May 2023 - Monthly Market Update

/Monthly Update || May 2023

“In investing, there is nothing that always works, since the environment is always changing, and investors’ efforts to respond to the environment cause it to change further.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters.We welcome the opportunity to bring to you our fifty-sixth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that already has and will continue to fundamentally change the world – continuing to create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, the banking crisis that kicked off in March chugged along relatively quietly in April before ending the month with an ongoing collapse and rescue acquisition of First Republic Bank (FRC), the 14th largest bank in the US as of 12/31/22. First Republic had been hanging on by a thread since all this kicked off in mid-March, as rumors swirled of its potential imminent demise. When FRC released their Q1 earnings - reporting $100bn of deposits were withdrawn in Q1 - it was the nail in the coffin.

Source: TradingView. As of 4/30/23.

At time of writing, it remains unclear what exactly will happen with FRC. At the moment, JPM looks to be acquiring what’s left of FRC, with quite a bit of “help” from the FDIC. In a weird way, the exact outcome of the FRC collapse doesn’t matter all that much. Because the US government is fully backstopping all FRC deposits, so customer funds are not at risk.

That last sentence remains more-or-less the only fact that matters in this whole ordeal, and what has allowed such a relatively orderly collapse of three of the top 25 banks in the United States in the last six weeks. So long as the US government ensures depositors are made whole, the knock-on effects into the rest of global financial markets have remained relatively subdued. Sure Treasury yields tightened a ton in March but they only tightened a bit in April. DXY was -1% in April. The MOVE index completely collapsed in April. The VIX closed April <16. Stocks were actually up in April. This speaks to the strength of the presence of the “Lender of Last Resort” in the current global financial system. Without the existence of the money printer and the willingness to make it go Brrrr, the last six weeks probably would’ve looked a lot like 1929. Does that feel fragile to you? Yeah, me too.

I won’t pretend to be a domain expert in banking, so I don’t have a high conviction view about how this saga will continue to unfold in the coming the months and quarters. I thought this tweet thread brought up some interesting points. It would make sense to me that there are some other regional banks that have experienced massive deposit runs that are at risk of similar fates as FRC. Regional bank stock prices could certainly go meaningfully lower from here.

Source: TradingView. As of 4/30/23.

There were other macro gyrations in April alongside the continuation of the regional banking crisis. Specifically, the Debt Ceiling is coming increasingly into focus as the Treasury is running out of money.

The House voted on 4/26 to raise the Debt Ceiling $1.5tn, but that vote is expected to fail in the Senate. Economists currently estimate the US government will run out of money in late June or July, so if the ceiling isn’t raised by then we could see significant stress in financial markets. But the government has raised the debt ceiling 78 times since 1960, so it’s a pretty safe bet it’ll get raised again after politicians are done with their silly handwaving.

In the current age of Fed policy utterly dominating all asset prices, investors are focused on the Debt Ceiling as it relates to liquidity in the market. Raising the debt ceiling allows for the resumption of the sale of Treasuries, which sucks liquidity out of the market. This tweet thread lays it out clearly. There’s good reason to think this will effectively act as QT once the ceiling is eventually raised this summer, which could be problematic for asset prices.

In the meantime, crypto mostly chopped around in April. US regulatory actions remained firmly in focus, as they have been for months. Operation Chokepoint 2.0 may have found its next victim in Cross River Bank. Gary Gensler testified for 4+ hours in front of the House Financial Services Committee, and a large chunk of that was about crypto. Although honestly I’m not sure how much new information we learned. We already knew the regulation of crypto in the US is deeply politicized. We already knew Gensler believes most crypto projects and most crypto exchanges are out of compliance. We already knew Gensler wasn’t going to provide helpful clarity to crypto companies. All of that was just confirmed by the hearing. It’s a frustrating setup that will likely continue to drive US-based crypto companies offshore. The path forward for US crypto regulations looks to be multiple avenues of painful, slow legal actions that will play out in courts for quarters and years on a case-by-case basis. The only hope for broad crypto rulemaking is with legislation, and that looks like a 2025 event at the earliest.

One bright spot in April was the FTX bankruptcy process continuing to progress better than expected. While it’s still hard to say for sure that the exchange will be restarted, that outcome is undoubtedly becoming increasingly more likely. Should that occur, it’s also difficult to guess the likelihood the exchange will be reasonably successful in its restart. The eventual fate will likely be a function of the restarted exchange’s: 1) management team; 2) strategy; and 3) transparency. If those three boxes get checked, I see no reason why the new exchange couldn’t gain significant traction. This would undoubtedly be the highest likelihood possible of the highest recovery possible for creditors. Given Ikigai’s involvement, this is great news for us.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

April Highlights

Gensler Testifies to Congress, Gets Praised by Democrats and Hammered by Republicans, Calls Most Crypto Companies Non-compliant, Refuses to Outright Call ETH a Security

Ethereum Completes Shanghai Upgrade

Cross River Bank Receives Cease-and-Desist From FDIC Over Lending Practices

Coinbase Receives Digital Asset License in Bermuda, To Launch Offshore Exchange in Weeks

Coinbase Sues SEC to Demand Answer for Rulemaking

Coinbase Responds to SEC’s Wells Notice from Last Month

EU Parliament Approve Crypto Licensing and Fund Transfer Rules in Landmark MiCA Regulation

LayerZero Raises $120mm Series B at $3bn Valuation Led by A16Z, Christie’s, Sequoia

Unchained Capital Raises $60mm Funding from Valor Equity Partners, NYDIG, et al

Delphi Labs Raises $13.5mm for Crypto Startup Incubator Led by Jump, P2P

FTX Bankruptcy Fee Statements Show Significant Consideration for Exchange Restart Plan, Including Recovery Rights Token

FTX Bankruptcy Has Recovered $7.3bn in Assets

FTX Bankruptcy Receives Unsolicited $250mm Bid from Tribe Capital to Restart Exchange

FTX Bankruptcy Prepares to Clawback $2.1bn Payment from Binance

The Bitcoin Whitepaper is Discovered to be Hidden in Every Recent MacOS Version, Apple to Remove in Next Update

MicroStrategy Purchases 1,045 BTC for $29.3mm

London Stock Exchange to Start Clearing Bitcoin Futures and Options Trades

House Financial Services Committee Introduces 73-page Draft Stablecoin Bill

OFAC and FinCEN Fine Bittrex $53mm for AML/Violations

Binance US Allowed by US Government to Continue with Acquisition of Voyager Digital, Then Backs Out of Acquisition

Peer-to-Peer Crypto Platform Paxful Shuts Down Operations Under Regulatory Pressure

Genesis Creditors Reject Previously Accepted Bankruptcy Restructuring Plan

Kraken Pushes Back Against IRS Demands for User Data

Binance Declines Offer to Buy Justin Sun’s Stake in Huobi

DYDX Disallows Access to Platform in Canada

FBI Raids Home of Former FTX Executive Ryan Salame, Said to Have Been Cooperating with Authorities

Former Genesis CEO Michael Moro Joins Crypto Derivatives Exchange Startup Ankex

| Asset Class | Apr | Q1-23 | YTD | Q4-22 | Q3-22 | Q2-22 | Q1-22 | 2022 | 2021 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 3% | 72% | 77% | -15% | -2% | -57% | -2% | -64% | 60% | 303% | BTC |

| NASDAQ | 1% | 21% | 21% | 0% | -5% | -23% | -9% | -33% | 27% | 48% | QQQ |

| S&P 500 | 1% | 7% | 9% | 7% | -5% | -16% | -5% | -19% | 27% | 16% | SPX |

| Total World Equities | 1% | 7% | 8% | 9% | -8% | -16% | -6% | -20% | 16% | 14% | VT |

| Emerging Market Equity | -1% | 4% | 3% | 9% | -13% | -11% | -8% | -22% | -5% | 15% | EEM |

| Gold | 1% | 8% | 9% | 10% | -8% | -7% | 6% | -1% | -4% | 25% | GLD |

| High Yield | 0% | 3% | 2% | 3% | -3% | -11% | -5% | -15% | 0% | -1% | HYG |

| Emerging Market Debt | 0% | 2% | 2% | 7% | -7% | -13% | -10% | -22% | -6% | 1% | EMB |

| Bank Debt | 0% | 1% | 2% | 2% | 0% | -7% | -1% | -7% | -1% | -2% | BKLN |

| Industrial Materials | -5% | 4% | -1% | 9% | -8% | -25% | 16% | -13% | 29% | 16% | DBB |

| USD | -1% | 0% | -1% | -8% | 7% | 7% | 3% | 8% | 6% | -7% | DXY |

| Volatility Index | -16% | -14% | -27% | -31% | 10% | 40% | 19% | 26% | -24% | 66% | VIX |

| Oil | 2% | -5% | -4% | 7% | -19% | 8% | 36% | 29% | 65% | -68% | USO |

Source: TradingView. As of 4/30/23.

With The Right Macro Backdrop, Crypto Narratives Will Just Magically Start Working

Source: TradingView. As of 4/30/23.

Bitcoin Dominance has increased from 40% to 49% since FTX collapsed. And when you think about the backdrop of the last six months, that makes sense. There’s been a banking crisis, which highlights the investment case for Bitcoin. And there’s been heavy US regulatory actions that put Alts at risk, making Bitcoin a relatively safer bet within crypto. Mind you, it’s not like Dominance is high at all by historical standards – at the time of the FTX collapse it was at near all-time lows. But there is a story here about BTC’s relative outperformance off the lows of last year.

How would we assess the likelihood of this upward trend in Dominance continuing through this year and into 2024? Is that a Bitcoin assessment, an Alts assessment, or a Macro assessment? I think it’s all three.

On the Bitcoin side, I don’t see compelling narratives currently present to drive prices much higher from here in the near-term. Sure, something could come out of nowhere. Elon could buy a couple billion of BTC and up we go. But that’s more of a white swan. I’m talking about strongly positive, identifiable catalysts/narratives. I don’t really see that at the moment. Thus, I think the chart below is a pretty good way to think about it.

Source: TradingView. As of 4/30/23.

There are certainly plenty of folks that would argue with my view here. Some would look at the ongoing banking crisis and the so-called global de-dollarization and claim these are excellent advertisements for the investment case of Bitcoin. Yeah, maybe. Perhaps those are enough to take us from $20k to $30k, but is it enough to take us from $30k to $40k and beyond? Doesn’t feel like it to me, especially with ongoing Silk Road and Mt Gox Bitcoin selling. Bitcoin needs something more, and no I don’t think Ordinals are enough. No I don’t think Lightning is enough either (near-term). Yes I know the halving is a year away, but I don’t think that necessarily keeps BTC from retesting $20k again this year.

Moving to Alts, I am admittedly not as close to the various subsectors at the moment as I was for most of the last several years. But it certainly hasn’t been all that hard to keep generally abreast of meaningful innovation occurring in the Alts space, because there hasn’t been much. I don’t mean to be flippant here. There’s a lot of smart folks working on all sorts of things in crypto, but I don’t see it producing anything that’s going to drive meaningful increases in user activity and thus capital inflows into Alts in the near-term. DeFi summer of 2020. NFT summer of 2021. I don’t think there’s going to be one of those for 2023.

Digging a bit deeper, we can rattle off a handful of potential catalysts/narratives that one might find exciting -

I’m bullish Alts that have some sort of AI narrative (e.g., RNDR, FET, NMR) because of GPT halo effect.

I’m bullish DEX’s (e.g, UNI, GMX, DYDX) because CEX failures and regulatory actions will push users into DEX trading.

I’m bullish new alt L1’s (e.g., APT, SUI) because it worked last time for SOL and AVAX.

I’m bullish decentralized storage (e.g., FIL, AR, ICP) because I’m bullish increased demand for compute.

I’m bullish DeFi borrow/lending (e.g., AAVE, MKR, COMP) because CeFi crypto lending is shut down and there’s a US banking crisis.

I’m bullish liquid staking tokens (e.g., LIDO, RPL) because I’m bullish Ethereum network activity and these are the highest beta way to play that.

I’m bullish meme coins (e.g., DOGE, SHIB, PEPE) because I’m bullish financial nihilism.

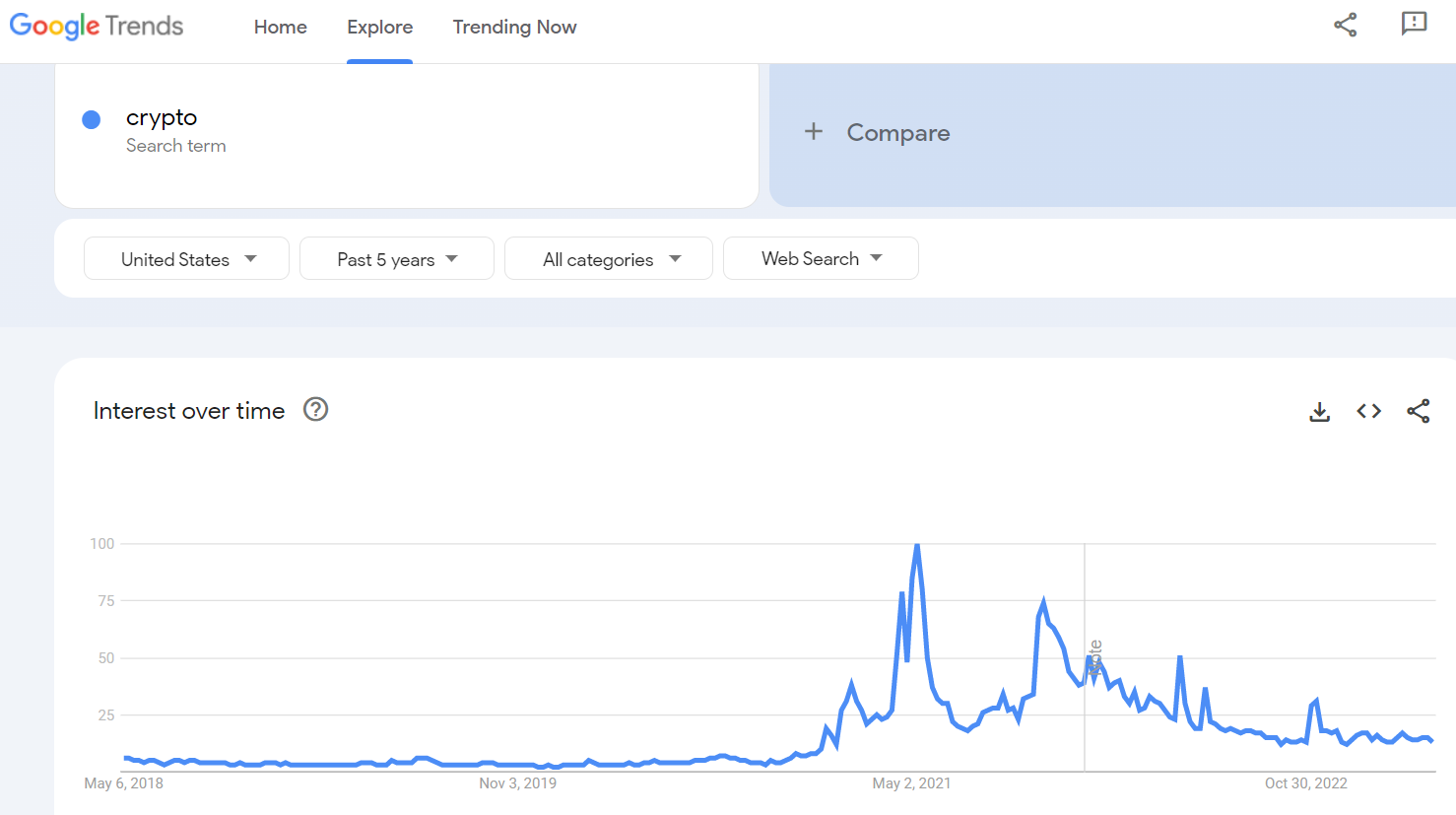

I don’t think any of the above are compelling near-term. I can poke holes in each of them pretty easily. I can also imagine some of them actually working with the right macro backdrop, but we’ll get to that in a bit. In terms of the Alt catalyst landscape at the moment, it feels about like this Google Trends chart-

Source: Google Trends. As of 4/30/23.

Which is to say, pretty dead. Now, in investing you want to skate to where the puck is heading, so it’s a good idea to get out in front of the Google Trends chart. But at this point, I struggle to have conviction on any of those individual themes mentioned above because I don’t see a compelling reason to think *now* is the time they will really start working. I think we need more passage of time to see where true utility shows up. Where a large increase in users shows up. Where value accrual mechanisms are compelling. Add to that the large overhang of regulatory uncertainty for Alts as potential unregistered securities, and I don’t get the sense Alts are going to run away to the upside this year. Were that to happen, the most likely culprit would be Macro tailwinds.

One way to think about the catalyst landscape for both Bitcoin and Alts is that it’s secondary to Macro. Essentially, making the assumption Macro tailwinds matter far and away more for crypto prices than the positive idiosyncratic happenings inside the crypto market. Said differently, with the right Macro tailwinds, whatever narratives in place at the time will just magically start working. This view makes sense to me. It speaks to the strength of It’s All One Trade; Don’t Fight The Fed; and Crypto Loves QE and Detests QT – my three favorite investing axioms for the last handful of years.

It's weird to think of the YTD Macro environment as being a tailwind for crypto, but NASDAQ is +21% through April and VIX is -27%. However we got there, that’s bullish crypto, banking crises be damned. If you gave me just those two stats on January 1st and nothing else and asked me to predict BTC price, I’d say at least +50% and probably more. Well, BTC is +77% and ETH is +57% YTD. And that happened with a backdrop of the most brutal stretch of regulatory enforcement actions in crypto history. So that speaks to the strength of how much Macro matters for crypto.

It's amazing that tech stocks could pull crypto up even in the face of all that bearish idiosyncratic crypto news flow. It certainly also matters that crypto experienced a horrendous puke into YE-22 and YTD price action has been a rebound from these deeply oversold levels. It goes back to the point I was making with the delineated BTC chart I showed above – some amount of rebound was to be expected from sub-$20k. But now that we’ve essentially doubled from those lows, I believe it’s going to take additional Macro tailwinds through year-end to carry crypto prices higher - the idiosyncratic positive factors currently in place for both BTC and Alts are insufficient on their own.

NASDAQ is +21% YTD. Could it close the year +30%? Maybe. Is it easier for me to imagine NASDAQ +10-25% for full year 2023? Yes it is. Part of the concern is that those index gains have been generated by a historically low number of individual companies.

As of 4/25/23.

As I’ve pointed out in the last two Monthly Updates, I still believe the glide path of decelerating inflation will be the single biggest factor for stock prices through year-end. If inflation goes from 5% to 4 to 3 in a straight line into YE (which inflation markets are currently predicting), I think that could put the NASDAQ up another 10-20% from here. I think that translates into $40k+ for YE BTC price and some of those Alt narratives I mentioned earlier will probably just magically work. You’ll still have other Macro landmines to avoid, but I think that could be doable if inflation rapidly decelerates from here.

So What?

In a way, I find it disappointing that the fate of crypto prices is so inextricably linked to the overall direction of Macro. But at this point I certainly shouldn’t be surprised. It’s true for stocks, for bonds, for real estate, for rare whiskeys and for Air Jordans. It’s All One Trade. When that gets going convincingly in the right direction, I would expect crypto prices to move higher, back towards testing all-time highs and eventually beyond. If you didn’t think M2 money supply was going to continue inflating. If you didn’t think central bank balance sheets were going to continue to expand. You’d probably want MUCH lower crypto prices than where we are currently in order to spark your interest. But the same could be said for stocks, bonds, real estate, rare whiskeys and Air Jordans. All those prices are just a function of the Brrrr, or lack thereof.

The crypto ecosystem hasn’t produced anything particularly compelling or powerful enough to kick off a secular bull market right now. If you feel differently, I urge you to reach out to me and let’s have a conversation about it. I’d love to hear differing opinions on this. Crypto is also still mired in a slew of negative current events. It doesn’t seem like those are done yet. Once the onslaught of bad news chills out a bit, we could also be in a position of positive Macro tailwinds. Then all of sudden the crypto narratives just start working.

Market Update – Liquid Crypto Asset Investing

| Symbol | Apr | Q1-23 | YTD | Q4-22 | Q3-22 | Q2-22 | Q1-22 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 3% | 72% | 77% | -15% | -2% | -57% | -2% | -64% | 60% | 303% |

| ETH | 3% | 52% | 57% | -10% | 24% | -67% | -11% | -67% | 399% | 469% |

| XRP | -12% | 58% | 39% | -29% | 45% | -59% | -2% | -59% | 278% | 14% |

| BCH* | -5% | 16% | 10% | -18% | 7% | -67% | -13% | -75% | 6% | 71% |

| EOS | -14% | 38% | 19% | -27% | 28% | -67% | -7% | -72% | 17% | 1% |

| BNB | 7% | 29% | 37% | -13% | 30% | -49% | -16% | -52% | 1269% | 172% |

| XTZ | -11% | 56% | 39% | -49% | 0% | -62% | -14% | -84% | 116% | 49% |

| XLM | -14% | 55% | 33% | -38% | 2% | -51% | -15% | -73% | 108% | 184% |

| LTC | -1% | 28% | 26% | 31% | 0% | -57% | -16% | -52% | 17% | 202% |

| TRX | 12% | 10% | 23% | -11% | -6% | -12% | -2% | -28% | 181% | 101% |

| Aggregate Mkt Cap | 1% | 49% | 51% | -16% | 7% | -58% | -5% | -64% | 186% | 301% |

| Aggregate DeFi* | -3% | 50% | 46% | -24% | 25% | -74% | -8% | -77% | 581% | 1177% |

| Aggr Alts Mkt Cap | 0% | 33% | 33% | -16% | 12% | -58% | -7% | -64% | 479% | 274% |

Source: CoinMarketCap. As of 4/30/23. BCH includes SV. Aggregate DeFi from Coingecko.

Fast forward a month, and not much has changed with the charts since April 1st. You could go back and read this section from a month ago and I think it all still pretty much holds.

BTC continues to sit right at significant resistance as volumes continue to dry up. Given we are now in May and the last two Mays have played out as “sell in May and go away”, this setup is pretty concerning in my opinion.

Source: TradingView. As of 4/30/23.

Given the lackluster trading volumes above $20k and a dearth of positive narratives, I think BTC is vulnerable to retrace a portion of its YTD gains in the coming months. ~$24.5k is a significant resistance level that was flipped in March and has yet to be retested as support. I think at a minimum we will see a retest of this level soon. The more major level is $20k and I continue to believe this level will also be tested again this year. I think there’s a good chance it will hold, but you’ll want to see how it’s acting when it gets there and see what the crypto qualitative and macro backdrop is like at that time.

Another reason I am wary about the sturdiness of the YTD rally is the massive drop in order book depth since the FTX collapse. The charts below say it all –

As of 4/26/23.

Thin order books cut both ways. It makes it easy to push price up, but if everyone rushes for the exit at once, downside volatility can be vicious. The current setup is a recipe for fireworks.

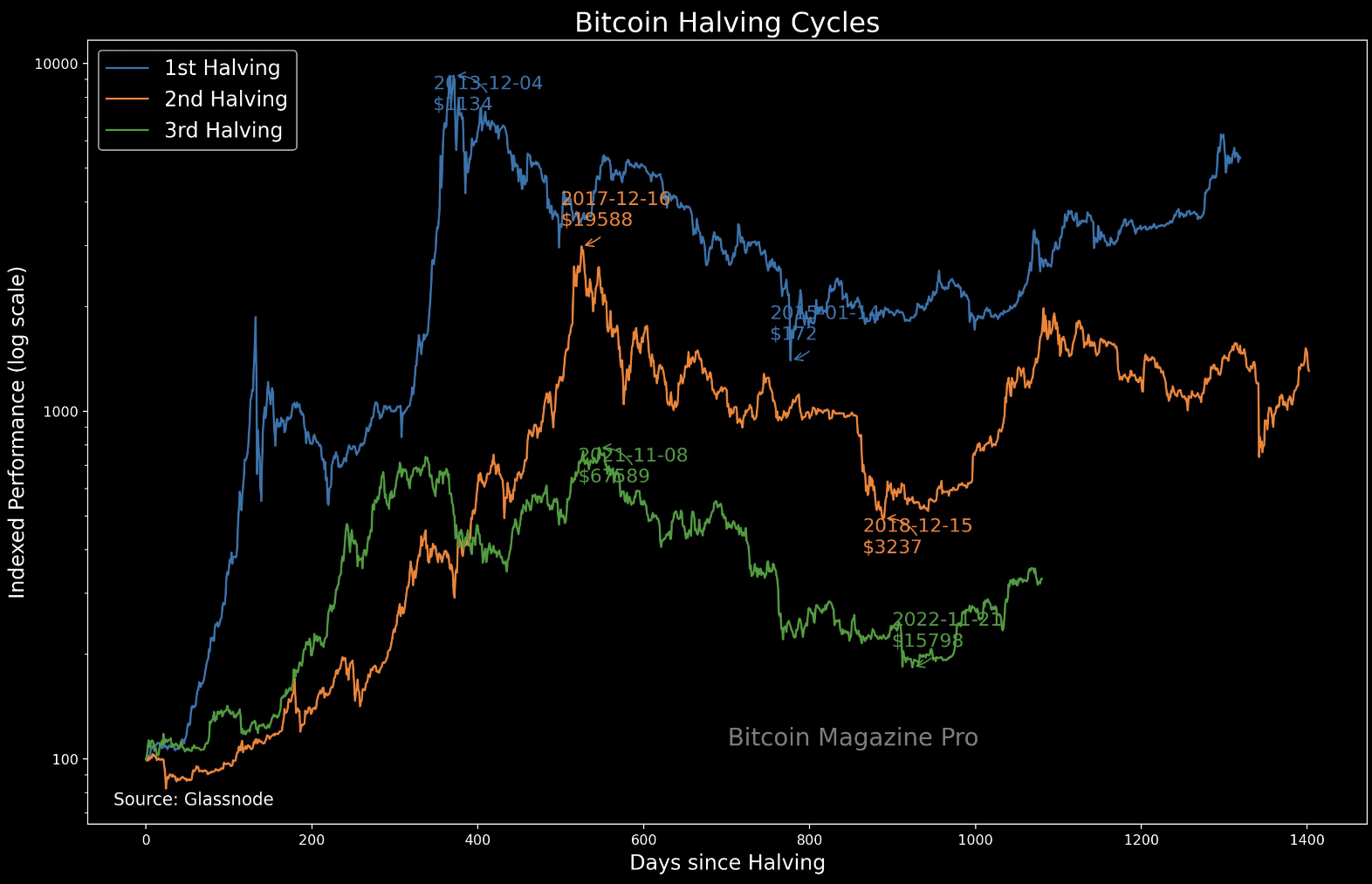

Many Bitcoin bulls currently make the case that BTC already declined 77% off its all-time high and that decline is in-line with prior cyclical declines. I agree with this view. Bulls also point out that the bottom occurred in explosive fashion on massive volumes during the collapse of FTX. I agree with this view too. Bulls will additionally point out that we are a year out from the next Bitcoin halving. When you line the halving cycles up next to each other, they look like this –

Source: @DylanLeClair_. As of 4/27/23.

You put that all together and it’s a pretty compelling case that we’ve already seen the cyclical bottom. And that is my base case. It’s not my base case that $15.5k will be retested, but I think $20k is certainly on the table. When looking at other long-term BTC charts, I don’t see any reason to think we can’t retrace to test $20k before heading higher –

As of 5/1/23.

Below is MVRV adjusted for volatility and then normalized with an oscillator. A further explanation of this metric can be found in this tweet thread. This chart also points to a cyclical bottom having occurred in November 2022, but doesn’t necessarily mean we can’t retest mid-low $20’s.

Source: @StackSmartly. As of 4/27/23.

Moving to ETH, this chart also finds itself sitting at major resistance at the big round number of $2k, with a declining volume profile similar to BTC.

Source: TradingView. As of 4/30/23.

Given the aforementioned regulatory woes in the US and lack of strong near-term narratives/catalysts, a break up from these levels in the coming months doesn’t make sense to me. Strong macro tailwinds would be the most likely way we get that outcome, but we’ve talked about that already.

Perhaps we can glean insight into the health of the overall crypto market by looking further out on the risk curve. Let’s first set the table by taking a glance at the top 50 cryptos by market cap. Spend a few minutes perusing the list below. Take note of the comments I’ve added to each.

Source: CoinMarketCap. As of 5/1/23.

Again, I welcome pushback on any of these. I could easily be missing something. Perhaps VeChain really is doing something other than getting locked in to long-term marketing agreements with the UFC. Maybe Charles Hoskinson has something going on with Cardano that I don’t know about. Maybe ATOM does accrue value in a way I don’t understand. Please, I welcome pushback.

There’s $1.25 trillion of fully-diluted market cap shown on that table, albeit 2/3 of that is BTC and ETH and another 10% is stablecoins. So that’s $300bn of FDV in the top 50 that’s not BTC, ETH or stables. How do we feel about that value for those 42 cryptos? Coincidentally, that’s the same value as the 43 smallest market cap stocks in the S&P 500. How do we feel about that?

My point here is I don’t think the “fundamentals” of the names on that table are going to carry prices higher in the near-term. Cause the fundamentals just don’t seem that great at the moment. But once the negative crypto news flow abates. Once the Fed is done raising rates and at least talking about cutting rates. Once the Fed balance sheet is no longer shrinking and ideally expanding. Once M2 money supply is once again growing…at that point my base case is the market will take whatever narratives are in place at that time, regardless of validity, and run with them. All of sudden APT isn’t expensive because it’s a relative value trade vs ETH. All of sudden FIL is the next AWS. All of a sudden Arbitrum DEX volumes are increasing so ARB is cheap. All of sudden everyone loves a good Dogcoin. That’s my read of the setup.

Closing Remarks

I continue to be worried about the state of the crypto ecosystem in general. I’m not that worried about the price of all this stuff. So long as the long-term trend of more Brrr is intact, I’m pretty highly convicted all this will be worth more in the future than it is now. But I continue to ask myself the question – to what end? Top 50 FDV is $1.25tn. That’ll go back to $3 and beyond in the coming years. Will the world be better off for it? That’s the part I’m worried about.

One reason I’m worried about crypto is because I’m worried about the leadership of this ecosystem, or lack thereof. Rewind back a year ago, and many of the most prominent names in crypto at that time are currently facing criminal charges or at least bankruptcy. The visions pitched at the time of Bitcoin as an uncorrelated inflation hedge and Web3 eating the world have fallen flat. There is a leadership vacuum as so many prominent crypto voices have fallen from grace and a narrative vacuum as so many previous investment theses have disintegrated. In the meantime, the US has become a lot more adversarial towards crypto. Like a LOT. Tough backdrop.

Leadership is hard in crypto for numerous reasons. One reason is because decentralization is at the ethos of crypto, and decentralization means the absence of centralization. Leadership is by definition centralizing. I believe this has caused a higher degree of miscoordination about the overall “gameplan” for crypto than would otherwise be present. It’s a challenge inherent in the nature of crypto’s potential. I think we need to do a better job managing through that challenge.

Leadership in crypto is also a challenge because it is a global ecosystem that spans languages, time zones and cultures. The crypto ecosystem also spans all nature of motivations and interests. Put differently, people come to crypto for all SORTS of reasons. Some come to crypto for hard money. Some for privacy. Some for the tech. Some for Web3. Some for NFTs. Some to speculate. Some to gamble. Some to scam.

We can argue about the legitimacy of each of those reasons (and others), but they’re here and they’re not going anywhere. So how do you lead in an environment like that? How do push the ecosystem in a direction where those factors come together in a way that maximizes the likelihood of positive outcomes for humanity?

It can start with discussion, perhaps partly in private but mostly in public. Discussion can lead to the identification of an agreed-upon set of goals and then a gameplan can be created to achieve those goals. No one said it would be easy, and it absolutely will not happen by accident and without a lot of intentionality. How can I contribute more in this endeavor? How can you?

“One man’s fault is another’s lesson.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS