July 2021 - Monthly Market Update

/Monthly Update || July 2021

“There are old investors, and there are bold investors, but there are no old bold investors.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our thirty-fourth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, Bitcoin battled in the month of June and finished the month down 6% - an admirable performance given the backdrop. China followed through on their May crypto crackdown announcement with a level of heavy-handedness never previously seen. It appears this time actually WAS different in terms of the CCP’s seriousness towards cracking down on crypto – a topic we discuss in detail below. Where the China crackdown situation goes from here is an open question, although the likelihood the worst is behind us in terms of negative news announcements is increasing. A month from now, that likelihood should be meaningfully higher than it is today. That’s important to note when assessing recent Bitcoin and crypto price action.

The $30k level was tested viciously in June - producing by some measures unprecedented price action. Bitcoin held $30k multiple times and while it’s not out of the woods yet, the strength of the bid that came to meet the massive supply between $29-$40k was noteworthy.

June led many market participants to ponder the question “where are we in the cycle”? It’s a worthwhile question to ask but one without a clear answer. As discussed in last month’s Monthly Update, Bitcoin is in unchartered waters at the moment. To reiterate, if what we just witnessed over the last six weeks was a cyclical top, we’ve never had a cyclical top look like that before. And if it that was simply a pullback on the way to new ATH’s in the coming months, we’ve never had a pullback look like that. So in either case, this price action is unprecedented.

Unprecedented price action should come as no surprise given the fundamental backdrop we find ourselves with. The Elon/ESG factor took a slight back seat to the fury of China in June, but neither factor is resolved at present. Additionally, US regulators have generally increased their jawboning towards crypto over the last two months. Although no concrete changes to US crypto regulations have been enacted over the last two months, it’s apparent the politicking around crypto has increased as of late and that may eventually lead to new US crypto regulations.

While it’s easy to have the kneejerk reaction of being frightened by US crypto regulations, and while there’s certainly the potential for heavy-handed, value-diminishing crypto regulations to be enacted, it’s worth paying close attention to the minutiae. This summary of the recent House subcommittee hearing is a great example. Sure, some of the politicians are obviously just flat out anti-crypto, but many others are not and are simply suggesting a more holistic, responsive and tailored approach to regulation within pre-established purviews. So taking a step back, what is the likelihood whatever additional regulatory oversight may eventually be put in place makes crypto MORE investable, rather than less? If the eventual outcome is some combination of less leverage trading, less scams, less price manipulation and less egregious shitcoining, isn’t that strongly bullish for crypto?

That said, what’s the likelihood of that directionally positive outcome with US crypto regulations occurring? I invite you to review prior Monthly Highlights and the most recent Highlights from June. With little exception, the largest financial institutions in the world are making concerted steps toward crypto in real-time. These institutions are acutely aware of the regulatory situation in Washington. After all, it is their donations who put these politicians in office and their lobbyists who actually enact change behind the scenes. What are the actions of these institutions telling you about their expectations for the future of this asset class and technology?

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

June Highlights

El Salvador Votes to Make Bitcoin Legal Tender, to Facilitate Transactions with Lightning Network

A16Z Raises $2.2bn Crypto Venture Fund

Solana Raises $314mm in Treasury Token Raise Led by A16Z and Polychain

Microstrategy Raises $500mm Senior Secured Notes to Buy Bitcoin

Microstrategy Purchases 13,005 Bitcoin at $37,617

World’s Largest Interdealer Broker, TP ICAP to Launch Crypto Trading with Fidelity and Standard Charter

NYDIG Partners with Q2 Software, Bringing Bitcoin Trading To 18.3mm Users

State Street Launches New Division Dedicated to Digital Finance

PayPal and Visa Invest in Blockchain Capital’s $300mm Venture Fund

Elon Continues Giving Confusing Mixed Signals on Twitter

FTX Signs Sponsorship Deal with MLB, First Ever Company Logo on Umpire Uniforms

FTX Buys Stake in Stocktwits

FTX Receives Investment and Endorsement from Tom Brady and Giselle Bundchen

Soros Fund Management Begins Trading Bitcoin

IRS Chief Asks Congress for Authority to Regulate Crypto

IMF Pushes Back on El Salvador’s Move to Make Bitcoin Legal Tender

Several LatAm Country Politicians Show Support for Bitcoin on Twitter, But None with Explicit Strong Steps Like El Salvador

Interactive Brokers to Offer Crypto Trading by End of Summer

CFTC Commissioner Criticizes DeFi

US House Financial Services Subcommittee Holds Hearing on Crypto with Mixed Stances

House Democrats Form Working Group Focused on Crypto

Elizabeth Warren Makes Multiple Outspoken Negative Comments About Bitcoin

Ontario Securities Commission Alleges Securities Law Violation by Bybit

Texas Department of Banking to Allow Chartered Banks to Custody Crypto

New York Unions Block Bill to Instate Moratorium on Crypto Mining

Michael Saylor Hosts Twitter Space with Bitcoin Mining Council

Microstrategy Launches “At-The-Market” Securities Offering to Selling $1bn of Common Stock Over Time

DeFi Exchange dYdX Raises $65mm From Paradigm, Three Arrows Capital and DeFiance Capital

Bitwise Raises $70mm Series B from Elad Gill, Electric Capital and Numerous Institutional Investors

Unchained Capital Raises $25mm Series A Led by NYDIG

Square to Construct Solar-powered Bitcoin Mining Facility with Blockstream

Market Maker Amber Group Raises $100mm Series B at $1bn Valuation

Citigroup Launches Crypto/Blockchain Unit Within Wealth Management Business

Google Ads to Let Crypto Exchanges and Wallets Target U.S. Users

German Exchange Deutsche Borse Group Acquires Majority Stake in Swiss Crypto Firm Crypto Finance

Coinbase Begins Offering Credit Card with 4% Back in Crypto Rewards

Coinbase to Offer 4% Interest Product on USDC Lending

| Asset Class | June | May | April | Q2-21 | Q1-21 | YTD | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|

| Bitcoin | -6% | -35% | -2% | -41% | 103% | 21% | 303% | BTC |

| NASDAQ | 6% | -1% | 6% | 11% | 2% | 13% | 48% | QQQ |

| S&P 500 | 2% | 1% | 5% | 8% | 6% | 14% | 16% | SPX |

| Total World Equities | 1% | 2% | 3% | 6% | 6% | 12% | 14% | VT |

| Emerging Market Equity | 1% | 2% | 1% | 3% | 4% | 7% | 15% | EEM |

| Gold | -7% | 8% | 3% | 3% | -10% | -7% | 25% | GLD |

| High Yield | 1% | 0% | 1% | 1% | 0% | 1% | -1% | HYG |

| Emerging Market Debt | 1% | 1% | 2% | 3% | -6% | -3% | 1% | EMB |

| Bank Debt | 0% | 0% | 0% | 0% | -1% | -1% | -2% | BKLN |

| Industrial Materials | -4% | 5% | 8% | 8% | 8% | 17% | 16% | DBB |

| USD | 3% | -2% |

-2% |

-1% | 4% | 3% | -7% | DXY |

| Volatility Index | -6% | -10% |

-4% |

-18% | -15% | -30% | 66% | VIX |

| Oil | 10% | 5% | 7% | 23% | 23% | 51% | -68% | USO |

Source: TradingView. As of 6/30/21.

China Punches, Bitcoin Absorbs

Honestly I’d prefer not to write about China again. I’m tired of it. It’s opaque, especially for English-speaking Westerners (me). It puts me into a naturally adversarial mental state that I generally prefer to avoid. But it’s too big of a deal. It matters too much. It’s too dominant of a factor right now. And it’s too dynamic. I do this all day every day for a living, and even I struggle to keep up with just how much has occurred with this factor just in the month of June. So the following is my presentation of the timeline of significant events out of China in the month of June as it relates to crypto. Pardon the graphic font, it’s hard to show that much information at once.

Kind of stunning when you look at it all together, right? This was nothing short of a full-on assault on crypto mining and trading. Could it get incrementally worse from here? Sure, it’s China. They do crazy stuff sometimes. But they’ve thrown a LOT at the crypto ecosystem – 25 discrete occurrences in 30 days, not to mention many more in the back part of May. Was that it? Are they done? It is instructive to try and parse through what China’s goals might be with the crypto crackdown. Social stability is a big one. DCEP (China’s CBDC) support is big. Reducing carbon emissions is big. Fraud and money laundering are big. Capital flight matters. Electricity grid utilization and pricing matter.

The question is, have the actions taken to-date sufficiently achieved these goals at hand? It’s hard to say right now. You could see that having been the worst of it, with the frequency and severity of actions against crypto diminishing in July and further in August. But there’s still some real chance they do more from here, so it bears close watching. Stepping back, it is unlikely they can, will, or even want to ban crypto entirely in every facet. That’s just not typically how they roll. But for the reasons mentioned above and likely others, the CCP decided crypto activity needed to be reined in significantly. If the onslaught shown in the timeline above wasn’t enough, perhaps by this time next month they’ll be done, and I can think/write about something else.

I will leave you with these two final reminders –

Bitcoin’s antifragility is on display right now. You’d be doing yourself a great disservice to not examine and appreciate this characteristic in action. Market cap went from $1.2tn to $600bn in two months. Hashrate went from 180 TH/s to 90 TH/s in 45 days. While Elon flipped on it. While China threw the book at it. While the Pope sneak dissed it. While Elizabeth Warren droned on propaganda against it. While Nassim Taleb wrote a crappy paper opposing it. What did the Bitcoin blockchain do throughout all that? Same thing it’s been doing since January 3, 2009 - spitting off a new block about once every 10 minutes… while the whole world adjusts around it.

China cracking down on mining and trading is strongly bullish for Bitcoin. It kills three birds with one stone: 1) Bitcoin is no longer so China-centric; 2) BTC mining uses way less coal (Elon); 3) Less highly-leveraged speculation. This appears the most likely outcome at the moment, and it is highly ironic that the CCP, which Western Bitcoiners view as one of the absolute worst actors on the planet, have acted in a manner so strongly bullish for Bitcoin.

Market Update – Liquid Crypto Asset Investing

| Symbol | June | May | April | Q2-21 | Q1-21 | YTD | 2020 | 2019 |

|---|---|---|---|---|---|---|---|---|

| BTC | -6% | -35% | -2% | -41% | 103% | 21% | 303% | 92% |

| ETH | -16% | -2% | 45% | 19% | 160% | 208% | 469% | -3% |

| XRP | -32% | -34% | 177% | 24% | 161% | 223% | 14% | -45% |

| BCH* | -23% | -33% | 73% | -11% | 45% | 29% | 71% | 30% |

| EOS | -38% | 3% | 34% | -14% | 85% | 59% | 1% | 0% |

| BNB | -14% | -43% | 107% | 0% | 708% | 712% | 172% | 123% |

| XTZ | -16% | -36% | 15% | -37% | 142% | 51% | 49% | 192% |

| XLM | -30% | -24% | 29% | -32% | 220% | 118% | 184% | -60% |

| LTC | -23% | -31% | 37% | -27% | 58% | 16% | 202% | 36% |

| TRX | -13% | -39% | 43% | -24% | 244% | 161% | 101% | -29% |

| Aggregate Mkt Cap | -13% | -25% | 17% | -24% | 146% | 88% | 301% | 51% |

| Aggregate DeFi* | -16% | -35% | 34% | -27% | 339% | 223% | 1177% | 77% |

| Aggr Alts Mkt Cap | -18% | -14% | 43% | 0% | 246% | 248% | 274% | -1% |

Source: CoinMarketCap. As of 6/30/21. BCH includes SV. Aggregate DeFi from Coingecko.

Bitcoin was down 6% in June and down 41% in Q2-21 - its worst Q2 performance ever. This leaves Bitcoin up a meager 21% through 1H-21. It is my base case that number will be higher on New Year’s Eve. Likely the most noteworthy point about price action in June was Bitcoin’s battle for $30k (which is honestly still ongoing at time of writing). See the long term 5D chart below.

Source: TradingView. As of 6/30/21.

Hard to see too much at that granularity, so here is the same chart zoomed in.

Source: TradingView. As of 6/30/21.

The point here is this is unprecedented price action. Those wicks are ~15% and there are five of them. Never seen something like that before. The prior section of this Monthly Update is instructive in understanding why such violent price action has occurred – China and before that, Elon/ESG. The result of which has been an epic battle of aggressive, price agnostic, sellers alongside predatory shorts meeting a wall of massive demand that to-date has held the $30k line.

Bitcoin is in no way out of the woods yet, neither from a fundamental perspective nor a TA perspective. The fundamental backdrop has been discussed at length in this Monthly Update and the last. And the TA, unfortunately, shows a rather damaged chart.

Source: TradingView. As of 6/30/21.

That is a chart with a LOT of resistance overhead – all the way through the $40’s. Price action over the last month has shown strong demand in the low $30’s and high $20’s but an unwillingness to chase higher, with rallies stalling out in the ~$40k range. I believe we need to see fundamentals improve from the current state in order to further incentivize buying and ward off additional selling higher. China needs to lay off. Elon need to show outward support. Both those outcomes are possible in the coming weeks and months, and unfortunately assessing the likelihood of an Elon flip forces you to comb through ridiculousness like this-

While uncertainty abounds in the near term for both the Elon/ESG and China factors, one thing is certain – we have laid down a LOT of mining rigs.

Source: Blockchain.com. As of 6/30/21.

This is the largest nominal and percent decline of hashrate in Bitcoin history. That’s a big deal. This Saturday will be the largest downward difficulty adjustment ever. Also a big deal. We know why this has occurred. We know that some amount of that hashrate is currently being transported away from China to destinations all over the world, to be hooked up to new sources of electricity and restarted. That process will likely take multiple months and it remains to be seen what percent of the hashrate laid down will actually be brought back online. Part of that, of course, depends on price. And as a reminder, price doesn’t follow hashrate, it is the opposite. Don’t let anyone tell you different. As for the Bitcoin network itself? It’s just fine. That’s what the difficulty adjustment is for - perhaps Bitcoin’s most ingenious piece of mechanism design.

After two months of massive outperformance, ETHBTC gave back a bit of its gains in June, with ETH down 16% vs BTC down 6%. ETH has still strongly outperformed YTD and over a TTM basis, and now has the much-discussed EIP-1559 catalyst around the corner. From a purely TA perspective, the chart may be challenged here in the near-term.

Source: TradingView. As of 6/30/21.

Although if you zoom out, this still looks very attractive.

Source: TradingView. As of 6/30/21.

If ETHBTC were to underperform in 2H-21, something will have gone mightily wrong with the ETH narrative, or incredibly right with the BTC narrative. We are coming in to one of the most telegraphed catalysts in ETH history - the London hard fork, aka EIP-1559, scheduled for July. Fade the news is a time-honored tradition in crypto and there’s some chance we see that play out again here, although I would expect at least some amount of ETHBTC outperformance between now and the hard fork date.

What happens to ETHBTC post-1559 may largely rest in the hands of ETH DeFi activity levels. As a reminder, DeFi has underperformed BTC and ETH meaningfully since the market top but generated so much relative outperformance in Q1 that the sector still posted an oustanding 1H-21 – up 223% vs ETH 208% and BTC 22%. It’s just that all outperformance came in the first 80 days of the year.

That said, I would be lying if I said this chart doesn’t look like it’s in trouble.

Source: TradingView. As of 6/30/21.

The DeFi subsector is one that hangs its valuation hat on the ever-elusive “actual usage growth”. DeFi has user growth. Volume growth. TVL growth. Revenue growth. That’s what makes the following charts so important, and potentially so concerning-

Source: Token Terminal. As of 6/30/21.

Source: Token Terminal. As of 6/30/21.

Source: Debank. As of 6/30/21.

Source: Polygonscan. As of 7/1/21.

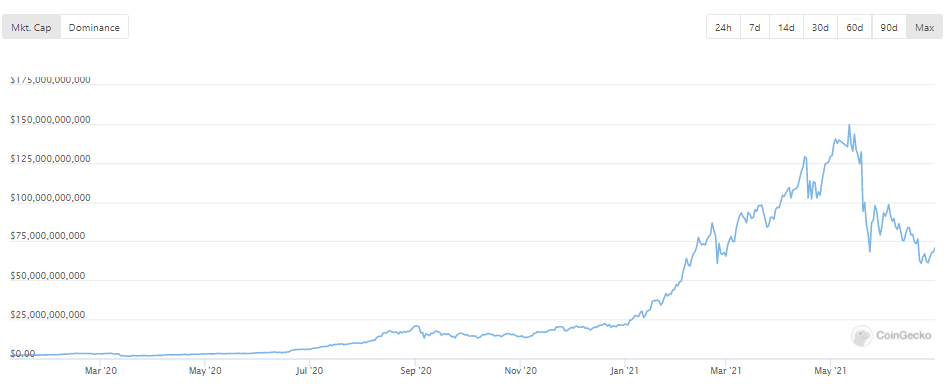

On a Y/Y basis, all these metrics show stunning growth. In the last 365 days, DeFi has exploded from relative obscurity to billions of dollars of daily transaction volume and millions of dollars of daily revenue. Impressive stuff. The aggregate DeFi market cap responded accordingly - going from $6bn a year ago to $70bn today. Yet in the fast-paced world of crypto, to quote Janet Jackson, it’s all about “what have you done for me lately”. Thus, the short-term rate of change of these metrics is concerning. Given recent current events, the decline in DeFi activity makes sense. We know Chinese crypto traders were large DeFi market participants. The CCP crackdown has undoubtedly scared many of these traders away and that’s a big hole to fill.

The current aggregate DeFi market cap of $70bn is down 53% from it’s May 11th high of $150bn. It should come as little surprise DeFi market cap topped out only a few days before activity levels topped as well.

Source: Coingecko. As of 7/1/21.

What was the embedded expected growth rate of DeFi activity 6 weeks ago when the aggregate market cap was $150bn? What is the current embedded expected growth rate of DeFi activity at $70bn? I’ve been saying for months now that DeFi is stunningly reflexive due to the circularity of TVL, ponzinomics and high yields driven by the demand to leverage long crypto. This works magic on the way up and has the potential to be brutal on the way down.

I believe DeFi finds itself at a crucial point in the reflexivity cycle right now. YTD, ETH has attracted significant traditional capital that had either never owned crypto previously or had only owned BTC previously. I believe there has been enough anecdotal evidence to assume that crypto native capital has been significantly overweight ETH for months and remains so today. While the EIP-1559 catalyst is certainly significant, if there was no DeFi, overall interest in ETH would be orders of magnitude lower. Because of this setup, these activity metrics need to be up and to the right. Consistently. That’s not where we find ourselves currently and that warrants caution. There is certainly an outcome where ETHBTC explodes higher from 1559, TVL heads higher, traditional capital gets back from summer vacation and deploys more into ETH and blue chip DeFi, China crackdowns fade and Chinese traders begin trickling back into the market, DeFi projects ship new updates that improves user experience, and we can get this whole train back on track. There’s a good chance that’s the outcome. And then there are other, less positive outcomes with significant possibility of occurring. What happens to aggregate DeFi market cap if activity levels decline another 30% from here? My bet is market cap would fall accordingly. Should that most negative outcome occur, and we are entering a full-on negative reflexivity death spiral, I strongly believe there will be incredibly attractive buying opportunities at the end of that, wherever those price levels may be. DeFi is highly unlikely to just go away.

Closing Remarks

Amidst all this exhausting talk of China and Elon, I have yet to mention El Salvador. On June 9th, the El Salvador Congress voted to make Bitcoin legal tender 90 days after passage. This is the first country to ever do so and it’s a country that needs help. Not the kind of help the US needs, with its unfettered access to the world reserve currency and the most sophisticated financial system on Earth. A more important kind of help. El Salvador ranks 133rd out of 215 countries in GDP per capita at $4,187/year. 23% of El Salvador’s GDP is from remittances – overseas workers sending money back home to support their families. Those remittances come with hefty fees, skimming precious dollars from people least able to bear that cost.

The President of El Salvador Karim Bukele reached out to Jack Mallers, the founder of Lightning Network-based app Strike looking for help. Jack agreed to help. It’s a touching story, and it has a real chance to make the lives of El Salvadorians much better in a short amount of time.

In what was likely the most memorable moment of my crypto career, Nic Carter casually opened a Twitter Space on June 9th to discuss El Salvador. Not long after, the brother of President Bukele joined the Space and began discussing El Salvador’s plans for Bitcoin, while sitting in the congressional building as the presentation, debate, and vote on the Bitcoin legal tender bill was ongoing. Not long after, President Bukele himself joined the Space and with 22,000 people listening in, further detailed El Salvador’s future with Bitcoin. There was a moment, when you could hear applause from congress in the background coming through Bukele’s brother’s microphone as the Bitcoin bill was passed. I will never forget that moment. It was a strong reminder of what we’re ACTUALLY doing here. Paul Tudor Jones is great – but he doesn’t need any help. State Street is great - but they don’t need any help. PayPal. Druckenmiller. Visa. MassMutual. It’s all fine that they’re involved. But they don’t need help. El Salvador needs help. Paraguay needs help. Turkey, Lebanon, Nigeria, Zimbabwe, Venezuela, Sudan. Those humans need help. They need access to sound money and a functional financial system. It will make their lives much better, very quickly. Seriously. Bitcoin actually fixes this.

“If you love your son, let him go travel.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS