May 2024 - Monthly Market Update

/Monthly Update || May 2024

“That’s why I make the case for responding to the current realities and their implications, as opposed to expecting the future to be made clear.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our sixty-eighth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, April brought a marked shift in sentiment and flows - both in crypto and macro alike. At the beginning of the year, the market was pricing in six rate cuts in 2024, beginning in May. Fast forward to today, and futures are only pricing in ~1.5 cuts, starting in November.

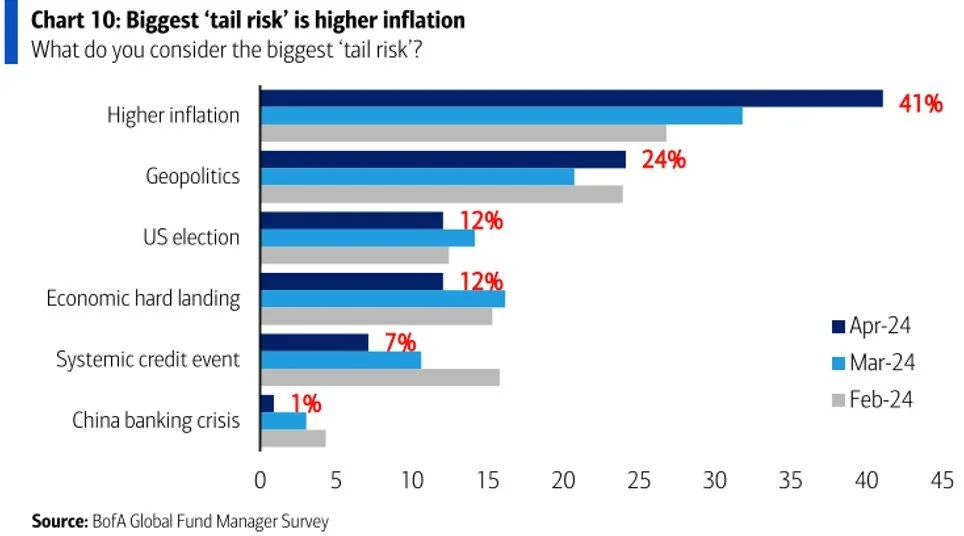

For the first three months of the year, crypto and risk assets broadly were able to shrug off this repricing of Fed expectations – NASDAQ was +8% in Q1. But as April unfolded and we got a hot CPI, hot jobs, hot PCE and weaker GDP growth – the market began to realize the Fed may be stuck with mild stagflation or at the very least inflationary growth – unable to hike nearly as much or as quickly as originally anticipated, and maybe not at all this year if things keep up the way they have been.

This realization was reflected in asset prices. US 10Y increased 50bps in April and is now only 30bps below the October cycle highs. DXY was up 1.5% in April, and +5% YTD. NASDAQ -4% in April. BTC -15%. Most Alts down nearly double that.

One interesting component of the crypto price action in April was during Iran’s weekend “attack” on Israel. I certainly don’t mean to put attack in quotes there to make light of the situation. All war is terrible and this one is no different. But the specific manner in which this attack was carried out…well, I’ll just let CNN make my point for me-

If you were paying close attention, it was relatively easy to see relatively quickly, that this attack was unlikely to metastasize into something bigger and more serious. Part of it occurred over the weekend, but the beginnings of it happened Friday 4/12 while markets were open. And stocks traded a little choppy but not terrible at all. And BTC traded pretty choppy on Friday and into Saturday, but not terrible. Alts, on the other hand. Alts got decimated.

Source: Tradingview. As of 4/13/24.

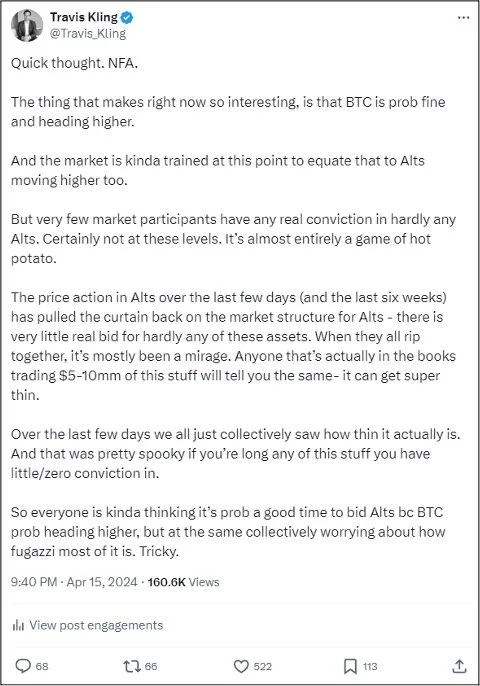

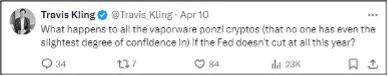

From what I gather, this event and its price action has shifted crypto market sentiment. I summed it up in a tweet that seemed to resonate with folks –

One last thing I want to point out - another big piece to the puzzle of “where are we in crypto markets right now?”

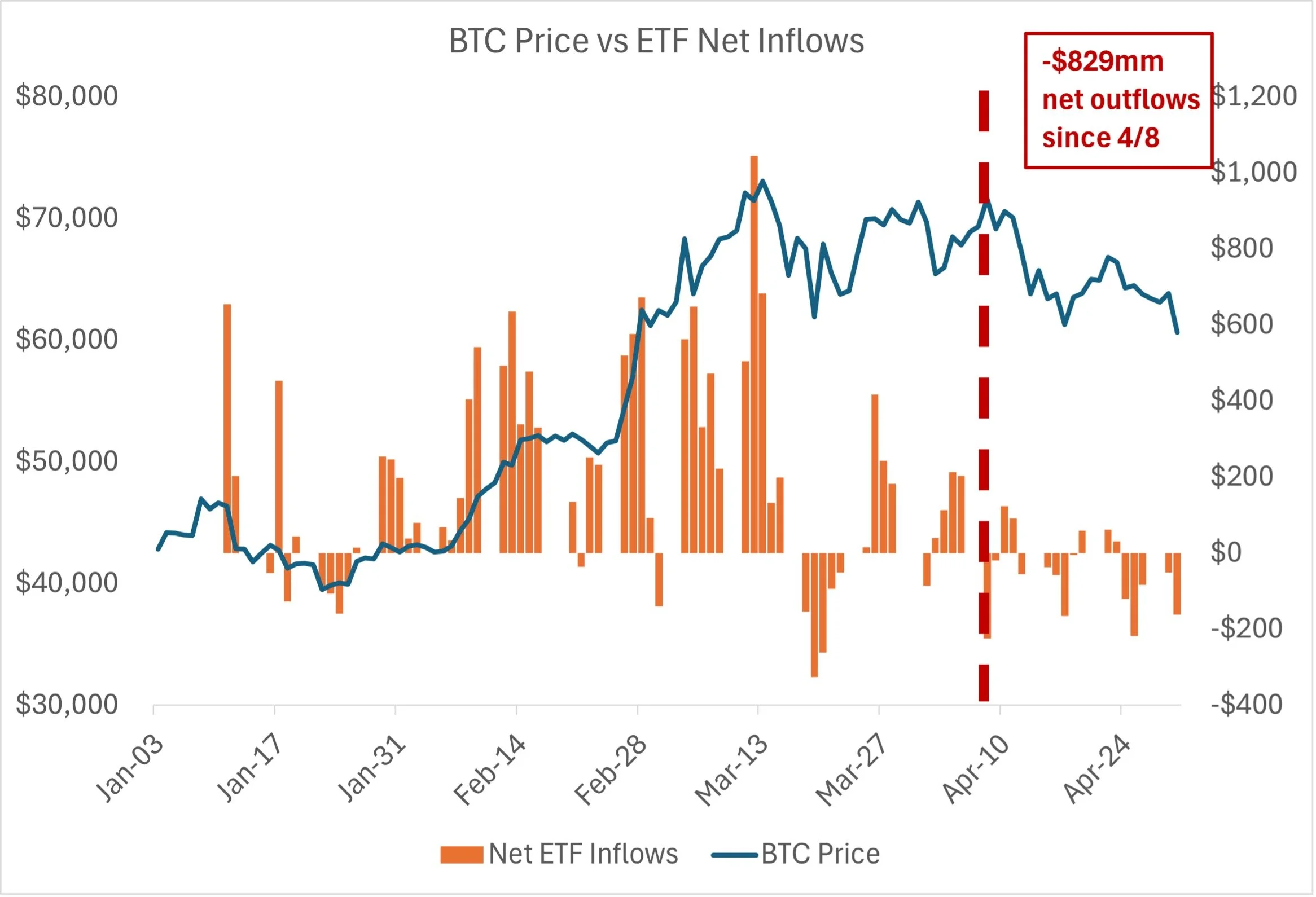

Source: Farside.co.uk. As of 4/30/24.

Real straightforward sitch. ETF inflows dried up the second week of April and price topped out right there. There’s a question of whether price went down because inflows dried up, or inflows dried up because price went down. And that’s an age-old question of BTC reflexivity. But I’ll save that topic for later on here.

So I think that basically sums up the sentiment shift that occurred in April:

Macro pricing out rate cuts plus a sprinkle of geopolitical stress causes some relatively mild shifts in traditional assets.

BTC ETF inflows dry up and turn negative second week of April.

Alts trade extra bad during Iran drone strike on Israel. This price action spooks Alt bagholders, who suddenly feel much more uncomfy with their longs. Alts continue to trade very weak into month-end.

Do you really want to be long crypto into the summer?

April Highlights

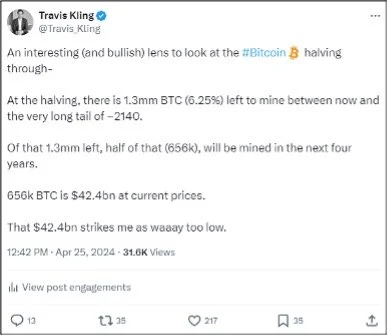

Bitcoin Blockchain Undergoes Fourth Halving, 6.25% of Bitcoin Yet to Be Mined

Consensys Sues SEC After Being Threatened with Wells Notice for ETH Being Security and MetaMask Operating as an Unlicensed Broker/Dealer

Changpeng Zhao Sentenced to Four Months in Prison

EigenLayer Announces Highly Anticipated Airdrop

Binance Converts All SAFU Fund Assets to USDC

Hong Kong Launches Multiple Spot BTC and ETH ETFs, First Day Volumes and Flows Weak

SEC Holds Comment Period on ETH ETFs

Solana Blockchain Experiences Significant Congestion, Solutions Expected in Coming Months

Stripe to Resume Crypto Payments This Summer

Uniswap Receives Wells Notice From SEC, Plans to Fight SEC

Monad Raises $225mm, Led by Paradigm

Two Founders of Mixer Samourai Wallet and Whirlpool Arrested, Charged with Money Laundering

US Government Moves $139mm of BTC from Silk Road Seizure to Coinbase, Presumably Sold

Two SEC Lawyers Resign After Agency Censure in DebtBox Case

Roger Ver Arrested in Spain, Charged with Mail Fraud, Tax Evasion

Do Kwon and Terraform Labs Found Liable for Fraud, SEC Asking for $5.3bn Fine

Blockchain Association and Crypto Freedom Alliance of Texas Sue SEC Over New Dealer Rule

Citadel, Goldman, UBS and Citi Added as Authorized Participants for IBIT

Binance Receives Dubai Crypto Permit After CZ Resigns

Philippines Orders Removal of Binance from Google and Apple App Stores

Genesis Bankruptcy Estate Sells GBTC Shares to Buy 32k BTC for Creditors

| Asset Class | Apr | Q1-24 | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -15% | 69% | 43% | 57% | -12% | 7% | 72% | 155% | -64% | 60% | BTC |

| NASDAQ | -4% | 8% | 4% | 14% | -3% | 15% | 21% | 54% | -33% | 27% | QQQ |

| S&P 500 | -4% | 10% | 6% | 11% | -4% | 8% | 7% | 24% | -19% | 27% | SPX |

| Total World Equities | -4% | 7% | 4% | 10% | -4% | 5% | 7% | 19% | -20% | 16% | VT |

| Emerging Market Equity | 0% | 2% | 2% | 6% | -4% | 0% | 4% | 6% | -22% | -5% | EEM |

| Gold | 3% | 8% | 11% | 12% | -4% | -3% | 8% | 13% | -1% | -4% | GLD |

| High Yield | -2% | 0% | -1% | 5% | -2% | -1% | 3% | 5% | -15% | 0% | HYG |

| Emerging Market Debt | -3% | 1% | -2% | 8% | -5% | 0% | 2% | 5% | -22% | -6% | EMB |

| Bank Debt | 0% | 0% | -1% | 1% | 0% | 1% | 1% | 3% | -7% | -1% | BKLN |

| Industrial Materials | 12% | -2% | 10% | -5% | 7% | -11% | 4% | -6% | -13% | 29% | DBB |

| USD | 2% | 3% | 5% | -5% | 3% | 0% | 0% | -2% | 8% | 6% | DXY |

| Volatility Index | 20% | 4% | 26% | -29% | 29% | -27% | -14% | -43% | 26% | -24% | VIX |

| Oil | 0% | 18% | 18% | -18% | 27% | -4% | -5% | -5% | 29% | 65% | USO |

Source: TradingView. As of 4/30/24.

A Smorgasbord of One-Off Thoughts

These are going to be mostly non-sequiturs. Hey, every month can’t be an impeccably crafted treatise!

But first, a handful of macro charts that kinda go together in the “macro” bucket –

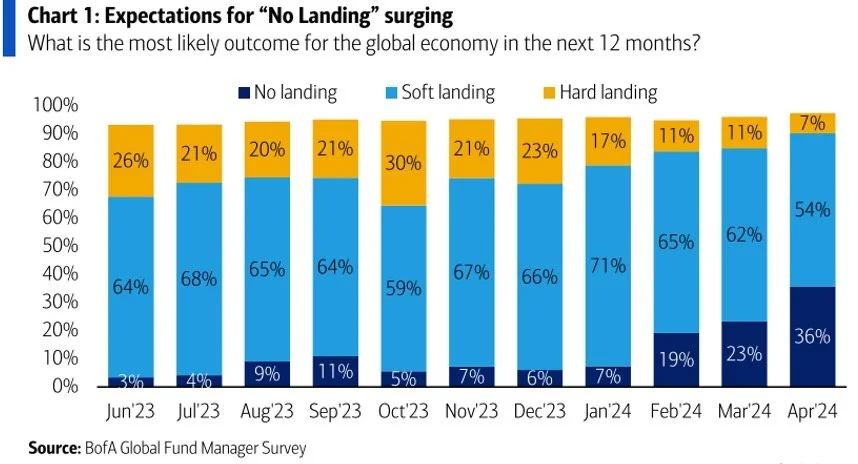

The market is rapidly coming around to “No Landing” and that includes fewer, later and potentially zero rate cuts in 2024 (or even hikes in 25). And that is the headline risk at the moment–

Powell appears intent on holding the line at this point. He does not want to be Arthur Burns –

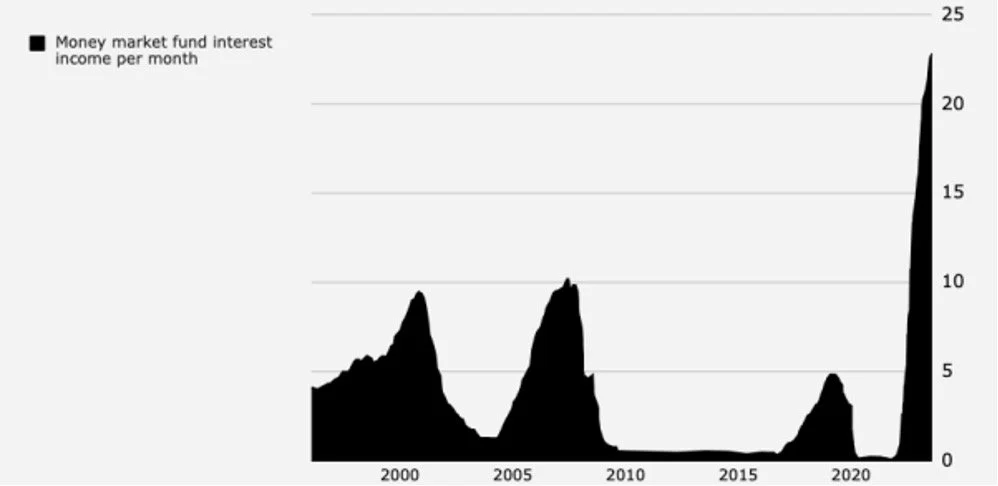

There is >$6tn sitting in money market funds earning ~5%. That is a tremendous amount of cash on the sidelines.

And that cash is earning a completely unprecedented amount of interest income-

Source: Ollari Consulting. As of April 2024.

US financial conditions have eased considerably over the last year and aren’t too far off the post-Covid lows, despite all the Fed rate hikes. Is the economy actually restricted right now?

Source: Tradingview. As of 4/29/24.

I think the overall picture being painted in macro right now is one where the current high interest rate regime is actually stimulating the US economy to a fair degree, due to the enormous amount of debt relative to GDP and the enormous budget deficits the government runs. This leads to the dominance of fiscal policies over monetary policies in the current environment. This is a drum Lyn Alden has been banging for over a year now, and it appears to be coming to fruition.

What does that mean for stocks and crypto? Well, NASDAQ was +54% last year while the Fed embarked on its most aggressive rate hiking campaign ever. And YTD, the market has gone from 6 cuts to 1 ½ cuts and Q’s are still +5% YTD. Is there a world where we go from 1 ½ rate cuts to 0 in 2024 (or even hikes in 25) and Q’s end the year up say, 15%? I think there is, but it could be choppy in the coming months. Now on to other random things.

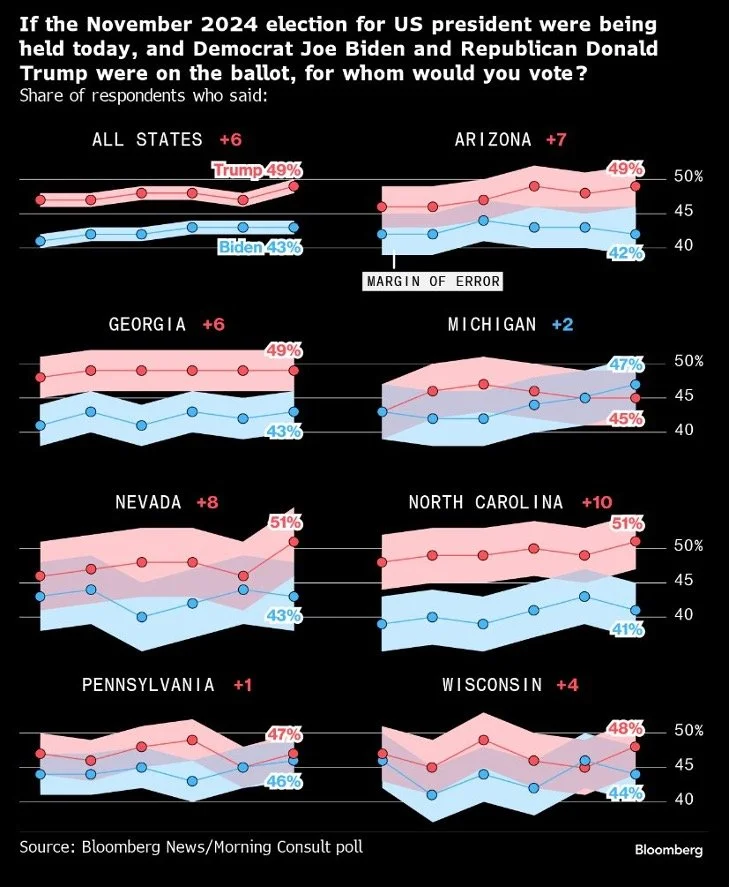

It appears the likelihood and magnitude of voter fraud in the upcoming elections has increased significantly. In the worst-case scenario, this could lead to a situation that makes January 6th look like a picnic. It is deeply disheartening that the United States of America, supposedly a beacon of democracy and rule of law, the greatest country in human history, has devolved into this.

If the below holds, the election will come down to Michigan, Pennsylvania and Wisconsin. How many total counties out of those three states will matter? 20?

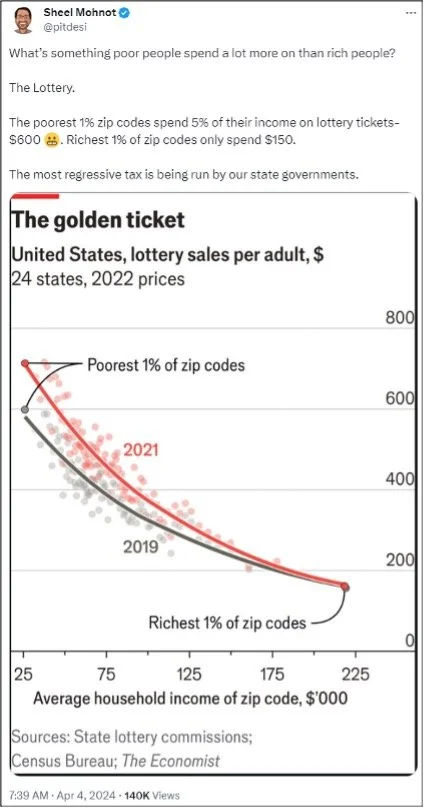

One time for financial nihilism.

Two times for financial nihilism.

Source: @globalmktobserv.

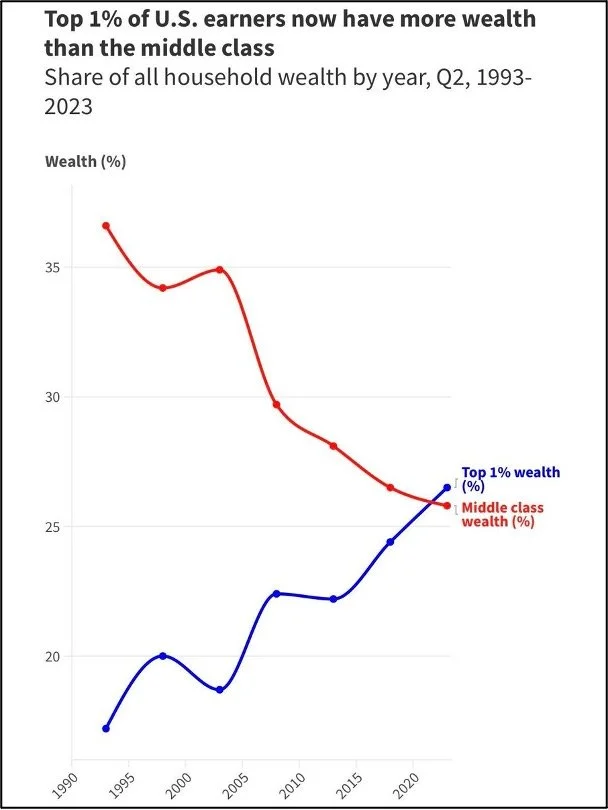

Three times for financial nihilism.

The table below really makes you want to own Bitcoin, never sell it, and have cash laying around to buy more on dips. Over the longer term, it seems totally untenable, and Bitcoin seems to be a great hedge against whatever the eventual outcome.

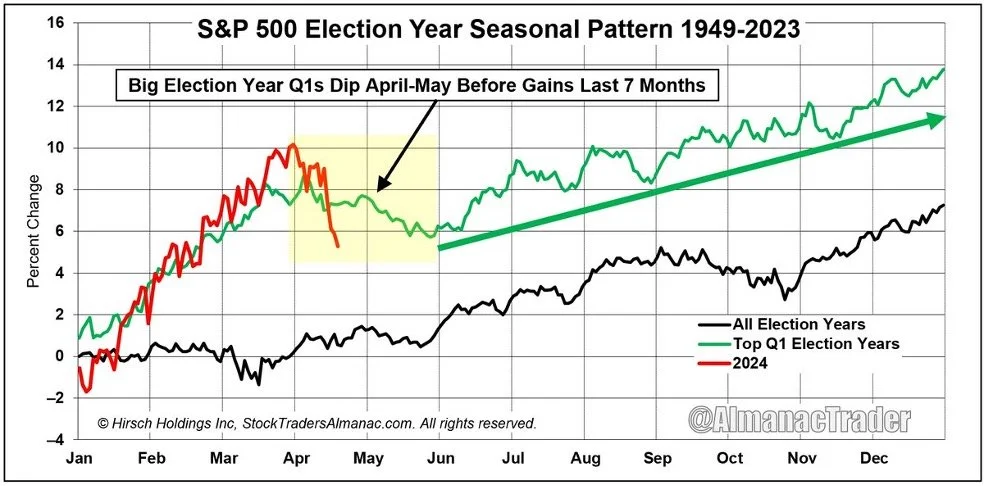

Worth keeping election year seasonality in the back of your mind.

This a tweet thread about a guy from the 1700’s named Alexander Tytler. It will take you 5 minutes to read. Or you can skip it and just read this quote-

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship. The average age of the world's greatest civilizations has been 200 years. These nations have progressed through this sequence: From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.”

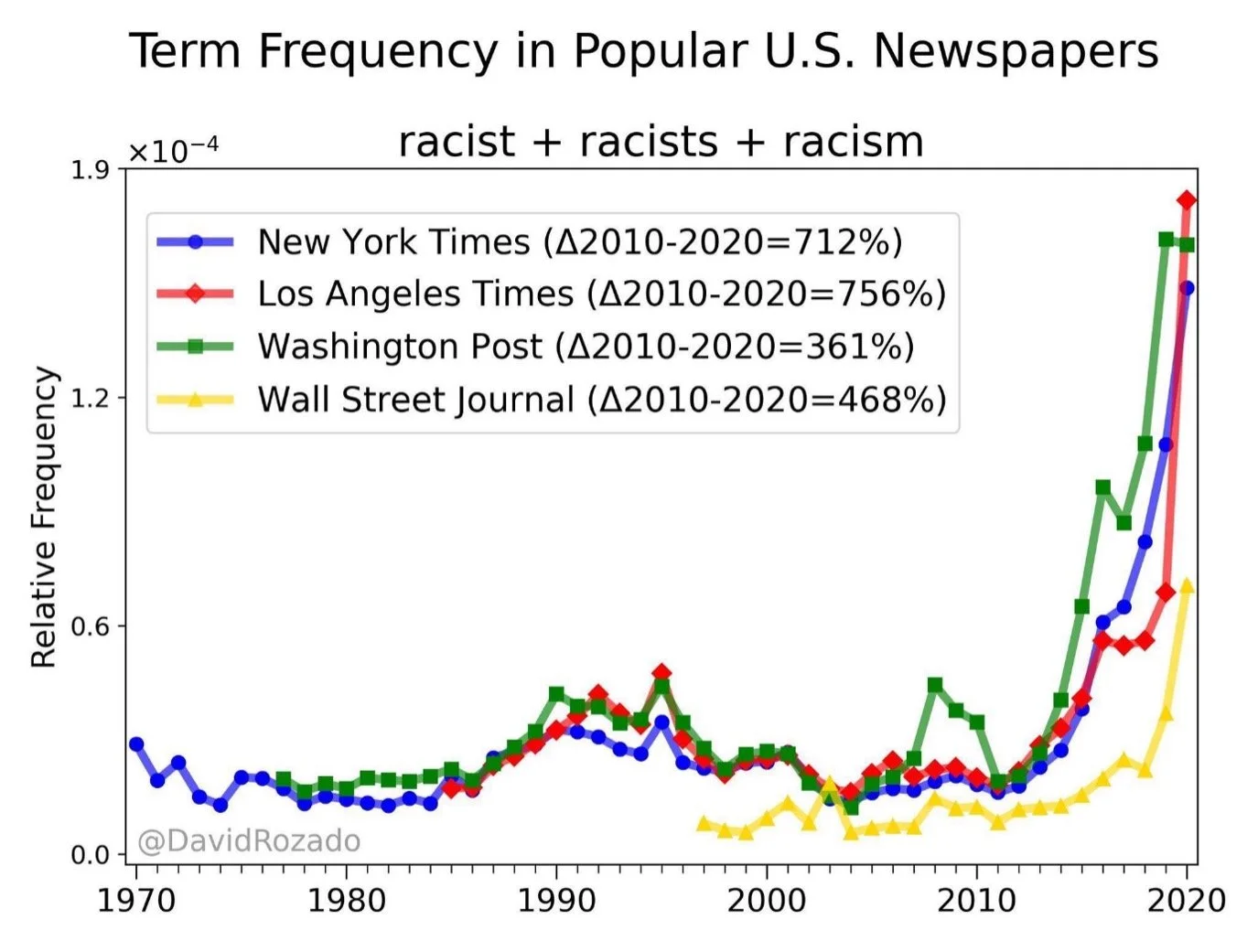

This is an interesting chart.

This is a thread about how real estate may not be a good investment going forward. It will take you 5 minutes to read. I know very little about real estate investing, but in the back of my head I’ve wondered for a long time how “The Great Wealth Transfer” will work, when so much of that Boomer wealth is in the form of a home that the children may not want. I discussed this topic briefly when I was on The Grant Williams Podcast this month. I don’t know how it’s going to play out, and it seems obvious that some parts of the country will be big winners and others will be big losers. But TBH I’d be surprised if there wasn’t a housing crisis of some sort involved in The Great Wealth Transfer.

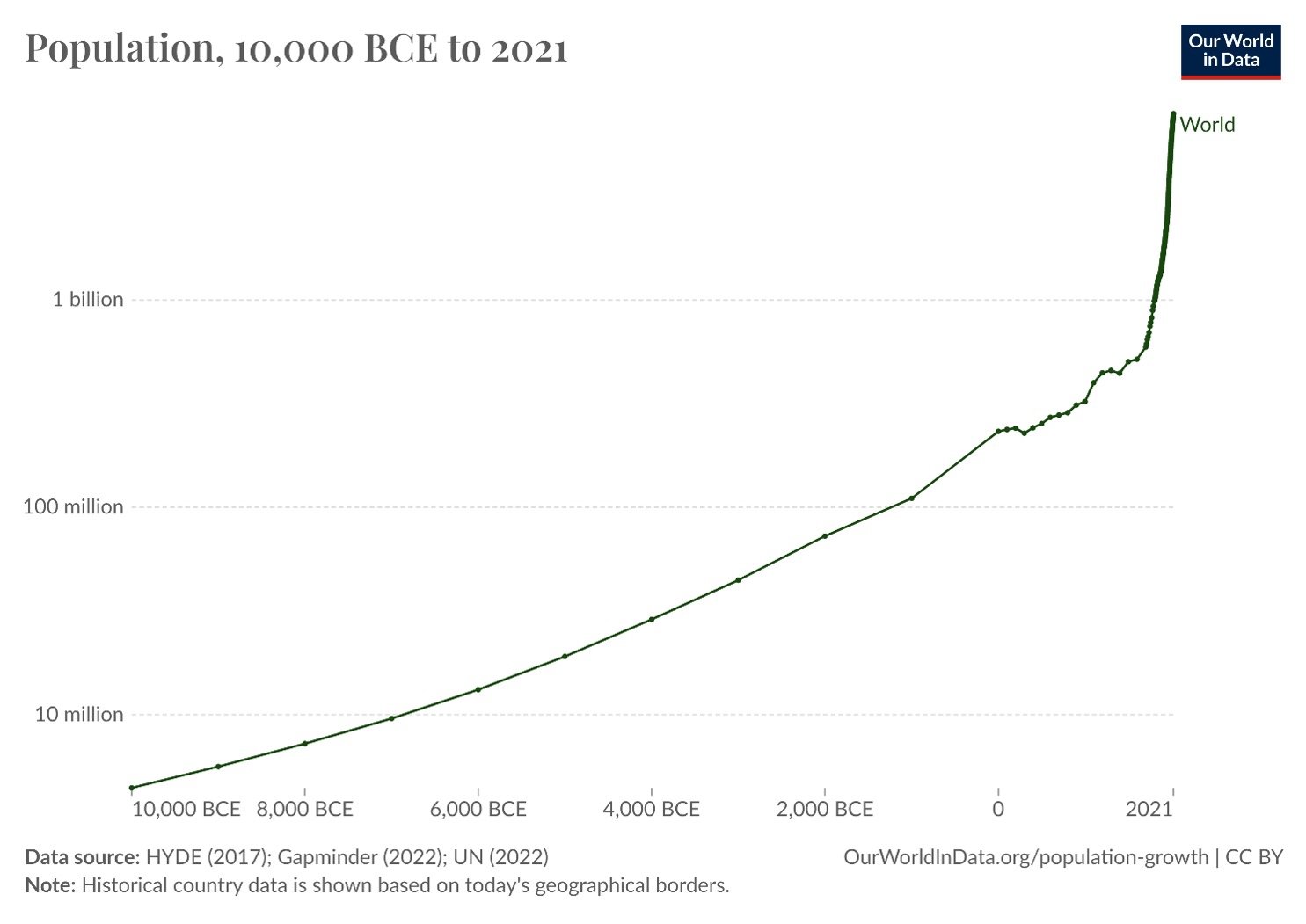

Final random thought. Came across this chart the other day. I’d seen it before, but it had been a while.

That’s in log scale. We crossed the 1 billion mark in 1810, the 2 billion mark in 1928, then went from 2 to 8 billion in the next 95 years. A breathtaking advance.

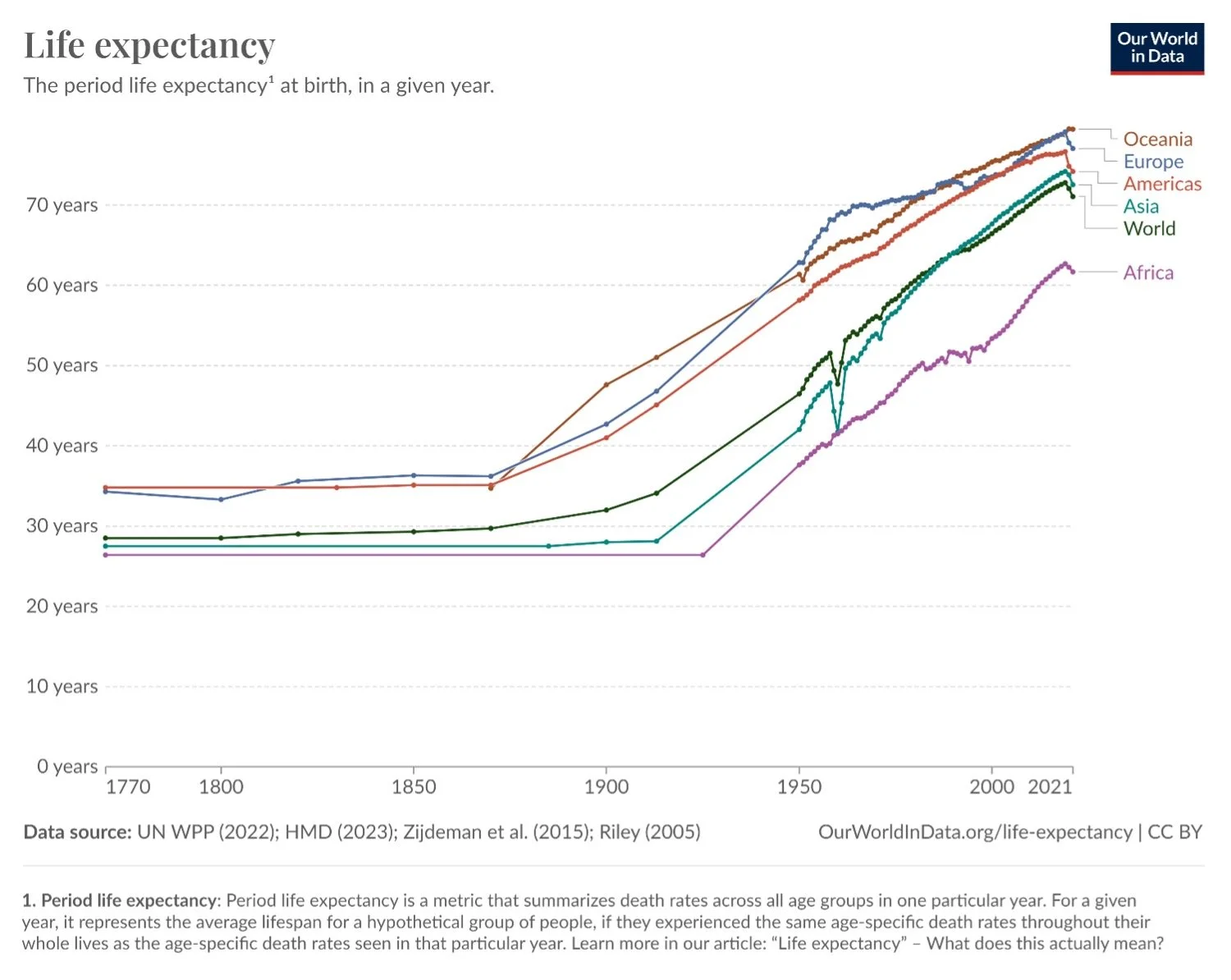

Combine that population growth chart with this chart-

And you have a truly remarkable accomplishment of humankind. How did we do it?

Source: ApeironCare.com

Perhaps it seems self-evident, but it’s nevertheless remarkable. Technological innovation propelled humanity to a level of abundance never before seen on Earth. We were just apes running around in the jungle and then one day we were apes with fire and then one day we were apes with farmland and then one day we were apes with rocket ships. That is astonishingly cool. What a privilege to just get to be on that ride for a hot second (or maybe all of eternity, TBD). I think if we all treated the human experience with as much reverence as it deserves and tried hard to help the least of these, the whole thing would be better off. It’s a worthwhile goal.

Market Update – Liquid Crypto Asset Investing

| Symbol | Apr | Q1-24 | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -15% | 69% | 43% | 57% | -12% | 7% | 72% | 155% | -64% | 60% |

| ETH | -17% | 60% | 32% | 37% | -14% | 6% | 52% | 91% | -67% | 399% |

| XRP | -21% | 2% | -19% | 19% | 9% | -12% | 58% | 81% | -59% | 278% |

| BCH* | -37% | 121% | 39% | 33% | -24% | 117% | 16% | 157% | -75% | 6% |

| EOS | -31% | 30% | -10% | 45% | -22% | -37% | 38% | -2% | -72% | 17% |

| BNB | -5% | 94% | 85% | 45% | -10% | -24% | 29% | 27% | -52% | 1269% |

| XTZ | -35% | 40% | -9% | 47% | -15% | -28% | 56% | 39% | -84% | 116% |

| XLM | -24% | 9% | -17% | 15% | 1% | 1% | 55% | 81% | -73% | 108% |

| LTC | -24% | 44% | 9% | 10% | -39% | 21% | 28% | 4% | -52% | 17% |

| TRX | -3% | 14% | 11% | 21% | 16% | 27% | 10% | 98% | -28% | 181% |

| Aggregate Mkt Cap | -17% | 63% | 35% | 51% | -6% | 1% | 49% | 119% | -64% | 186% |

| Aggregate DeFi* | -26% | 47% | 9% | 72% | -5% | -5% | 50% | 132% | -77% | 581% |

| Aggr Alts Mkt Cap | -20% | 58% | 26% | 53% | -2% | -5% | 33% | 90% | -64% | 479% |

Source: CoinMarketCap and CoinGecko. As of 4/30/24. BCH includes SV.

In April, Bitcoin gave back all its gains from March plus a little bit but is still up 43% YTD. ETH was down a bit more than BTC and is lagging BTC by 12% YTD after dragging by more than 60% last year. Alts were down 25%-45% in April. Memes were down that much or more. We can take each of those categories separately.

BTC I’m less worried about. I’ve been showing this chart since Sept 1st here which is honestly pretty impressive-

Source: Tradingview. As of 4/30/24.

I’ve had those yellow X’s drawn there since September. You can see price front-ran the second yellow X by about seven months. We know why that happened – ETF inflows waaay outperformed expectations. I think part of that was because the market was expecting a Fed easing cycle to commence, and that’s a good reason to own BTC. Now that the Fed easing has been diminished and pushed out (or cancelled), I actually think that second yellow X is probably in play again. I think that would be my base case at this point – BTC ranges this summer $50’s to $70’s. That’s a pretty big range and if you’re in the mood to play it, go for it. But your time will likely be better spent touching grass with resting bids, or at least some price alerts.

This ranging period over the coming months will give time for the Fed’s path to develop further and the market to decide how it feels about said path. As discussed earlier, there is a path of “No Landing” instead of Soft or Hard Landing, and there’s a path where NASDAQ trades well the rest of the year with that backdrop. Frankly I don’t know how to handicap that likelihood – it feels too new, too different. But I could see it happening. In a way, NASDAQ +15% and BTC +80% in a year where the Fed goes from 6 cuts to zero cuts, is an extension of a year where NASDAQ was +54% and BTC was +155% while the Fed aggressively raised rates.

So at this point, would you expect Q’s and BTC to trade better WITH or WITHOUT a couple rate cuts at the end of 2024? I really don’t know. My gut says you’d still prefer the cuts, but I’m not married to that.

So maybe something like this into YE-

Source: Tradingview. As of 4/30/24.

Over a shorter timeframe, we could be seeing a Wyckoff re-accumulation schematic unfolding-

Source: Tradingview. As of 4/30/24.

If that were the case, we would want to see BTC perform strongly in May – now is the time to “Jump across the creek” or the schematic is invalidated. Could that happen? Yeah, maybe. What would be the most likely cause of that price performance? Probably some big names are announced in the 13F filings for ETFs – perhaps some well-known investors. And that gets the market excited and ETF inflows resume. Certainly possible. Not sure I’d have it as my base case though.

One last comment I want to make about BTC and reflexivity -a topic I’ve been talking about here for 5+ (wow) years. The ETFs introduce a new component to BTC’s reflexivity because the buying and selling has never been easier, safer and more widely available, and it’s never been so transparent. It’s easy to understand how transparency and reflexivity would be so intertwined – if higher prices beget higher prices and lower prices beget lower prices (i.e., reflexivity), then transparent large scale buying and selling should only serve to further exacerbate those tendencies, because they are so clearly observed by market participants.

That is where we find ourselves now with these ETFs. The reflexivity worked in our favor in Feb and March - incredibly strong ETF inflows = incredibly strong price action. Since April 8th, we have been on the other end of reflexivity – outflows = weak price action. There is a question to be asked, “were there outflows because price was going down, or was price going down because there were outflows?”. My answer is, an intricate dance of both.

I think right now, month four of BTC ETF trading, is worth watching closely to glean insight into how reflexivity is going to be expressed through these transparent ETFs. The ETFs saw ~$11bn of inflows in the first three months of trading. What is the makeup of these buyers? How many are holding for the long term? How many are fast money that are fine taking 20-50% profit in a trade that lasted a couple months? How many are macro guys that sell when the Fed goes from 6 rate cuts to 2 or 1 or 0 or hikes? How many are buyers on dips? How many are panic sellers on pukes?

Those are many questions that are currently left unanswered. But they matter, and they’ll continue to matter more and more. This is a new, important feature for Bitcoin price discovery.

Moving on, ETH is in a pretty rough spot. ETHBTC made a marginally lower low in its three-year range in April, and has now been very steadily underperforming for 18 months.

Source: Tradingview. As of 4/30/24.

The SEC has officially manned the battle positions against ETH this month – as Consensys sued the SEC after receiving a Wells notice… So that’s what that FUD tornado was about in March. It appears there’s now going to be a fight in front of a judge about the security status of ETH. I like ETH’s chances vs the SEC, but there’s good reason to assume that this situation takes the ETH ETFs off the table for this year, or at least until the elections. That leaves ETH without much of a catalyst going into the summertime. That strikes me as worthy of caution.

That said, ETH is quite beat up. It feels incredibly under-owned here. And it has a lot of bad news baked in at this point. It wouldn’t take much positive news to get it heading higher. Not exactly sure where that would come from in the near-term because I think this SEC case is going to take a while to get spun up and the fundamentals don’t strike me as compelling near-term. If you think I’m wrong, happy to hear why.

SOL has one of the most unique setups in crypto history. The most successful “ETH killer” ever gets mired down in the largest crypto bankruptcy ever and then claws its way out of the rubble via a strong community hellbent on rampant shitcoining and an inability of its competitors to get their heads out of their asses for two seconds and actually do anything. The FTX bankruptcy estate sells BILLIONS of dollars of locked SOL at a variety of times and at a variety of prices and they continue to sell SOL today and presumably a ton more in the future. The market continues to find a bid for all this locked SOL, at prices as low as $40 and as high $110. All that locked SOL is currently unlocking linearly with a big cliff in March 2025. The current price of SOL is $120, down from $200 a month ago but still up 50% YTD and +500% over the past year. The Solana blockchain is ground zero for the most reckless shitcoining in crypto history and said shitcoining has congested the blockchain to a point that it doesn’t really function at the moment, which is a problem Solana has had in the past but promised it fixed but didn’t actually fix but promises its going to fix soon…PHEW. A lot going on.

Chart looks like this-

Source: Tradingview. As of 4/30/24.

My guess is this heads lower this summer to that white box and then we see what we get. Eventually I think SOL hits new ATH and beyond, just a question of how low it goes first. Like I said, it’s a really unique situation.

Below is Aggregate Mkt Cap-BTC-ETH-USDT-USDC:

Source: Tradingview. As of 4/30/24.

Alts were down ~26% on average in April, giving up most of their YTD gains. That composite number belies one of the widest dispersions of performance I can remember. There have been some big winners and big losers YTD in Alts.

Take the Top 35 by market cap. Note the YTD performance column in the far right-

Source: Tradingview. As of 4/30/24.

Very broad dispersion. BTC is outperforming most other names by a LOT. 16 of the top 35 are down on the year, many down >20%. There are a few names that have about kept up with BTC (ETH, XRP, STX) and a few names that have outperformed BTC YTD (BNB, DOGE, NEAR, RNDR, WIF, MKR, AR). If you move down market cap into sub-$2bn market cap names, the dispersion continues. Many names down on the year and a handful that have outperformed BTC, some massively.

There’s not much of a pattern to the names that have outperformed BTC other than a number of meme coins, but that also ignores the 15,000 memecoins that have done nothing YTD. Several AI names have outperformed BTC YTD.

Overall, I would be worried about Alt performance this summer. If BTC chops I think Alts mostly bleed. There is no DeFi summer on the horizon. There is no NFT summer on the horizon. People have (mostly) made money and probably want to take the summer off because frankly there’s not much that I see that’s worth sticking around for. The points/airdrop narrative is dying. I think memecoins probably need a breather, although it’s easy for me to imagine some random memecoins pumping this summer because they’re incredibly manipulated.

I wouldn’t advise completely walking away though, because the Alts washout could come sooner rather than later, and this summer could provide some extremely attractive entries. Because I still think Alts broadly are heading much higher into 2025, but we’re probably in for multiple months of chop, or worse, first.

We’ll end with this Adjusted Alt Dominance chart, which I’ve shown the last two months here-

Source: Tradingview. As of 4/30/24.

I’m not a huge fractal guy, but the current setup continues to be eerily similar to four years ago, which you see in the yellow channels. If history repeats, BTC and/or ETH are about to suck the life out of Alts (orange box) and then Alts will go on a breathtaking run – a proper Shitcoin Bonanza. Two months ago when I first introduced this chart, I said I struggled to imagine the orange box replaying again this cycle. I said that it seemed the desire to shitcoin this cycle was too strong, and the relative preference for BTC and/or ETH too weak, to reproduce a big down move again like in the orange box four years ago. I think after this past month’s price action, it’s *easier* for me to imagine at least a decent sized down move in Adj Alt Dom. Maybe not as big as the orange box, but perhaps half that move down or a bit more. It goes back to my tweet I pasted here earlier about the mirage of the Alt bid. The curtain may have just been pulled back, and Alts may be in for a bit of a reckoning.

Closing Remarks

I’ll paste this here for you one more time –

Alts are down another ~10% since I wrote that and they look like they’re heading lower. The above setup assumed BTC would be heading higher, which I think is probably not my base case for this summer, but rather a choppy range of $50s-$70s. That bodes even worse for Alts.

In the 6+ years I’ve been doing this full time, there’s never been a time with Alt market caps this high while conviction is this low. This is my assessment from talking to hundreds of active market participants and receiving all sorts of feedback on my public comments. PEOPLE BY AND LARGE DO NOT ACTUALLY BELIEVE IN MOST OF THEIR BAGS. They do not believe the tech is solving an important problem or need. They do not believe the token accrues value over a long period of time. They bought it because they came to believe that the number would go up, but not for any sort of fundamental reason. And that makes these bags very uncomfortable when prices start going down. It is a natural extension of “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”.

Some meaningful portion of the crypto ecosystem is going through a type of mourning right now. Mourning the loss of belief. Mourning the loss of purpose. Mourning the loss of the reason they got into crypto in the first place. Many want to do something about that but struggle to see what they can do that will make any difference. And many find themselves resigned to just play the game that’s in front of them because there are opportunities to make money even as the opportunities to positively impact the world are diminished. It’s a resignation that can leave a bitter taste, even as your wealth grows. And it’s a resignation that leaves you wondering about the longer-term fate of crypto- what is the logical destination if this continues on for another 5-10 years?

If we get a meaningful washout in Alts in the coming months, some amount of self-healing may take place to address the ridiculousness of the Alts market. But I wouldn’t hold my breath those changes would be large-scale. Bitcoin is likely heading higher this year and that will only serve to stoke the fires of greed that drive the Alt market, so I would guess any sobriety we get for Alts to be relatively short-lived.

It will be interesting to see what pockets of Alts end up massively outperforming BTC this cycle because I’m pretty highly confident there will be some. Will it be mostly memecoins, as the market gives VC’s a “screw you” and refuses to buy their marked-up bags? Will it be L1 competitors because “muh relative valuation to ETH”? Will it be AI names because “muh ChatGPT”? Will it be DePIN because it can actually show a modicum of real-world adoption?

We shall see.

“Even dust, when piled up, can become a mountain.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS