November 2021 - Monthly Market Update

/Monthly Update || November 2021

“What the wise man does in the beginning, the fool does in the end.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our thirty-eighth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, October brought a Bitcoin CME futures ETF (ticker: “BITO”) and along with it, a new ATH for BTC. If you’ve been reading these Monthly Updates, the ETF approval shouldn’t have caught you by surprise because we’ve been discussing it at length for the last two months. While many have pointed out flaws in a BTC CME futures ETF (namely, the contango roll costs), that did nothing to stop the flood of capital coming into BITO – it reached $1bn of AUM in only two days, the fastest ETF ever to reach that size.

For as much noise as the ETF made in October (and it was plenty), that noise was nearly matched by everything else going on in crypto. Check the Monthly Highlights below. I know I say this often, but the pace of news flow for crypto is truly stunning. The fundraises are stunning. The institutional adoption is stunning. NFTs are stunning. But perhaps most stunning of all is Facebook’s announcement this month that it’s changing its name to “Meta”. When I wrote the main section of last month’s Monthly Update – “A Cursory Glance At The Metaverse”, hand to God I had no idea FB was about to change their name. It’s even more ironic/timely that a month ago I wrote this:

“If you’ve been reading these for a while you’ve heard me talk about the four questions many times. When evaluating uses cases for DLT, we ask ourselves:

How ready is the tech for the world?

How ready is the world for the tech?

What do you need decentralization for?

How decentralized is decentralized enough?

The captivating thing about Metaverse is that it answers those four questions pretty well. The tech could be better but it’s way better than it was a couple years ago, and it’s getting better quickly. A post-Covid, stay-inside world is a world primed for Metaverse. Decentralization removes platform risk. Decentralized enough is “sufficiently far away from Facebook-level centralization”. It’s pretty good product/market fit.”

Lol. So here we are now a month later, with Facebook going full-on into the Metaverse while the crypto ecosystem iterates at breakneck speed towards the same destination, albeit with a fundamentally different approach. If you haven’t yet watched Zuck’s keynote address from October 28th on the Metaverse and Facebook’s role in its buildout, I highly suggest you do. It sets the stage for where all this is heading and how Facebook wants to position itself in the Metaverse. It should come as no surprise, but Zuck wants Facebook to be the lynchpin of the Metaverse - the foundational hardware and operating system upon which the rest of the Metaverse flows. His army of engineers and infinite supply of capital are running full steam ahead towards capturing as much of the Metaverse as possible. He pays lip service to creators, ownership and openness a long the way, and to some extent he’s telling the truth. He needs to deliver a product everyone builds on and then uses. But if he has his way, it will be under the vision and control of Facebook.

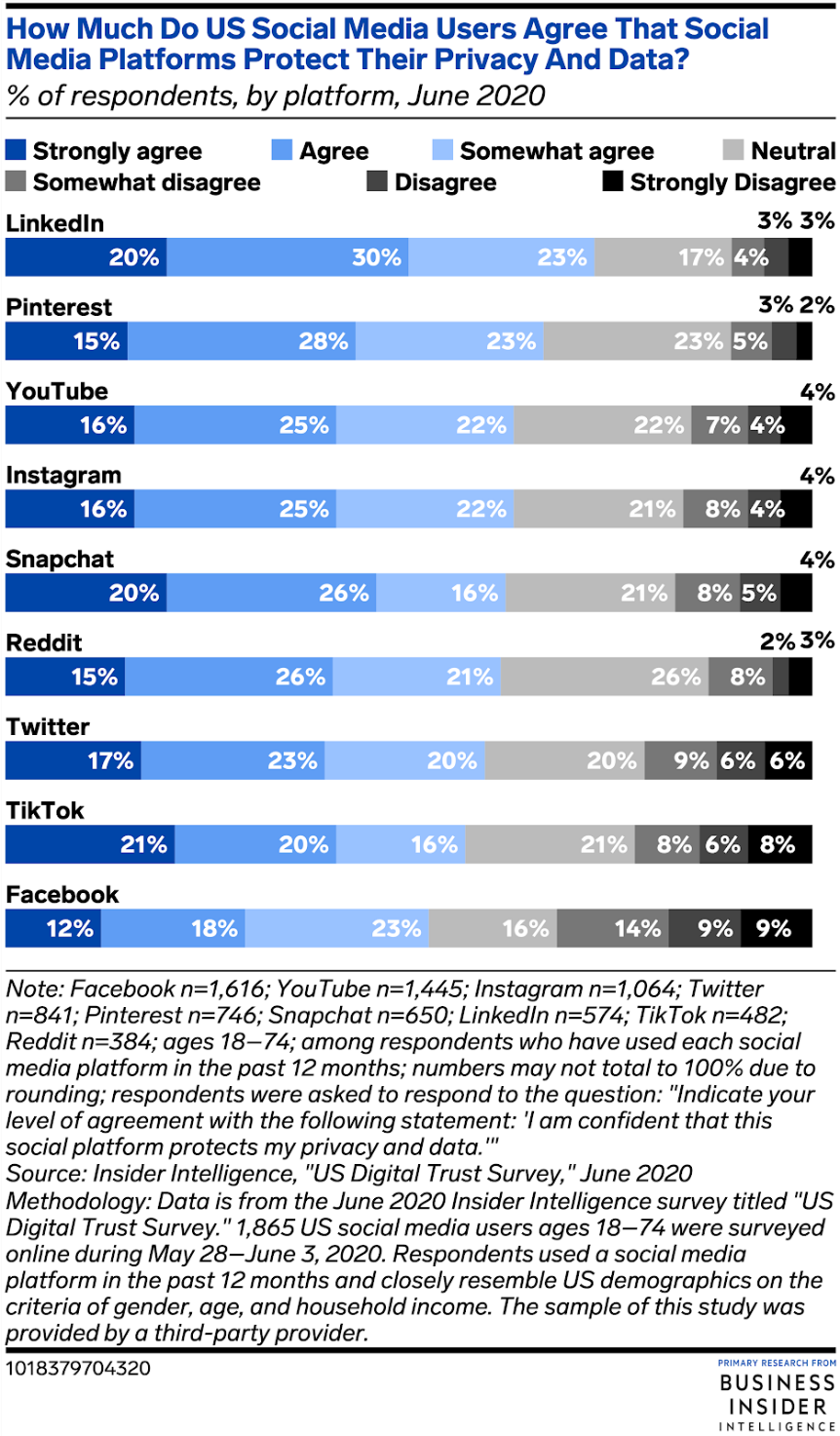

I won’t reiterate my views on Metaverse as an investable sector in crypto here - I laid them out well last month. But with this most recent news from Facebook, it’s worth highlighting how firmly the concept of decentralization sits in the midst of the build-out of the Metaverse. Very simply – do you want Facebook to be in charge of the virtual worlds that are (in my view) highly likely to eat our analog world in the coming years and decades? Where does society REALLY want Zuck to be in all this? How much does society trust Facebook in general?

Source: Business Insider. As of June 2020.

So there’s your answer. Facebook is the least trusted social media platform in existence. There’s also no way Facebook can iterate like crypto can – in its Cambrian explosion manner. Facebook can’t try out a dozen different blockchains at the same time and hundreds of disparate ideas. Facebook can’t juice network effect with a token (yet). Facebook can’t push the envelope in a murky regulatory backdrop.

But they have infinite money and 2.9 billion monthly active users. They have an army of top engineers (although in real-time, less of those are going to FB and more of those are going to crypto). It really sets up for a classic “siloed corporation vs open-source” battle. We’ve had plenty of those battles before. Open source hasn’t won a ton of them, but they’ve won some. This time around, the siloed corporation is run by the least trusted social media platform with the most users, and the open-source technology has a $2.5tn market cap, a massive and growing war chest, enormously improved tooling and technology, and the ethos and potential to make the world a decidedly better place. We’re here for it.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

October Highlights

BTC CME Futures ETF “BITO” Launches, Reaches $1bn AUM in Two Days, Fastest ETF to Reach $1bn Ever

Pimco Announces It Is Investing in Crypto

Facebook Changes Name to Meta

FTX Raises $420,690,000 From 69 Investors at $25bn Valuation

Axie Infinity Developer Sky Mavis Raises $150mm at $3bn Valuation Led by A16Z

“Crypto AWS” Company Alchemy Raises $250mm at $3.5bn Valuation Led by A16Z

ConsenSys Plans Raise at $3bn Valuation

MoonPay Raises $400mm at $3.4bn Valuation from Tiger Global, Coatue

Celsius Raises $400mm at $3bn Valuation from WestCap, CDPQ

CoinList Announces $100mm Series A at $1.5bn Valuation

Elliptic Raises $60mm From Softbank, Wells Fargo

Animoca Brands Raises $65mm at $2.2bn Valuation

Publicly-traded Crypto Trading Platform Voyager Receives $75mm Strategic Investment from Alameda Research

NYDIG Acquires Bottlepay for $300mm

Venture Fund NFX Raises $450mm Venture Fund with Crypto Focus

China-based Crypto VC Fund Sino Global Launches $200mm Fund with Backing From FTX

Variant Fund Raises $100mm Early-stage Venture Fund

Arca Raises $30mm Early-Stage Venture Fund

CBOE Acquires ErisX

Republican Leader Patrick McHenry Introduces the Clarity for Digital Tokens Act

US Senator Lummis Buys More Bitcoin, Sees BTC as “Excellent Store of Value”

Houston Firefighter’s Pension Makes $25mm Direct Investment in Bitcoin, Ether

Binance Launches $1bn Growth Fund for Binance Smartchain

NEAR Protocol Launches $350mm Grants DAO to Fund Ecosystem Growth

DCG Authorizes Additional $750mm Share Buyback

Huobi Ceases Offering Services in China, Delists CNY Trading

Binance Ceases Offering Services in China, Delists CNY Trading

Mesh 5G WiFi Provider Helium Announces Partnership with Dish Network

FTX.US Launches Collectibles Arm on Solana

Bank of America Releases 141-page Research Report: “Digital Assets Primer: Only the first inning”

Stripe Creates New Crypto-Focused Team

A16Z Launches Major Crypto Policy Campaign

Tether and Bitfinex Settle with CFTC for $42.5mm

NYAG Orders Celsius and Nexo to Cease Services

Facebook Chooses Coinbase as Custodian for Novi Project Pilot

Coinbase Becomes Exclusive Crypto Partner of NBA

Bloomberg Releases FUD article “Anyone Seen Tether’s Billions?”

FATF Releases Relatively Benign Guidance on “Virtual Assets”

Biden Administration Continues to “Weight Wide-Ranging Push for Crypto Oversight”

DeFi Fund Manager MNGR Experiences Hack

| Asset Class | Oct | Sep | Aug | Jul | Q3-21 | Q2-21 | Q1-21 | YTD | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 40% | -7% | 13% | 19% | 25% | -41% | 103% | 111% | 303% | BTC |

| NASDAQ | 8% | -6% | 4% | 3% | 1% | 11% | 2% | 23% | 48% | QQQ |

| S&P 500 | 7% | -5% | 3% | 2% | 0% | 8% | 6% | 23% | 16% | SPX |

| Total World Equities | 5% | -4% | 2% | 1% | -2% | 6% | 6% | 16% | 14% | VT |

| Emerging Market Equity | 1% | -4% | 2% | -6% | -9% | 3% | 4% | -1% | 15% | EEM |

| Gold | 1% | -3% | 0% | 3% | -1% | 3% | -10% | -7% | 25% | GLD |

| High Yield | -1% | -1% | 0% | 0% | -1% | 1% | 0% | 0% | -1% | HYG |

| Emerging Market Debt | 0% | -3% | 1% | 0% | -2% | 3% | -6% | -5% | 1% | EMB |

| Bank Debt | 0% | 0% | 0% | -1% | 0% | 0% | -1% | -1% | -2% | BKLN |

| Industrial Materials | 3% | -1% | 0% | 3% | 2% | 8% | 8% | 24% | 16% | DBB |

| USD | 0% | 2% | 1% | 0% | 2% |

-1% | 4% | 5% | -7% | DXY |

| Volatility Index | -30% | 40% | -10% | 15% | 46% |

-18% | -15% | -29% | 66% | VIX |

| Oil | 9% | 9% | -5% | 2% | 5% | 23% | 23% | 73% | -68% | USO |

Source: TradingView. As of 10/31/21.

YTD Crypto sector Review

As we move into the homestretch for 2021, I want to take this opportunity to look at the relative price performance of different crypto sectors and provide a bit of commentary on that performance.

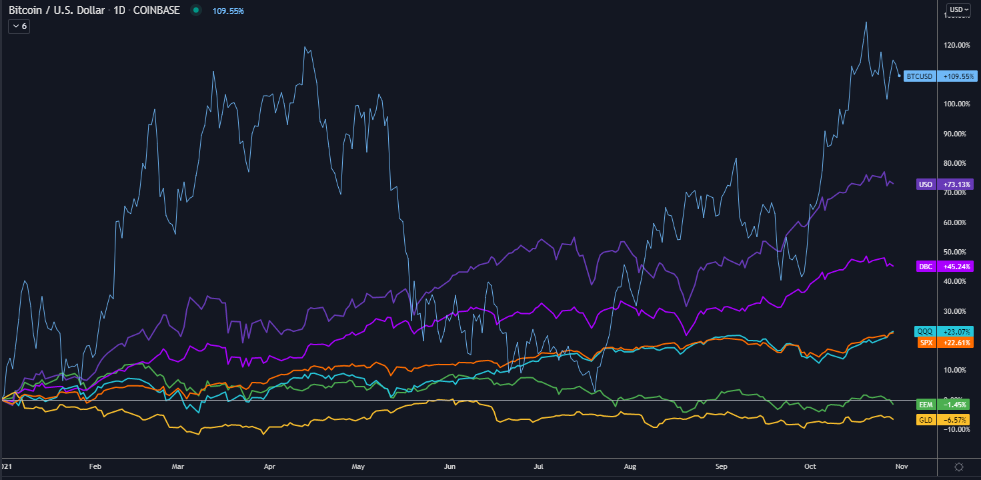

When comparing Bitcoin against other major global macro asset classes, it is once again the best performer. As it was in 2020 and 2019.

Source: TradingView. As of 10/31/21.

But when comparing BTC to the rest of the top 10 cryptos by market cap, it’s lagged badly. Bitcoin may be the fastest horse on the global macro scale, but it’s been one of the slowest within the crypto universe YTD.

Source: TradingView. As of 10/31/21.

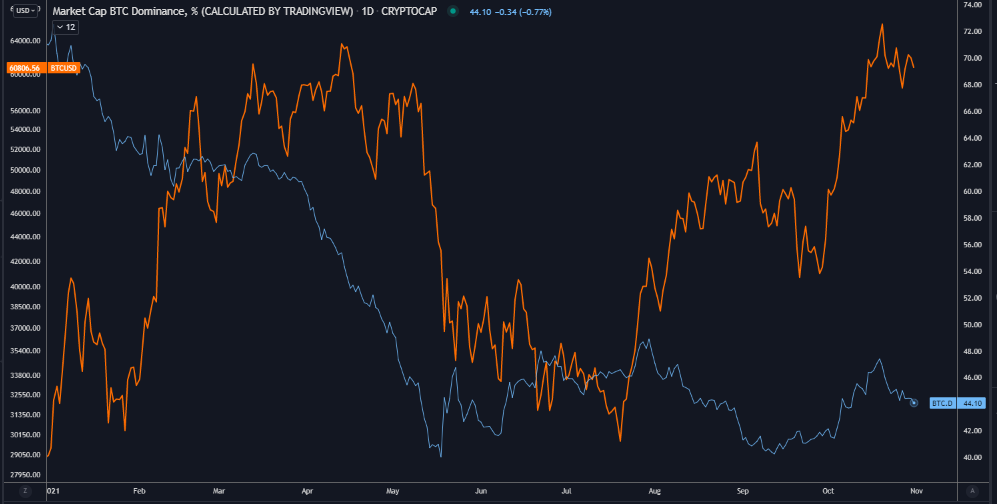

This is a trend we’ve been discussing here at length for many months. We are living in a Multichain World. That has driven BTC Dominance from over 70% on January 1st to 44% currently, only a few points off its YTD low.

Source: TradingView. As of 10/31/21.

I struggle to see this trend of downward Dominance reversing without a broader macro risk-off move. The prices of nearly every risk asset on the planet have increased meaningfully in 2021, which makes sense when you print as much money as governments have in the last 18 months. The world is awash in liquidity and that liquidity has found its way into the tail-end of crypto assets. In my view, far-and-away the most likely setup to drive Dominance meaningfully higher would be a risk-off, liquidity draining macro move. It’s why I (and many others) have been following the Fed’s tapering plans so closely. When you turn the faucet off on the bathtub, there’s less liquidity sloshing around. And if the Fed actually gets around to raising rates, now you’ve pulled the plug out of the bottom of the bathtub too. If and when we get to that, I would expect BTC price to decline significantly (50%+), ETHBTC to underperform and the large majority of Alts to underperform ETH. A significant rise in BTC Dominance while BTC price is flat-to-up is difficult for me to imagine, but it’s crypto so certainly anything could happen.

The Multichain World is being driven be the innovation happening on Layer 1 smart contract platforms. Stablecoins. DeFi. NFTs. Gaming. Metaverse. DAOs. Almost none of it is happening on Bitcoin and all of it is happening on Layer 1’s. Which has led to this chart.

Source: TradingView. As of 10/31/21.

The L1 trade has been an absolute monster this year. Even picking the worst performing L1 still gave you 250% of outperformance vs BTC. It’s certainly worth examining the L1 performance not just from a percentage perspective, but from a dollars of market cap growth perspective.

Source: Coinmarketcap. As of 10/31/21.

Interestingly, the aggregate YTD dollar market cap growth for L1’s isn’t that much greater than the increase in BTC’s dollar growth - $692bn vs $609bn. It’s just that BTC started the year at more than half a trillion dollars, while aggregate L1’s were barely $100bn. It’s also worth mentioning here that these market cap numbers only give a VERY rough estimate of actual capital flows into these names. $692bn of L1 market cap increase does NOT equate to $692bn in capital flows. Not even close. There is a multiplier effect that is difficult/impossible to estimate. But the order books of all those L1’s are meaningfully thinner than BTC’s. It is safe to assume MUCH less capital flowed into L1’s to produce that $692bn increase in market cap than the capital flows into BTC to increase its market cap $609bn. Friendly reminder that when the tide goes back out, those thin order books in smaller cap names work the other way too.

Turning to “blue-chip” DeFi, again you see meaningful outperformance vs BTC in most but not all cases.

Source: TradingView. As of 10/31/21.

The performance of DeFi broadly has lagged that of L1’s broadly YTD. DeFi got off to a very hot start in the first part of the year, but you can see most DeFi names have not made recent ATH’s. Many are still quite a ways away from their peak YTD gains earlier this year, while L1’s have continued roaring higher. As discussed in prior months, I believe the market is assigning value to the broad innovation occurring on top of L1’s by buying L1’s. DeFi as a sector is here to stay and will continue to innovate, create value and accrue value, but there’s good reason to think its aggregate market cap will always lag the aggregate L1’s.

Layer 2’s, sidechains and “specialized” Layer 1’s is a bit more of a hodgepodge sector. Many different use cases. Many different stages of development. A wide array of traction. Some don’t actually have their own tokens. I probably wouldn’t have included it separately here if not for one reason – MATIC. Lots of usage has equated to lots of price gain. To a lesser extent, the same is true for CELR.

Source: TradingView. As of 10/31/21.

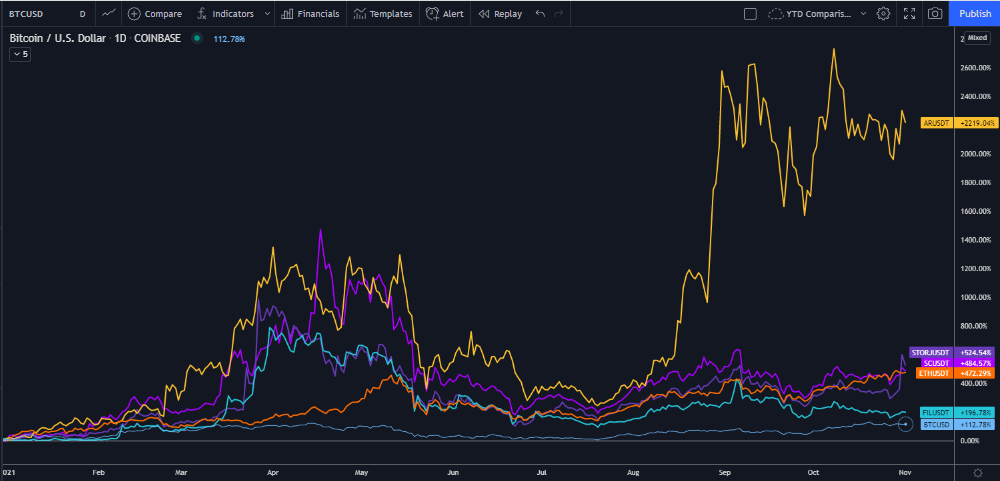

Decentralized Storage has been an interesting sector. The main standout here is Arweave – which brought to market the unique concept of permanent decentralized storage. As you can see below, Arweave caught fire August and September as the Solana NFT ecosystem started gaining significant traction. Many of the most popular Solana-based NFTs are underpinned by Arweave. For this reason, many are speculating Arweave could become the storage protocol of choice for NFTs in the future, and that’s likely to be an important business.

Source: TradingView. As of 10/31/21.

Gaming, Metaverse, P2E and DAOs are so intermixed with one another that it’s sort of impossible to break them apart into separate sectors. Comparing these names is challenging because they represent significantly different types of innovation. Comparing these names is also difficult because some have been around for years (MANA, WAX) while others only weeks or months. And lastly, visually comparing these names is difficult because the returns are simply eye-watering. Axie Infinity in particular, has produced some of the most astounding returns ever seen for any asset in anything.

Source: TradingView. As of 10/31/21.

Again, here it is instructive to look at the dollar increases in market cap. The aggregate market cap of these names at the beginning of the year was $3bn and has increased $31bn YTD. Yes, the percentage returns have been otherworldly, but the dollar increase is likely a better way to think about it.

Source: Coinmarketcap. As of 10/31/21.

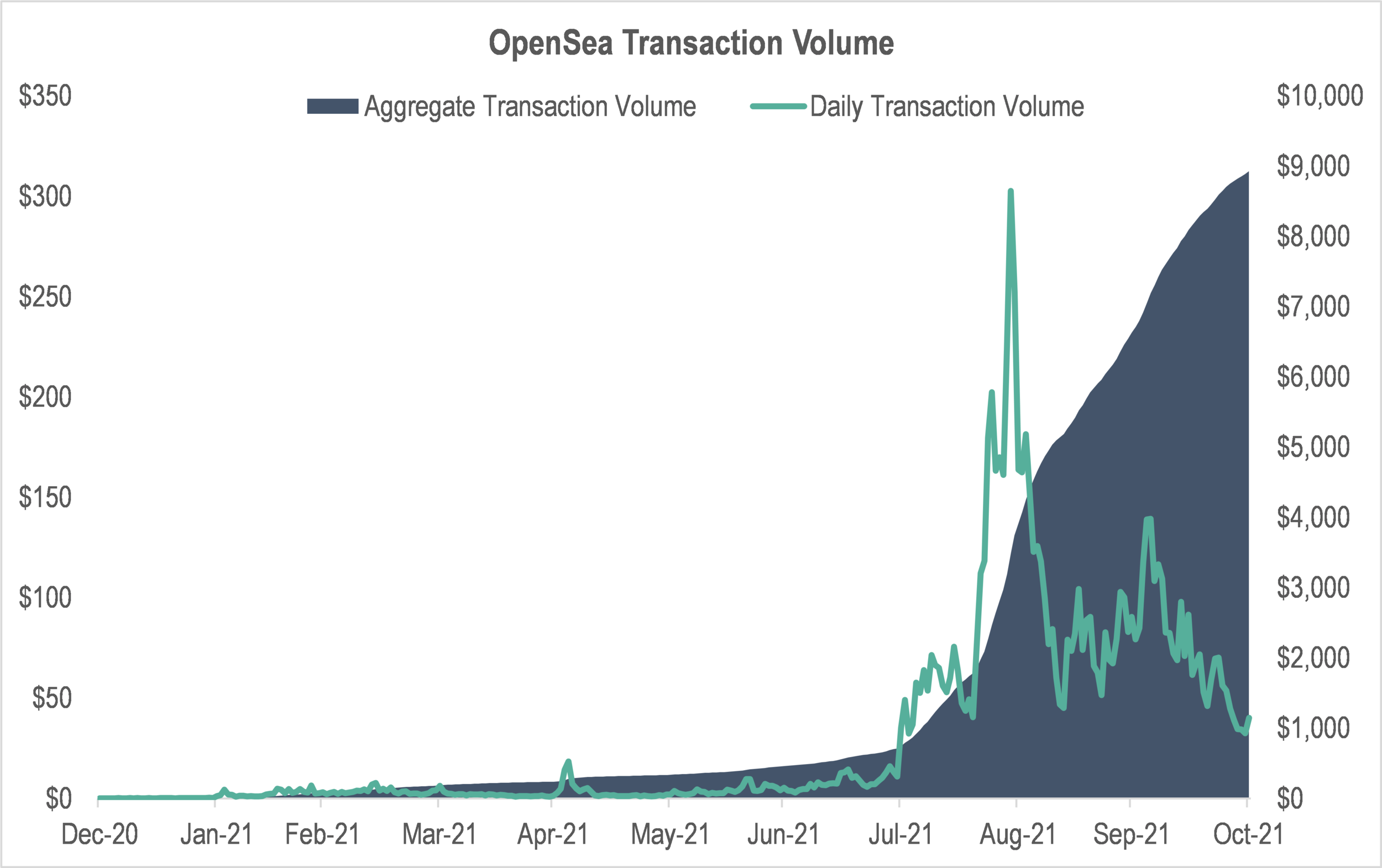

Regarding NFTs specifically, we must acknowledge OpenSea transaction volume. Nearly $9bn of NFTs have traded on OpenSea YTD. Insane. And while daily volume is well off it’s YTD highs of $300mm (wait, what??), we’re still seeing $40mm/day of transaction volume. Not bad for a bunch of JPEGs!

Source: DappRadar. As of 10/31/21.

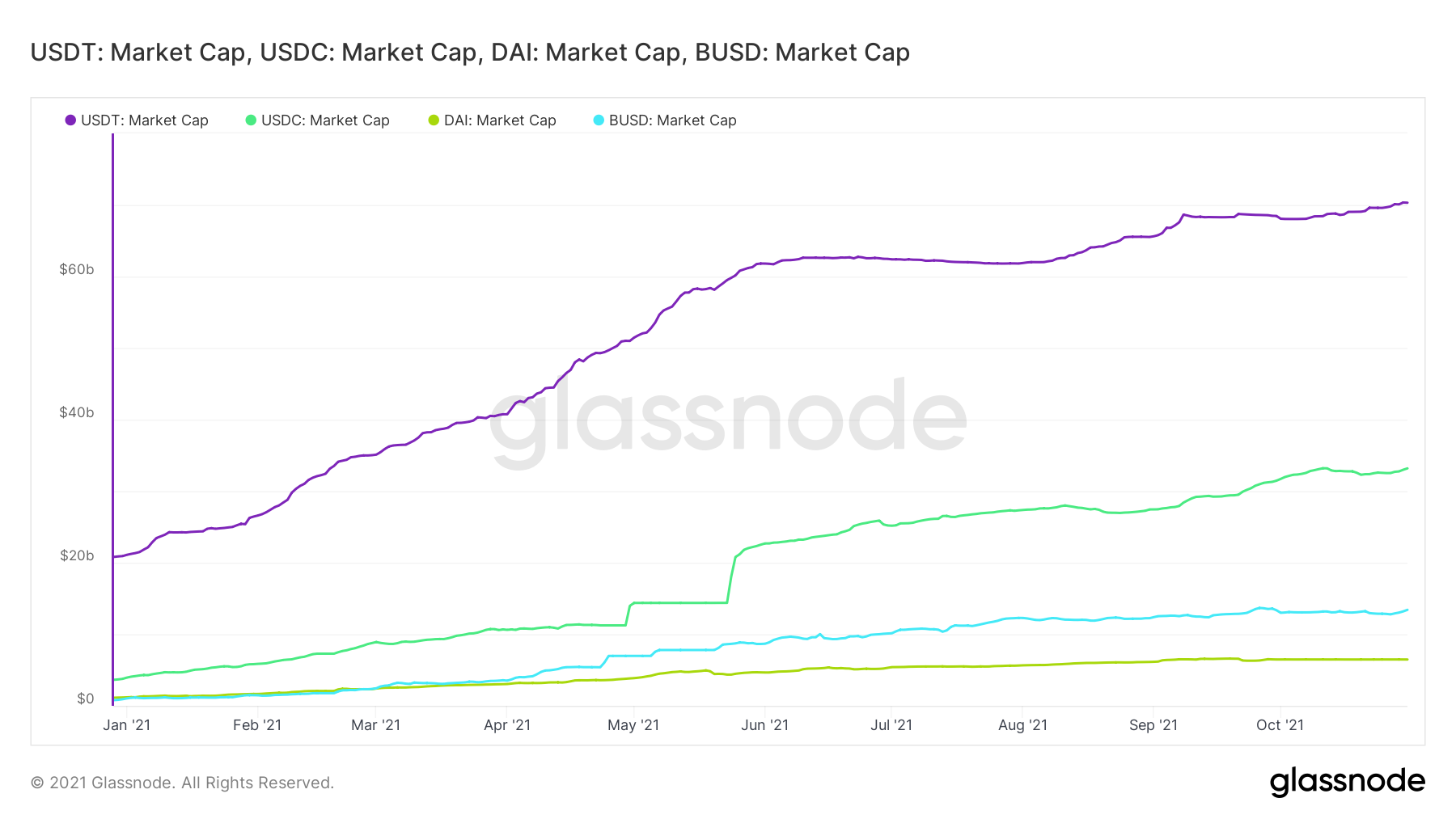

Stablecoins have been one of the single largest use cases for crypto. Their market caps have ballooned as adoption gained traction for all sorts of use cases, not just moving dollars around to crypto exchanges. At the beginning of the year, the aggregate market caps of USDT, USDC, DAI and BUSD was $27bn. That number is currently $123bn. Massive.

Source: Glassnode. As of 10/31/21.

Exchange tokens have largely outpaced BTC YTD, some by a little and some by a lot. BNB and FTT are two of the best performing large-caps in crypto YTD, although BNB is more of hybrid L1/exchange token with its usage on Binance Smart Chain.

Source: TradingView. As of 11/1/21.

Privacy tokens have been a sector that has been relatively quiet YTD. The price performance dispersion has been significant, with projects both significantly outperforming and underperforming BTC. The privacy use case is one that investors continue to grapple with.

Source: TradingView. As of 11/1/21.

In summary, on a YTD % gains basis King BTC has been firmly beat in most every direction. All of the other cryptos mentioned here are smaller market cap than BTC, and many are only a tiny fraction of BTC’s market cap. Financial markets globally have been risk-on for the vast majority of 2021 and that backdrop has emboldened investors to step further out in assigning market cap to early-stage innovation occurring in crypto. We can argue about whether the magnitude of those market cap increases are warranted or whether those capital flows will prove to be sticky over time, but you can’t argue whether crypto has delivered real innovation that has driven real adoption. You can’t argue about the tsunami of venture capital coming into the space every which way. You can’t argue about how bright the future looks.

Market Update – Liquid Crypto Asset Investing

| Symbol | Oct | Sep | Aug | Jul | Q3-21 | Q2-21 | Q1-21 | YTD | 2020 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 40% | -7% | 13% | 19% | 25% | -41% | 103% | 111% | 303% | 92% |

| ETH | 43% | -13% | 35% | 12% | 32% | 19% | 160% | 481% | 469% | -3% |

| XRP | 20% | -22% | 59% | 6% | 31% | 23% | 161% | 405% | 14% | -45% |

| BCH* | 21% | -21% | 16% | 2% | -6% | -11% | 45% | 46% | 71% | 30% |

| EOS | 18% | -22% | 23% | -1% | -5% | -14% | 85% | 78% | 1% | 0% |

| BNB | 35% | -17% | 39% | 10% | 28% | 0% | 708% | 1302% | 172% | 123% |

| XTZ | 4% | 18% | 70% | 0% | 100% | -37% | 142% | 214% | 49% | 192% |

| XLM | 34% | -18% | 19% | 1% | -1% | -31% | 220% | 190% | 184% | -60% |

| LTC | 25% | -11% | 18% | 1% | 6% | -27% | 58% | 54% | 202% | 36% |

| TRX | 13% | 1% | 39% | -6% | 31% | -26% | 244% | 279% | 101% | -29% |

| Aggregate Mkt Cap | 36% | -8% | 27% | 14% | 33% | -23% | 146% | 243% | 301% | 51% |

| Aggregate DeFi* | 31% | -9% | 37% | 32% | 64% | -27% | 339% | 594% | 1177% | 77% |

| Aggr Alts Mkt Cap | 33% | -9% | 40% | 9% | 40% | 1% | 246% | 550% | 274% | -1% |

Source: CoinMarketCap. As of 10/31/21. BCH includes SV. Aggregate DeFi from Coingecko.

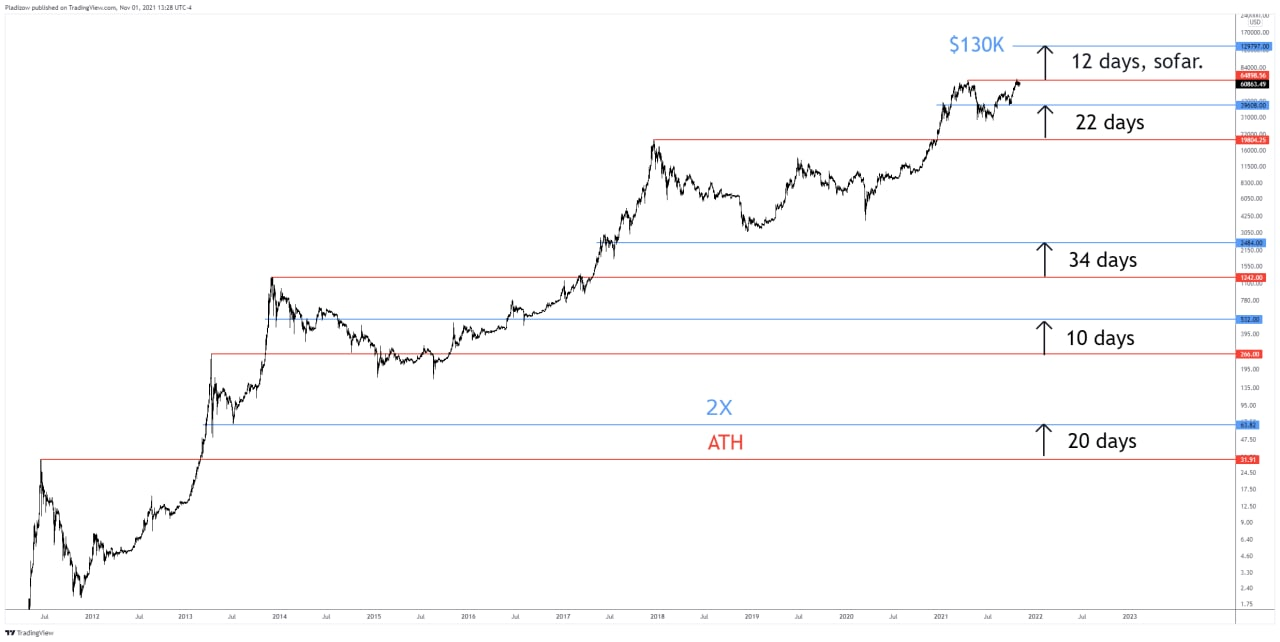

Bitcoin was up 40% in October, it’s best performance since December 2020, on the back of the BITO ETF approval. We breached a new ATH daily close for a single day before pulling back ~8% off the highs into month-end. We also closed a new ATH weekly candle and a new ATH monthly candle. While these timeframes are somewhat arbitrary, they are undoubtedly viewed by many traders. The historical price performance after new monthly ATHs is resoundingly bullish – if history holds, a double is around the corner.

Source: @Pladizow. As of 11/1/21.

Some traders have been worried that price made a new ATH but then pulled back underneath. This is not unprecedented. The below chart shows number of days (subjectively measured) where BTC price “hung around” prior ATH before moving higher. If this time is like the last times, there’s nothing to worry about - we’re heading higher.

Source: @Pladizow. As of 11/1/21.

CME futures open interest exploded to massively new ATH in response to the market’s expectation of a BTC CME Futures ETF approval. Contango expanded higher to levels last seen in late March 2021, shortly before Bitcoin topped out.

Source: Coinglass. As of 11/1/21.

The steepness of the curve and the overall growth of BTC CME futures will be a function of fund flows into BITO, and that is a number I am not confident in estimating. The $1bn of AUM in two days of trading completely blew away my expectations. In hindsight, if I were to wrap a narrative around those massive flows, it would make sense to me that Bitcoin whales would peel a couple bucks off to throw into BITO out of the gate, to get the market excited about the magnitude of flows. That would make perfect sense. Where those flows go from here will be worth watching closely.

When I look at the current levels of long-term on-chain indicators, many of them look “middle of the road” in terms of under vs overpriced. This one, which shows the “ratio of the cost basis of Long-term Holders to the cost basis of Short-term holders”, is an example of being middle of the road but still firmly bullish. A lot of them look like that.

Source: @WClementeiii. As of 10/27/21.

It’s worth noting this and many on-chain indicators are printing signatures they’ve never printed before – in the sense that there’s no clear historical analog. Which makes sense because the Bitcoin/crypto market has changed a LOT since say, 2013. There are instances that would point to the 2013 “double bubble” being the most similar historical period vs current. I put some weight in that, but not a ton.

The manner and degree to which on-chain indicators have been a part of our investment process at Ikigai has ebbed and flowed over the last three years. There’s been times when they were a lot of our process and times they were only a little. We look at them differently now than we used to. And we always look for confluence across other market factors.

One specific factor about the current crypto market that’s different than years past is the significance of Alts. I’ve talked at length about this previously, but Bitcoin is the most hated it’s been on a relative basis in the four years I’ve been doing this. That does not look set to change. Given that, when thinking about price targets for BTC over the coming years, if you’re expecting $100k Bitcoin and then beyond, it’s certainly worthwhile to consider the sheer magnitude of capital that will need to flow in to BTC. It currently takes way more cash to pump BTC 100% than it takes to pump YGG 10,000%. Bitcoin will need to see heavy institutional adoption in very big size for it to continue producing really outsized returns relative to its peers.

Which brings up the question, what are Bitcoin’s peers? It doesn’t really have any, to be honest. World’s never had anything like it. But you could pick and choose certain aspects, like it’s store of value properties (gold) –

Source: TradingView. As of 11/1/21.

Or it’s tech properties (Nasdaq) –

Source: TradingView. As of 11/1/21.

Or it’s market cap (TSLA) –

Source: TradingView. As of 11/1/21.

Or it’s crypto properties (ETH) –

Source: TradingView. As of 11/1/21.

You could even just pick its direct competitor (M2 money supply) –

Source: TradingView. As of 11/1/21.

Bitcoin looks like it’s winning most of those battles (gold, Nasdaq, M2). It’s losing a couple (TSLA, ETH), although in the long run it’s still a wide-open game on both. There’s a different set of risks embedded in each of those charts – under what circumstances and to what degree might Bitcoin under or outperform gold, Nasdaq, M2, TSLA and ETH in the future? From that perspective, Bitcoin remains an outstanding asset to have a meaningful part of your portfolio in.

While I showed the BTC/ETH chart above, that is more typically viewed as ETHBTC. ETHBTC looks ready to head higher.

Source: TradingView. As of 11/1/21.

You would be remiss to look at ETHBTC without looking at SOLETH. That’s not exactly what Paul Tudor Jones had in mind when he mentioned “the fastest horse”, but at this point I’d be surprised if PTJ doesn’t already have a SOL bag. This chart wants higher.

Source: TradingView. As of 11/1/21.

We continue to do more work on the Metaverse (even before Facebook changed their name). As mentioned above, some of these names are really running away at the moment. Most are VERY thinly traded, so when Facebook goes and changes their name, they can get a little, uhh, gappy to the upside.

One of the aspects we’ve been contemplating is which “sectors” within this broad Metaverse umbrella do we want to invest in. Another is how early in a project’s lifecycle do we want to invest. The market is heavily speculating on projects that are a long way away from launching. You can make that bet if you want and it can be a great bet to make, but it’s a different type of bet than betting on a project that is live right now with has measurable activity and assessable working features. One way to potentially approach this is to just do small allocations to a large majority of the legit projects out there and size them appropriately, looking to add along the way as a project progresses through its life cycle. Then just pay a lot of attention. It’s simple, but sometimes simple is a good approach.

Closing Remarks

Four weeks after I write about Metaverse for the first time, Facebook goes and changes their name to Meta. In some ways that makes me feel late but in other ways it makes me feel early. I think crypto broadly can have a tendency to make almost everyone feel like that – both late and early at the same time. This entire technology and asset class has been built not on how the world is, but how it might be. Only a few hundred or few thousand people saw it at the very beginning and thought any of it might do anything or be worth anything. Everyone else picked it up somewhere along the way. I bought my first Bitcoin at a $45bn market cap and I felt both late and early then! There’s beauty in that.

People come to crypto for all sorts of reasons, but on average, crypto has a higher percentage of “purpose-driven” participants than almost any other sector of the global economy. There is an ethos to crypto. That ethos ebbs and flows over time and there is a diverse array of priorities driving that purpose. As crypto continues to eat the world and do battle with some of the largest competitors in the world, it must be noted that the crypto ethos has been and will be firmly under attack.

Crypto is a disruptive technology, and to the point where it changes the fabric of society. Just like the internet did. Think about how hard corporations battled for the internet. So, it should come as no surprise that the status quo is battling crypto in every which way. What’s becoming increasingly clearer is that rather than fighting crypto head-on (and losing), the status quo will attempt to co-opt crypto. Makes total sense - groups of people have been taking that same strategic approach since the dawn of time when faced with similar situations. For those that are purpose-driven, we mustn’t lose sight of the underlying reasons we’re here. My underlying reason is that I believe centralized power is failing the people at nearly every level. I believe society is recoiling from this to an increasing degree, and that younger generations feel this more acutely than older generations. DLT and crypto assets provide a technology platform to deliver decentralization to every aspect of life in way that makes the world a better place. From that perspective, it’s still very early.

“Vision without action is a daydream. Action without vision is a nightmare”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS