October 2019 - Market Update

/Monthly Update || October 2019

“Return alone—and especially return over short periods of time—says very little about the quality of investment decisions.”

Opening Remarks

Greetings from inside Ikigai Asset Management1 headquarters in Marina Del Rey, CA. We welcome the opportunity to bring to you our thirteenth Monthly Update (and our one-year anniversary of the first Monthly Update!) and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, September brought negative price action that puts Bitcoin’s cyclical bull market status at significant risk. On September 24th BTC broke down from a three-month descending triangle on the highest volume since mid-July. BTC price decreased ~20% on the 24th before bouncing and finished the month -14%. At time of writing, BTC’s YTD uptrend is hanging on by a thread. The setup for this breakdown experienced in September was several months in the making – a market structure we discussed at length in the last two Monthly Updates and a topic we’ll dive into in more detail below.

In our Monthly Update letter that went out on September 1st, our main theme was “A Canary in The Coal Mine”. We discussed weakness in the crypto markets over the back part of July and August as a potential harbinger for stress in traditional asset classes. That view was correct. First, the week of September 9th we had the “Quant Quake” momentum unwind, which saw the second worst day for Momentum stocks since 1984. Next, the week of Sept 16th, it was the repo market blowout and subsequent Fed bailout, a symptom of a much larger overarching issue - dubbed the dollar shortage. Only seven days later, when Bakkt’s first day of trading yielded a disappointing 71 BTC of volume, the crypto market collapsed. We believe it is highly unlikely that series of events was unrelated.

We had many discussions with the full spectrum of potential investors in September – from accredited investors looking to invest $100k to large institutional investors looking to invest $10mm+. Anthony “Pomp” Pompliano’s meme of “get off zero” has gained real traction with this full spectrum of investors. Investors are becoming increasingly convinced that zero exposure to the asset class is the wrong number, but investors are confused about how to get off zero. Do they buy a little BTC and store it at Fidelity and that’s their exposure? Do they buy an index fund, like you do for stocks? Should they invest in a fund? If it’s a fund investment, should they go with a venture fund? If it’s a venture fund, should it be equity only? Tokens and equity? Should they invest in a liquid hedge fund? If it’s a hedge fund, should it be a discretionary strategy? Quant strategy? This landscape has proven difficult to navigate for investors, largely because the underlying dynamics of the crypto ecosystem are evolving at a breakneck pace.

Over the prior 18 months, crypto venture funds have been able to raise significantly more capital than liquid-focused crypto hedge funds because 1) institutional investors understand equity investments; 2) crypto venture easily fits within the existing venture slice of an overall portfolio; 3) the existing illiquid investments are marked at levels much higher than can and likely will be realized; 4) the institutional investor doesn’t have to see wild monthly swings on their capital account statement with a 10 year venture vehicle.

That has broadly led to a crypto venture landscape characterized by too much money chasing too few good deals. Or good deals coming at valuations so high that they’re not such good deals anymore. This. Should. Sound. Familiar. While this puts the potential for attractive future ROI at risk, it simultaneously funds the buildout of the crypto ecosystem infrastructure necessary to bring crypto to the masses. In a truly ironic turn of events, Quantitative Easing from the Fed has pushed investors searching for returns far enough out on the risk curve that their equity capital will fund (likely unprofitably) the infrastructure for the very asset class that will threaten their monopoly on money.

A beautiful irony indeed.

September Highlights

Bakkt Launches Bitcoin Futures with First Week Volumes of Only $6mm

Franklin Templeton to Launch Tokenized Money Market Fund on Stellar

Caliber to Offer Home Mortgages on SoFi’s Blockchain Platform Provenance

Binance Launches US Platform with Seven Crypto Assets

Abra Partners with ECPay to Allow Crypto Purchases in Philippines 7/11’s

Wells Fargo to Pilot Dollar-backed Stablecoin Project on R3 Blockchain

Block.One Settles with SEC For $24mm

France and Germany Announce Intention to Block Facebook’s Libra

NBA Denies Nets Player Spencer Dinwiddie’s Attempt to Tokenize Contract

IMF Releases Article Supporting “Synthetic Central Bank Digital Currencies”

| Symbol | September | August | July | Q3-19 | Q2-19 | YTD | % ATH | % Cycle Low |

|---|---|---|---|---|---|---|---|---|

| BTC | -14% | -5% | -7% | -23% | 164% | 122% | -58% | 159% |

| ETH | 4% | -21% | -25% | -38% | 105% | 35% | -87% | 115% |

| XRP | 0% | -20% | -19% | -35% | 28% | -27% | -93% | -1% |

| BCH | -23% | -14% | -20% | -47% | 154% | 34% | -93% | 178% |

| EOS | -11% | -25% | -23% | -49% | 38% | 15% | -87% | 86% |

| BNB | -25% | -23% | -15% | -51% | 86% | 157% | -36% | 273% |

| XLM | -2% | -25% | -20% | -41% | -3% | -46% | -93% | -17% |

| LTC | -13% | -34% | -19% | -54% | 101% | 84% | -85% | 144% |

| TRX | -7% | -31% | -30% | -55% | 36% | -23% | -95% | 32% |

| Aggregate Mkt Cap | -11% | -10% | -11% | -29% | 117% | 75% | -73% | 118% |

| Aggr Alts Mkt Cap | -7% | -21% | -19% | -40% | 68% | 18% | -87% | 60% |

The X-Man Toddler

In our August 1st Monthly Update, our main theme was “A Change in Season or Just A Temporary Weather Pattern?” We discussed a new market structure emerging - characterized by low volumes and spotty order books. At the time we weren’t sure whether this market structure was transitory or more long-lasting. We said, “we think these are just temporary choppy weather patterns within an overall bullish season. But there’s a chance the season may be changing. We’re watching carefully.”

That market structure was exacerbated in the month of August to the point wherein our September 1st Monthly Update we talked about crypto being a potential canary in the coalmine for coming stress in traditional asset classes. We highlighted the decoupling of BTC from Gold and the CNH, both of which moved meaningfully higher in August while BTC was down. We highlighted the descending triangle pattern, reminiscent of 2018 price action prior to the breakdown in mid-Nov and the potential for that price action to break down again like it did last year.

On September 1st, we said, “a further collapse, say to the $4k-$5k range, would be at odds with where we are in BTC’s bull cycle. Essentially all the multiyear analysis of BTC’s history points to us not correcting to those levels at this time, but instead moving higher. Something would need to go VERY wrong for BTC to see that type of crash. But if the VIX goes to 35, that could indeed happen. We believe a higher likelihood outcome could be a short-term, further correction down to the $7.5-$8.5k range. This would still be within the range of historical pullbacks in an overall cyclical uptrend for BTC when looking at past cycles.”

We closed our September 1st letter by stating, “there are periods when risks are higher than others and we believe now is one of those times”. We were correct in our view and well-positioned for the ensuing volatility. That said, where do we go from here?

From a TA perspective, Bitcoin’s uptrend is hanging on by a thread, bouncing off the 50% Fib retracement level, which also has a confluence of support from price action. We’ve had our eye on this level for the last two months. The strength of price action in the coming days and weeks will be crucial in defining whether we are still in a bull market or a deeper correction is in store.

By other TA measures, this uptrend is already broken. The 21-week EMA is shown in blue. Note the many touches during the 2016/2017 bull market and the clean break we just had last week.

Another view that shows the risk present to the current setup is the 200D MA in yellow and the 200D EMA in orange. Again, note the support these levels provided in 2016/2017 and the sustained break below last week.

Finally, broken down descending triangles produce “measured moves” to the downside equal to the peak height of the triangle. Note that we reached those levels and actually went a bit lower in December. Note that the measured move of the current breakdown is ~$7k.

As you likely know by now, we believe macro matters a lot for crypto broadly and BTC specifically. We believe the multi-month weakness we’ve seen in crypto markets, which led to a breakdown in prices in September, was caused in part by traditional asset classes. The dollar shortage situation touches every corner of financial markets globally. The Eurodollar market is a quadrillion dollar market. If you drop a big rock in the middle of a pond, how far do the ripples go? All the way out - getting smaller as they go. If you throw a wrench in the quadrillion dollar Eurodollar market, how far out does liquidity hiccup? BTC 30-day circulating supply is <$20bn. Small ripple.

I have gone pretty far down the rabbit hole on this dollar shortage situation, listening to viewpoints from investors much more knowledgeable about the intricacies than I am. There are smart folks on both sides of the fence – some say its transitory and is already getting better. Some say the issues will last through year-end as the Fed continues to issue piles of Treasuries to refill their cash balances after raising the debt ceiling, sucking up all the dollar supply. Still, others say it won’t get better until the Fed starts juicing full-blown QE.

I don’t have a strong view on which of those outcomes is most likely. We don’t make calls on big macro situations like that. Instead, we ingest new information as it becomes available and make investment decisions accordingly, based on the preponderance of evidence across many signals. Global Macro is just one layer to that decision-making process. We can watch the repo market and the Fed’s overnight facility draws on a daily basis. We can watch the Eurodollar market. We can watch precious metals. If it gets better on a day-over-day basis, we can feel better about the near-term prospects for BTC to have found a bottom. If it worsens, or if other risks arise from elsewhere in financial markets, geopolitical landscape or the global economy, we can feel worse about those near-term prospects.

What is clear is that the whole world is slowing down at the same time, because the whole world is addicted to the drug of cheap money and it needs more of it right now.

What is also clear is that the whole world is cutting interest rates and juicing QE in response to that global slowdown in growth – give the addict what they want.

So, what does that mean for crypto broadly and BTC specifically? It looks increasingly likely that we’re heading for either a mild recession or perhaps kissing the zero GDP growth line for a couple quarters in 2020. In the event Elizabeth Warren wins the 2020 election, it is likely animal spirits will collapse, and the whole world will go into a larger recession. What happens to BTC in either of those cases depends on: 1) the severity of the recession; 2) what skeletons fall out of the closet during the recession; and 3) the swiftness and ferociousness of central banks and governments’ responses to the economic slowdown with their monetary and fiscal policies.

BTC is a risk asset, but it’s a risk asset with a specific set of investment characteristics that become increasingly more attractive the more irresponsible monetary and fiscal policies become. It is an insurance policy against that irresponsibility. Put differently, BTC loves QE and hates QT. BTC has never seen a full-blown recession before, but as a risk asset, it is our assumption that price will go down in the event of a global slowdown. The 23% decline we saw in Q3-19 may very well end up being a harbinger of an impending slowdown. That certainly appears to be the case at the moment.

The more severe the recession, the worse BTC’s price slide will be. To the extent an ugly skeleton falls out of the closet, say a blowout in the Eurodollar market due to a dollar shortage, the price slide will be worse. To the extent central banks and governments are slow with their accommodation, the price slide will be worse. What appears most likely, however, is that central banks will be exceedingly accommodative with monetary policies (see chart of rate cuts above) and governments will be exceedingly accommodative with fiscal policies (did someone say MMT?)

This is the ideal backdrop for a non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value to gain mass adoption. However severe a BTC pullback may be – whether 1) the worst is behind us; 2) we find a bottom lower in the $6-$7k range; or 3) the unlikely event we retrace the full YTD move back to the $3k’s – that will present what is likely a generational buying opportunity for Bitcoin. Make no mistake, Bitcoin is deeply antifragile – perhaps its single most attractive characteristic. I liken Bitcoin to an X-Man toddler. Yeah you can push on it right now and it will tump over. And you can even kick it in the head while its tumped over. But it will be fine. It will get back up, no worse for wear. And when it grows up, it is going to kick your ass. Our long-term outlook remains exceedingly bullish and as always, we remain patient, objective, vigilant, and flexible.

Market Update – Liquid Crypto Asset Investing

After being up 164% in Q2-19, BTC price declined 23% in Q3, including 14% in September. Alts were down 7% in September, but down 40% in Q3. YTD, BTC price is +122% vs Alts only +18%. Fundamentals matter for crypto price performance. That’s a good thing.

As previously mentioned, the setup for BTC’s swift price decline on 9/24 was two-months in the making and the signs were evident. The 9/22 Bakkt launch was widely telegraphed and should have led to a BTC price increase in advance of that, but there was none. In the first several weeks of September, Risky Whales orchestrated a mini “Alt Season”, pumping the price of ETH, EOS, LTC and a handful of other Alts off of deeply oversold levels in an attempt to pull BTC price higher (a textbook Risky Whale move). That Alt Season ran out of gas on 9/19 – another clear sign the crypto market was in trouble. By the time we got to the end of the descending triangle, the weak Bakkt volumes at launch was the catalyst needed to send price lower.

While recent price action is certainly a cause for concern, friendly reminder that this is normal course of business for Bitcoin. Price has still managed to increase 9,600,000% since mid-2010.

Below is a chart we’ve been focused on for months. Note the velocity of price in the most recent yellow box relative to prior. That overextension may very well be leading to a correction of a magnitude we haven’t previously seen (e.g., we’ve never had three consecutive months of negative returns in a bull market before and we just had three). This view gives us comfort that price could retrace to the ~$6k level and remain “on track”. That said, we acknowledge there has never been a global recession as the backdrop for this historical price action, and we may have one on our hands right now.

Continuing with a focus on BTC halvings, below is Plan B’s stock-to-flow model - 0.95 R2. Price is slightly cheap relative to the model at the moment, but entirely within range and looks a lot like early 2016. If this model is even directionally correct, it is wildly bullish.

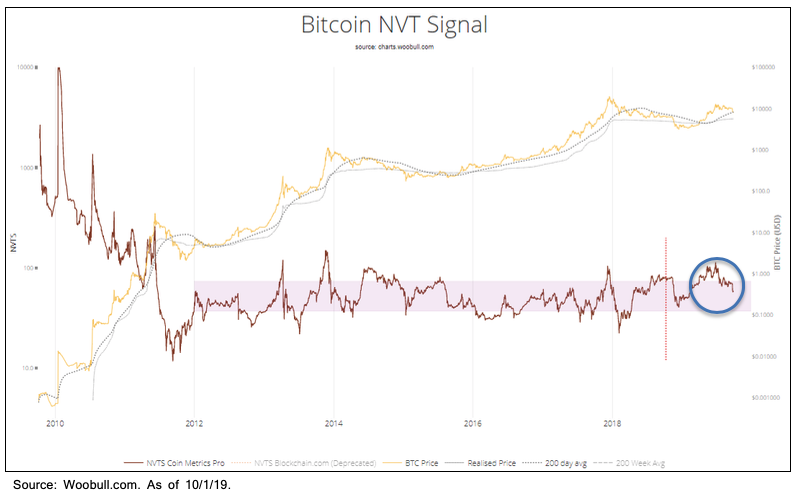

For months we have discussed the historic nature of BTC’s pump off of the lows. Q2-19 was the 5th strongest quarterly performance since 2012 for BTC. The increase in network value outpaced the increase in network activity by a considerable margin in 2019. This was causing a number of our proprietary on-chain metrics to flash overbought. The recent pullback has allowed those metrics to partially reset. If price declines further to the $6-7k range, those on-chain metrics will likely fully reset. If you asked me three months ago, I would have told you that reset was unlikely to happen and that these metrics were just going to blow out relative to historical levels in the approaching bull run. And yet here we are. Below are two publicly available examples of this.

A bull market is highly unlikely to end without a lot of old Bitcoin being moved to exchanges to be sold. This shows up in Binary Bitcoin Days Destroyed, a proprietary metric we first introduced publicly in May. Cyclical tops are put in with big red blocks. We’re not seeing that right now.

Cross-coin correlation remains in a healthy range but note the pickup as the market broke down. Worth keeping a careful eye on.

Hashrate made new ATH’s again in September. Note the quick blip down on 9/22. The rumor mill began cranking at high speed around this sudden decline, but it was quickly identified as a data anomaly based on how hashrate is estimated, rather than miners actually going offline. This is an increasingly secure network.

Closing Remarks

Last month we pointed to a high degree of risk present in the crypto market and why we thought that might be the case. Those downside risks came to fruition in September and continue to linger currently. The macro backdrop is an overhang on the crypto ecosystem, which is unlikely to hold current price levels if the whole world goes risk off. To the extent central banks and governments are accommodative with their policies; to the extent a global growth slowdown isn’t too deep; to the extent Trump and Xi come to an agreement on trade – BTC should be well on its way to new ATH’s in the next 12-18 months, if not sooner.

But taking a step back, the backdrop for Distributed Ledger Technology to gain mass adoption, both as the foundation for a non-sovereign money and many other use cases, is compelling.

We are in the midst of a Trust Revolution. The very words “Trust” and “Truth” are being contorted in today’s society. Society is recoiling from this with increasing vigor. The Hong Kong protests. JPMorgan precious metals. WeWork & Juul CEO’s. The Governor of Puerto Rico. Jeffery Epstein.

Power tends to corrupt and absolute power corrupts absolutely. This unchecked power has led to massive wealth inequality.

Which has led to populism.

Which has led to a deepening sense of distrust amongst the majority.

DLT is a technological platform on which to drive societal change for the good. The outcome is not yet written in stone. Far from it. These multi-decade, generational shifts will only be accomplished if desire is translated into effort, which will in turn lead to change. That’s the kind of thing worth spending your career on. It’s why we named it Ikigai.

“When you’re thirsty it’s too late to think about digging a well.”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

Invest

Ikigai is currently fielding interest from new investors. Contact us to see if you qualify.

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Timothy Lewis, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2019 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS