largely a reflection of 1) wealth inequality and 2) how utterly unelectable the rest of the Democratic candidates are.

If Bernie wins the Democratic nomination and by some chance the Presidential election, this would be even more bullish for BTC, as Bernie is assured to want even more irresponsible monetary and fiscal policies than Trump. He has plans to tax Wall Street and billionaires, and traditional asset classes will probably hate that. But a Bernie presidency will unequivocally further demand for a non-sovereign money.

10,000 Baby Boomers turn 65 every day. An estimated $59 trillion, with a T, of wealth will be transferred from Boomers to Millennials by 2061. This has been dubbed "The Great Wealth Transfer". The below table from Charles Schwab shows top self-directed 401k equity holdings by generation. The Grayscale Bitcoin Trust is the *fifth* most popular equity holding in Millennial 401k's. This is just GBTC holdings- excluding BTC owned in Coinbase, Cash App, Robin Hood, etc. I cannot overstate the importance of this demographic shift and Millennials’ understanding and demand for BTC to the coming years and decades.

Picks and shovels crypto infrastructure buildout has come a long way in the last two years, and progress continues. It’s never been easier for institutional and retail investors alike to get exposure to Bitcoin in a secure, regulated manner. A regulated, listed options market on CME means it’s never been easier to manage fat tail downside risk – a key requirement for institutional demand. New projects in the crypto ecosystem are being funded at a steady pace. Where is the funding coming from? Significant new capital into crypto venture funds.

I’m certainly not one to blindingly take a tweet at face value, but our current knowledge of the crypto fundraising rumor mill broadly supports this data point. The big crypto funds are getting bigger and most or all of them hold a meaningful portion of AUM in BTC.

So What?

1) A high likelihood of much higher prices between now and May or shortly thereafter.

2) Significant risk of a meaningful price decline on the back side of the halving.

3) Supportive macro backdrop from many angles.

4) Bullish demographic shifts.

5) Improved crypto infrastructure.

6) Significant capital inflows into crypto funds, many of which passively buy and hold BTC.

This is the setup for 2020. While we are understandably biased, we strongly believe these market dynamics lend themselves to gaining exposure to this asset class through active portfolio management. That’s what we’re here for.

Market Update – Liquid Crypto Asset Investing

After finding a bottom on December 18th at $6,425, BTC put in a higher low on January 2nd, a higher high on January 7th, and was off to the races in typical BTC fashion - +30% in January for the best monthly performance since May 2019. While many active Bitcoin traders were bullish on the first part of 2020 going into the halving, the strength of BTC in January caught many investors by surprise.

First off, January is historically the weakest month of the year for BTC, with the last five years producing negative monthly returns.

This poor monthly performance is often attributed to Chinese New Year, with the view being that money comes out of the crypto market and given as gifts in China for the Hong Bao tradition. January 2020 bucked that trend with conviction.

Second, the PlusToken overhang, which we’ve discussed in the prior two monthlies, has not yet been alleviated, from what we can tell. The wallet forensics work around tracking PlusToken BTC balances is tedious. We have relied primarily on the work of ErgoBTC, which we believe is the highest quality in the space. Per Ergo’s January 11th report, PlusToken has 4k-24k BTC in mixing but yet to be distributed, and another 49k BTC behind that yet to enter the mixing process. If that additional 49k never enters the mixing process, PlusToken selling pressuring price lower is largely behind us. They may have enough BTC remaining that has already been sent through the mixing process to push the market significantly lower one more time if they move it aggressively, but if they keep the pace seen in late December, the market should be able to absorb that without much detrimental effect. On December 1st we said, “it would be reasonable to assume price will bottom in advance of that selling being done, as investors anticipate this significant overhang coming to an end.” We still think that’s true and the price action in January may be indicative that the risk around PlusToken has significantly diminished.

If they begin moving the unshuffled 49k into the shuffling process, the market is unlikely to respond to that positively. Additionally, PlusToken wallets hold 789k ETH and 26mm EOS. If either of those move, the market isn’t going to like that. We are keeping a close eye on the situation.

January’s strong performance also came with a backdrop of the most severe global health threat since SARS – 2019-nCoV, or the coronavirus. Details on this outbreak are outside the scope of this letter, but it is undoubtedly a big deal and a dynamic and opaque situation. It is difficult to wrap a crypto-related narrative around coronavirus, but from all accounts Chinese New Year celebrations were largely cancelled because of the outbreak. The first reported case of coronavirus was on December 31st, and by the second week of January, reports became widespread. There is some chance that folks located in Asia were forced to stay indoors because of the outbreak and chose to spend that time trading crypto, but we don’t have evidence of that other than strong price and volume trends.

We talk a lot about regime shifts here. Correctly identifying the current regime and understanding the risks and opportunities associated with that regime is a big part of generating attractive risk-adjusted returns on a consistent basis. Risk is often most acutely present during regime shifts – when the set of characteristics defining the current price action change and new characteristics become dominant. These shifts are where the present stops being like the past, and if you assume otherwise you can generate poor returns. Crypto has a habit of throwing headfakes – bearish regimes that will act bullish for a short period of time, or bullish regimes that will act bearish for a short period of time. Raging bear markets can be almost as easy to trade as raging bull markets. However, correctly identifying the shift from one to another is difficult but paramount. Did January bring a regime shift? We believe it did. We have a lot evidence of this but perhaps the most compelling evidence was simply the ferociousness of the bid at multiple times during January. Couple that with the lack of aggressiveness to the selling, and you have a very different market in January than you had in the prior five months (outside of a few days surrounding the President Xi pump in late October).

Could it be a headfake, like the President Xi headfake on October 25th? Possible, but not likely in our view. The timeline doesn’t add up for the Risky Whales to throw a headfake right now. They know there’s easy money to be made on the upside into the halving. Too easy. Too much mainstream media coverage. Too much conversation. Too many people banging the halving drum on Twitter. Too much Stock-To-Flow. There’s easy profits to the upside. To go make a lower low from here, $9.3k, back down to say $6k would be too damaging to the market structure. A 35% decline over the coming 1-2 months wouldn’t give whales enough time to pick the whole thing back up off the floor and run it all the way back up to $14k/$20k/etc into and directly after the halving, JUST so they can hang a punishing short on from those levels. You need to take it higher, so you have more room to go down on the backside. How high? We’re not sure. There’s resistance at various points overhead - $10k/$10.3k/$11.4k/$12k. BTC may find those levels get defended. With that said, we think dips are meant to be bought for the next several months. As a reminder, when BTC gets moving to the upside, dips are typically swift and shallow.

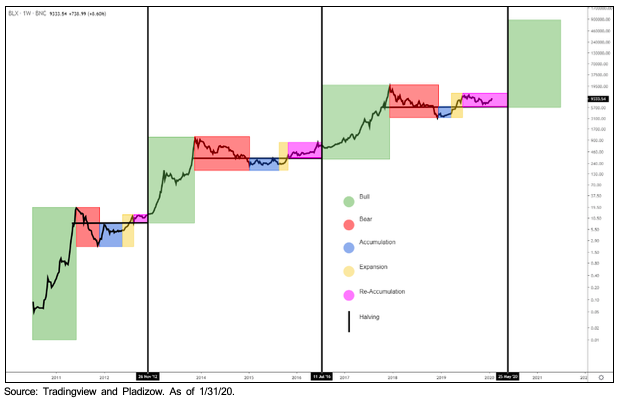

We’ve been showing this chart for months. BTC looks beautifully on-schedule.

Speaking of beautifully on-schedule, if Stock-To-Flow is even remotely on target, we will see multiples of the December 2017 peak in the next 18 months.

Importantly, January BTC volumes were strong – the strongest since August. We’ll want to see follow-through for confirmation, but my bet is we’ll see it.

Publicly available on-chain metrics, like MVRV and NVT Signal, are heading north. We expect these to reach or exceed their highs of the last 2 1/2 years. Other proprietary on-chain measurements look more bullish. We’re watching them all closely.

A low amount of Bitcoin days are being destroyed right now relative to average. This is bullish.

To further prove the point, the % of Bitcoin moved in the last 30 days is sitting approximately at multiyear lows.

Hashrate reached net ATH’s in January.

Cross-coin correlation broadly increased off the mid-December price lows. We need to be watching this carefully, as it is our expectation that this would decrease in a bull market.

Speaking of Alts, they ripped in January. As is so often the case, the most easily manipulatable names led the pack – LTC, BCH, BSV, ETC, DASH, ZEC, ICX. BCH and BSV specifically were able to wrap narratives around their price action in January – their halvings are both in early April, more than a month before BTC’s. Thus, by pumping those two, BTC is given “permission” to pump.

We weren’t long any of the above-mentioned names in January. Should we have been? Should we have seen the “BCH & BSV halve first so they pump first” narrative coming and played that? Maybe. I’m not too fussed about it though. They are fundamentally unsound projects. Their blockchains are disasters. Picking those pumps doesn’t strike us as a compelling long-term business that can take significant capital deployment.

Other Alts have the potential to put together compelling stories this year. EOS and ADA both have catalysts upcoming. XTZ, ATOM, FTT, HT and others could have real stories woven around them. New token listings are coming down the pipe for 2020 which could bring promise. But the burden of proof is on the Alt universe – they must present a compelling investment case to outperform BTC on a risk-adjusted basis, otherwise we prefer our exposure to be in BTC. At the moment we have some, but limited, Alt exposure. This may change in the coming weeks and months but it’s not a foregone conclusion.

Closing Remarks

I’m fired up for 2020 and the 2020s. The backdrop for this year and this decade for a non-sovereign money to gain mass adoption is compelling. The opportunity is right in front of us. That opportunity is not without significant risk, but we believe the potential returns make exposure to the asset class one of the most attractive investments on the planet.

Bitcoin will not stop moving in these big booms and big busts anytime soon. Those movements are a function of network effect driving such a significant portion of the value of the technology – so we think those cycles will continue. In prior BTC bull trends, Alt exposure acted as a leveraged bet on BTC – generating outperformance above BTC returns by being long select Alts. 2019 changed that and for fundamentally sound reasons. Alts broadly do not have the same compelling investment propositions that BTC does right now, and we’re not sure that’s going to change in 2020. Over the course of the last year, that market structure has rightfully pushed our investment strategy towards trading more and more Bitcoin. Our aim has always been to outperform BTC through cycles – by catching the meat of the up moves and missing or profiting from the meat of the down moves. We believe achieving this goal primarily through exposure to Bitcoin is a systematic endeavor. A systematic investment strategy is one rooted in quantitative analysis more so than qualitative, thus that has been the evolution of our investment strategy over the last 6+ months. One of the reasons I’m so fired up for 2020 is that I believe our current investment strategy is purpose-built to excel in the current market environment. The market is going to give us a lot of opportunities this year – and we believe we’ll capture those. Onward!

“Rather than chase the cat, take away the plate.”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

Invest

Ikigai is currently fielding interest from new investors. Contact us to see if you qualify.

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Timothy Lewis, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS