August 2024 - Monthly Market Update

/Monthly Update || August 2024

“A great deal of investment success can result from just being in the right place at the right time.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our seventy-first Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, July was one of the most eventful months in crypto history, intertwined with one of the most eventful months of the last 50 years for the United States broadly.

Two weeks to the day after the July 13th assassination attempt, Donald Trump gave a rousing speech in support of Bitcoin and crypto at the Bitcoin 2024 conference, including a pledge that when elected, he would establish a Bitcoin reserve and never sell any Bitcoin the government seized.

It would not be an exaggeration to call this a jaw-dropping turn of events. I don’t know how you reacted when I heard the news that Trump was shot at a rally, but I was stunned. It was likely the most shocking political event of my life besides 9/11.

In the one weekend between Trump being shot and promising to create a Bitcoin reserve fund, Joe Biden announced he would not run for re-election. In the immediate wake of this announcement, support for Kamala Harris poured in from most corners of the Democratic party. And shortly thereafter, it became clear Kamala would be the Democratic candidate in November.

Questions/accusations/rumors swirled aggressively around both Trump’s assassination attempt and the replacement of Joe Biden as presidential candidate. And for good reason. There is still not - in any way - a clear, evidenced explanation for exactly what happened on July 13th. I’m not sure we’ll ever get one. And there is still not a clear, evidenced explanation of Biden stepping down from re-election. Not sure we’ll ever get on there either.

July 2024 will go down as a month when the erosion of trust in the US government accelerated. No one looks at the assassination attempt or the White House hot swap and feels better about how things are going in general with the US government. I could write an entire monthly letter about that concept, but I’ll just leave it be for now.

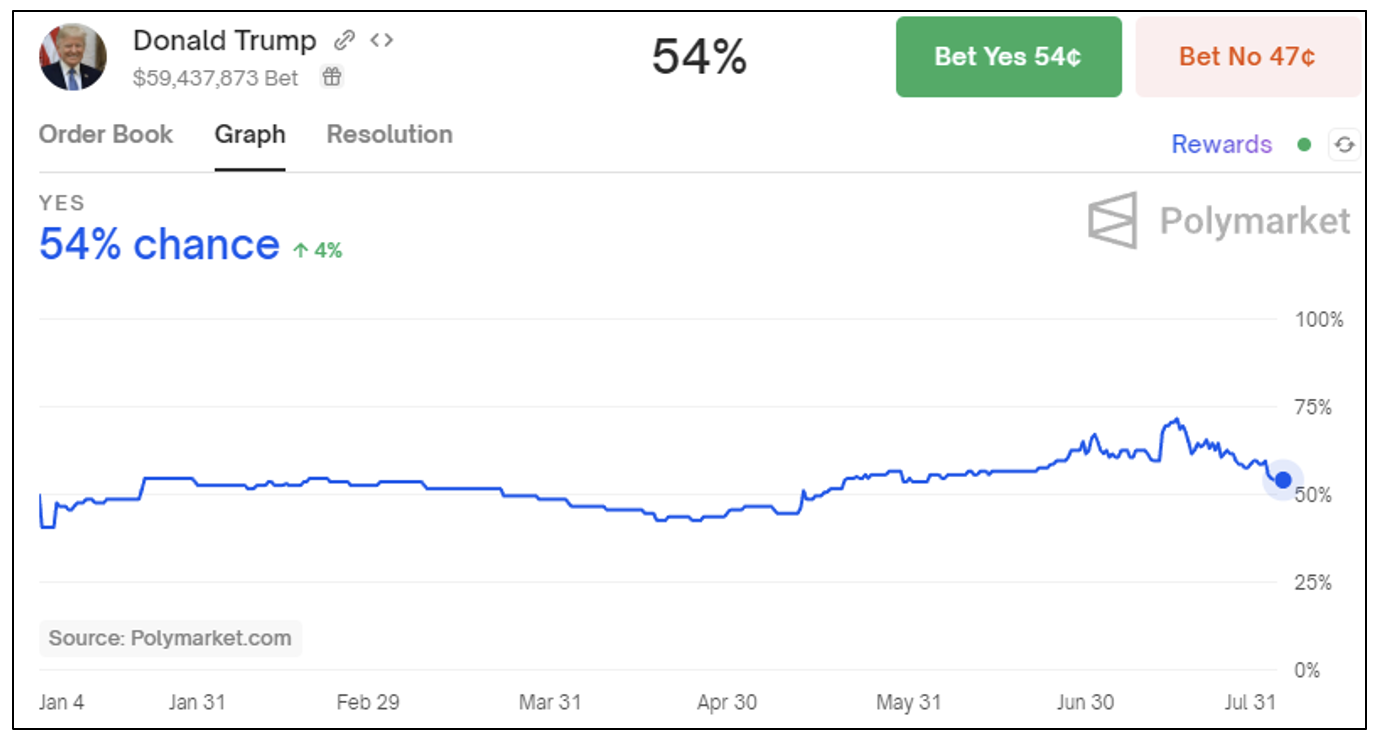

The one potential shining light, depending on your politics, is that Trump is probably now more likely to be elected president than he was a month ago, although that is up for debate (or gambling). It is certainly noteworthy that Trump is now trading BELOW where he was before the debate with Biden that ended up being his demise as the Democratic nominee.

After the month we just had, the next four months leading up to the election are set to be incendiary to say the least. It will be a time of increased divisiveness in this country because by all measures, the country is very divided over whether they would rather have Trump or Harris as the next president. It would be amazing if, regardless of who wins in November, the country finds some unity in the wake of the election. But I am not holding my breath.

Bitcoin and crypto are officially “on the ballot” in a major way this year. The crypto super PAC Fairshake is the largest super PAC in this election. Money = power in the electoral process in this country. So Bitcoin and crypto have power in this election. What exactly will come of that, remains to be seen.

July Highlights

Trump Keynotes Bitcoin Conference, Says He Will Fire Gensler, End Operation Chokepoint, Not Sell Government’s Seized BTC, Create A Bitcoin Strategic Reserve, Clarify Crypto Rules, Embrace Stablecoins and Block A CBDC

Spot ETH ETFs Launch, Seeing $484mm of Total Net Outflows in Seven Days ($1.5bn Inflows, $2bn Outflows from Grayscale)

Spot BTC ETFs See $3.2bn of Total Net Inflows

German Government Aggressively Sells 50k Seized BTC

Mt Gox Estate Moves ~62k BTC to Kraken, Bitstamp, BitGo, Distributions to Creditors Underway

Trump Names JD Vance, Bitcoin Holder and Crypto Proponent, As Running Mate

Senator Lummis Announces Legislation to Establish A “Bitcoin Purchase Program” of Up To 200,000 BTC Per Year for Five Years

RFK Jr Announces If Elected He Will Buy 550 Bitcoin Every Day Until the US Owns 4mm BTC

Crypto Super PAC Fairshake Is Now the Largest Super PAC in the US, Raising >$200mm

Trump Raises $25mm in Donations at Bitcoin Conference

US Government Moves $2bn Seized Silk Road BTC to New Wallet, Rumored to Be Custody-Related and Not Sold

SEC Retracts Request for Court to Classify Solana, Cardano, et al As Securities in Case Against Binance

Circle Receives First Stablecoin License Under EU’s New MiCA Crypto Rules

Galaxy Digital Raises $113mm Crypto Venture Fund

Cantor Fitzgerald Announces Bitcoin-Based Lending Business

Ryan Selkis Steps Down as CEO of Messari

Founder of BitClout Charged with Fraud and Offering Unregistered Securities by DOJ/SEC

BlockFi to Begin Repaying US-Based Creditors

BitMEX Pleads Guilty to Bank Secrecy Act Offense

SEC Sues Defunct Silvergate Bank for Securities Fraud

| Asset Class | Jul | Q2-24 | Q1-24 | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 3% | -12% | 69% | 53% | 57% | -12% | 7% | 72% | 155% | -64% | 60% | BTC |

| NASDAQ | -2% | 8% | 8% | 15% | 14% | -3% | 15% | 21% | 54% | -33% | 27% | QQQ |

| S&P 500 | 1% | 4% | 10% | 16% | 11% | -4% | 8% | 7% | 24% | -19% | 27% | SPX |

| Total World Equities | 2% | 2% | 7% | 12% | 10% | -4% | 5% | 7% | 19% | -20% | 16% | VT |

| Emerging Market Equity | 1% | 4% | 2% | 7% | 6% | -4% | 0% | 4% | 6% | -22% | -5% | EEM |

| Gold | 5% | 5% | 8% | 19% | 12% | -4% | -3% | 8% | 13% | -1% | -4% | GLD |

| High Yield | 2% | -1% | 0% | 1% | 5% | -2% | -1% | 3% | 5% | -15% | 0% | HYG |

| Emerging Market Debt | 2% | -1% | 1% | 2% | 8% | -5% | 0% | 2% | 5% | -22% | -6% | EMB |

| Bank Debt | 0% | 0% | 0% | -1% | 1% | 0% | 1% | 1% | 3% | -7% | -1% | BKLN |

| Industrial Materials | -6% | 12% | -2% | 3% | -5% | 7% | -11% | 4% | -6% | -13% | 29% | DBB |

| USD | -1% | 1% | 3% | 3% | -5% | 3% | 0% | 0% | -2% | 8% | 6% | DXY |

| Volatility Index | 32% | -4% | 4% | 31% | -29% | 29% | -27% | -14% | -43% | 26% | -24% | VIX |

| Oil | -2% | 1% | 18% | 17% | -18% | 27% | -4% | -5% | -5% | 29% | 65% | USO |

SOURCE: TRADING VIEW. AS OF 7/31/24.

What Is To Come of Bitcoin?

Bitcoin has been doing more or less the same thing since January 3, 2009 – making new blocks every 10 minutes. The world around Bitcoin has changed a LOT since then, and the world around Bitcoin changed a lot in July 2024. So I think it’s worthwhile to check in on Bitcoin’s outlook and investment case in light of these recent changes.

A Refresher

To set the stage, let me restate my investment case for Bitcoin. Bitcoin is a non-sovereign, hard capped supply, global, immutable, decentralized, digital store of value. It is an insurance policy against monetary and fiscal policy irresponsibility from central banks and governments globally. If you’ve been reading these for a while, that catchphrase should come as no surprise – I have said it many times here over the last five years.

Bitcoin seems to be purpose-built to capture an outsized share of M2 money supply growth and central bank balance sheet growth. So if you’re bullish M2 and central bank balance sheet growth, you should be bullish Bitcoin because it should give you a multiplier on fiat debasement.

Over the last couple years, I have taken to characterizing the expected future returns of Bitcoin price appreciation as “levered NASDAQ with a call option on being the next world reserve currency”. That still makes sense to me. It’s been generally trading like that for years and I think it will continue to trade like that.

Now you can drill down into what exactly I mean by “a call option on being the next world reserve currency”. And I use that phrase somewhat colloquially. What I mean is, if one or more major world currencies collapse, there will likely be a meaningful price response in Bitcoin. My guess is that in a major currency collapse (e.g., Yen) price response in Bitcoin would be sharply down, but then very quickly it may be sharply up, and up more than it went down. And that would be very noteworthy and could accelerate a price response in Bitcoin as the world collectively readjusts its view of Bitcoin’s value proposition. Fast forward another decade and maybe the Euro collapses and you do that again, with BTC eventually rerating much higher. Eventually, by the time Millennials turn into Boomers, the chickens might come home to roost for many decades of dollar recklessness, and BTC might have a shot. That’s what I mean by “a call option on being the next world reserve currency”.

The other moniker I’ve used to describe Bitcoin’s long-term value proposition over the last few years is “pristine collateral”. Bitcoin as pristine collateral. What I mean by that is – we live in a debt-laden global financial system. There are turns and turns of debt everywhere you look – from real estate to high frequency trading. And the USD is the world reserve currency in the sense that contracts and assets are most typically priced in USD. It is the most widely accepted and most widely desired. But with this much debt in the world, US Treasuries are actually the collateral foundation of the global financial system. The interest rate on Treasuries sets the interest rate for every other yield bearing instrument on planet Earth, and in turn the price of every asset on planet Earth.

USD M2 money supply is ~$21tn –

But the velocity of M2 has collapsed, not ideal for a well-functioning collateral -

When it comes to Treasuries, the aggregate market value is $28tn –

And trading volume has increased a ton, currently running ~$320tn a year, that’s a liquid collateral foundation!

Source: SIFMA. As of 6/30/24.

So that’s why Treasuries are the collateral foundation of the global financial system. Objectively, the investment outlook for US Treasuries is challenged over a multi-decade period, which is the period of time you consider when buying 10 and 30-year instruments. Debt-to-GDP, deficit-to-GDP, entitlement spending-to-GDP. These are worrisome metrics for a debt-laden global financial system relying on US Treasuries as the collateral foundation. The only issue is, when you look around for alternatives to US Treasuries as the collateral foundation of the global financial system, your traditional options are all worse. JGB’s a joke. ECB debt a joke. China a joke. Eventually you come to Bitcoin and you can squint a little bit and actually put together a cogent argument that Bitcoin would be a better collateral foundation than Treasuries.

It’s not like I expect it to get there tomorrow. BTC needs to get a lot bigger, less volatile and more liquid. But I suspect it will do all three of those things over the course of this decade and the next. You wake up in 2034 and BTC is $10tn market cap, trading $100tn a year, and that may very well be better collateral than a US Treasury at that point. Bitcoin as pristine collateral.

So I think all of the above is relevant regardless of who wins in November. That’s basically the pitch for Bitcoin either way. But the election will matter.

If Harris Wins

With the information we have currently, a Harris win is unequivocally worse for Bitcoin and crypto than a Trump win. You can hate that or love that, but you’d be foolish to think otherwise. What we don’t know is exactly how much worse a Harris administration would be than a Trump administration.

We still don’t know what, if any, official stance the Harris campaign will take on crypto and Bitcoin. Supposedly she is looking to “reset” with crypto companies, but we don’t really know what, if anything, that means or will lead to. Stay tuned there.

On the margin, a Harris executive branch will be less supportive of crypto than Trump, but we don’t yet know to what degree. Treasury Secretary, CFTC Chair, Comptroller of the Currency, and a plethora of appointees one level down in seniority. These matter a lot for how crypto and Bitcoin are treated in the coming years, and it’s safe to say all of that will be at least somewhat less supportive of crypto under Harris. I would expect some meaningful portion of appointees to stay in their current roles, because a Harris administration is a lot like the current Biden administration. And obviously the current Biden administration has not been supportive of crypto.

Gensler may soon be gone either way, but if Harris wins and he ends up staying, that is a bad outcome for crypto. If he stays and is empowered by a Harris administration to keep treating crypto so unfairly (not my base case but certainly possible), that would be even worse.

Which party controls the House and the Senate will matter a lot for crypto as it relates to passing sensible legislation to regulate crypto. But a blue wave would be less likely to pass sensible legislation and may even pass damaging legislation. A red wave would be much more likely to pass sensible legislation. If it’s split, it’s a toss-up and could go either way.

A Harris administration would likely be more adversarial towards self-custody and DeFi, based on the demonstrated stances of Elizabeth Warren, Sherrod Brown and the Biden White House. But it’s hard to know exactly how that would play out.

I think at this point, stablecoins are pretty safe either way. I think they probably have bipartisan support as both sides realize stablecoins are strongly pro-dollar.

A Harris administration will likely sell seized BTC but would likely do so periodically in relatively small sizes so as not to disrupt the market. There’s a chance Harris tries to curry favor with crypto folks by announcing she would not sell seized BTC either (like Trump’s announcement), but I’m not sure how to weight that likelihood.

A Harris administration or a blue wave will both likely result in a lot of fiscal spending, deep deficits and M2 money supply growth. It’s hard to say whether a Harris or a Trump administration would spend more, but I think it’s safe to say both will spend a lot.

A Harris administration will likely result in generally loose monetary policy although I’m not sure if they would be more or less loose than a Trump administration. Powell will likely be Fed chair until his term expires in May 2026 regardless of who wins in October, and he will be executing monetary policy in response to the business cycle using inflation and labor market signals as a guidepost.

If Trump Wins

As of last Saturday in Nashville, Trump has now promised a lot to Bitcoin and crypto. Additionally, we now have some new insights into Trump’s administration that are also relevant.

The biggest swing factor for a Trump presidency is the potential creation of a Bitcoin reserve fund by the Treasury. Not selling the BTC the US government already has is likely easy to do and I think highly likely to be done if he wins. Buying more BTC through the Treasury is a tougher lift and I don’t know how to weight the likelihood it actually happens – feels like maybe 30% chance it happens. My guess is, this could probably get done via executive order, but it may require legislation (which was why Lummis announced a bill to do just that).

The second biggest swing factor if Trump wins is regulatory clarity for crypto. My guess is, if Trump wins, you get a crypto bull as SEC chair, a crypto bull as CFTC chair and at least a somewhat crypto supportive Treasury Secretary. Not too long after appointment and confirmation, I would guess you would see a series of settlements and no action letters from the SEC and CFTC, along with executive orders out of the White House that would, in aggregate, act as a de facto regulatory framework for crypto, even without legislation.

If Trump wins, we likely get more crypto ETFs in 2025.

As mentioned in the Harris Wins paragraph, getting sensible crypto legislation passed will be more likely in a red wave, but I think still possible under a Trump administration with a split congress (although less likely than a red wave). Legislation would take longer than the de facto regulatory framework and may not actually be necessary.

Trump said he would put an end (at least for four years) to a CBDC. I think that will happen.

One specific angle on a Trump administration that I haven’t seen talked about much is the potential for an explicit strategy of dollar devaluation. JD Vance, from the rust belt, wants to bring manufacturing back to the United States. The dollar must be weaker or that simply doesn’t work- the maths don’t math. I’m not sure what the most likely avenues of action would be for a White House trying to devalue the dollar, I’ll dig more into it and get back to you.

In the broadest sense, a Trump administration would have: 1) a president who just gave the speech he gave in Nashville last Saturday; 2) a vice president who owns Bitcoin, understands the value proposition of Bitcoin, and despises Gensler; 3) And a senior advisor (at the least) in Vivek that has been a vocal proponent of Bitcoin.

One last point I want to touch on. There has been some commentary along these lines –

Which granted, is fair. Bitcoiners (mostly) rail against the government and (mostly) warn of the eventual collapse of the dollar and other fiat currencies. But yet, here we are, begging on our knees for Trump to have the US government buy a bunch of Bitcoin. A large part of that, undoubtedly, is just number go up in fiat terms. Pump my bags, Orange Man. You can be as principled as you want to be, but if you have a bag of Bitcoin and Trump says he’s gonna have the US government buy a ton of it, it’s hard not to open a Zillow tab, ya know? Another valid point is that the US buying BTC is good for America and Americans. If you’re a true believer in Bitcoin, it’s a major step in the right direction of keeping America as the leader of the free world. And the last thing I’ll say is – if Bitcoin is going to get much bigger, much more valuable, much more widely adopted, its either going to happen by becoming more institutionalized or its going to happen because of some sort of Mad Max dystopia – and I don’t want that and I don’t think that’s going to happen. So BTC will succeed by becoming more institutionalized. The entire concept of “BTC as pristine collateral” is a deeply institutional outcome. “BTC as pristine collateral” means Bitcoin taking market share from US Treasuries – it doesn’t get any more institutional than that. Granted, I do worry about price manipulation of Bitcoin in the coming years in the same vein as gold’s price manipulation. Cash collateralized and cash settled derivatives alongside ETFs are the perfect instruments to manipulate Bitcoin’s price and neutralize its inherent scarcity. You’d be fooling yourself at this point to think that can’t happen or that the powers that be would never do such a thing. It doesn’t mean Bitcoin price won’t go up a lot in the coming years and decades – it can and I think it will – even more so if we get Trump come November.

Market Update – Liquid Crypto Asset Investing

| Symbol | Jul | Q2-24 | Q1-24 | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 3% | -12% | 69% | 53% | 57% | -12% | 7% | 72% | 155% | -64% | 60% |

| ETH | -6% | -6% | 60% | 42% | 37% | -14% | 6% | 52% | 91% | -67% | 399% |

| XRP | 31% | -24% | 2% | 1% | 19% | 9% | -12% | 58% | 81% | -59% | 278% |

| BCH* | 6% | -44% | 121% | 31% | 33% | -24% | 117% | 16% | 157% | -75% | 6% |

| EOS | 1% | -48% | 30% | -31% | 45% | -22% | -37% | 38% | -2% | -72% | 17% |

| BNB | -1% | -4% | 94% | 84% | 45% | -10% | -24% | 29% | 27% | -52% | 1269% |

| XTZ | -8% | -43% | 40% | -27% | 47% | -15% | -28% | 56% | 39% | -84% | 116% |

| XLM | 10% | -35% | 9% | -22% | 15% | 1% | 1% | 55% | 81% | -73% | 108% |

| LTC | -7% | -28% | 44% | -4% | 10% | -39% | 21% | 28% | 4% | -52% | 17% |

| TRX | 3% | 1% | 14% | 20% | 21% | 16% | 27% | 10% | 98% | -28% | 181% |

| Aggregate Mkt Cap | 0% | -14% | 63% | 40% | 51% | -3% | 1% | 49% | 119% | -64% | 186% |

| Aggregate DeFi* | -7% | -21% | 47% | 9% | 72% | -5% | -5% | 50% | 132% | -77% | 581% |

| Aggr Alts Mkt Cap | -7% | -15% | 58% | 25% | 53% | -2% | -5% | 33% | 90% | -64% | 479% |

SOURCE: COINMARKETCAP AND COINCECKO. AS OF 7/31/24. BCH INCLUDES SV.

For the second month in a row, I would say BTC and ETH price action was pretty strange, all things considered (and there were plenty of things to consider). It was a huge month for both assets. BTC had Trump keynote the Nashville Bitcoin conference, talking about establishing a Bitcoin reserve fund if elected. ETH had its long-awaited spot ETFs launched and the numbers were pretty good ($1.5bn of inflows, $2,0bn of outflows from Grayscale), at least relative to low expectations. But it all added up to about flat for the month – BTC +3% and ETH -6%.

Granted it was a tail of two months – the first two weeks were mired with the German government unloading ~50,000 BTC aggressively onto the market over the July 4th holiday. At the bottom on July 5th, BTC was -15% on the month and -26% from the recent high a month prior – the largest pullback in BTC price since the collapse of FTX. It was ETF inflows that came to the rescue during the German selling –

Bitcoin found a bottom as the market watched the BTC ETF inflows devour the German’s selling. Immediately thereafter, Trump almost had his head blown off on national television. And once it became clear he survived the assassination attempt, Bitcoin rallied strongly alongside Trump’s chances of winning in the prediction markets. There were other crosscurrents in Bitcoin price action in July – most notably the distribution of ~62,000 BTC to Mt Gox creditors, who have been waiting to get their Bitcoin back for a decade. It seems this has also weighed on price some, although I think it’s more fear than actual mass selling of BTC by creditors.

All that adds up to produce the below chart –

I would characterize the above BTC chart as five months of consolidation at prior ATHs. Zooming in, it has been a bit of a tricky range-

You could argue the nine-day dip below $58k support was a sort of “inefficiency” from a TA perspective, driven by Germans hammering through their seized BTC. Regardless, the Trump assassination attempt catapulted BTC back towards the top of range, while the rumor mill was whirring about Trump’s upcoming Nashville speech and a Bitcoin reserve fund.

Given where we are in the Bitcoin cycle (four months post-halving) and where we are in the monetary policy cycle (entire world starting to ease, including the Fed), my take on this range is to call this consolidation bullish and poised to breakout to the upside. Could be August or could be closer to the election, but that’s my base case. Obviously there are risks to that and at this point, they seem to be primarily from the election. Harris is an unknown risk to crypto but, as discussed at length earlier, there is a sizeable gap between how Trump and Harris would approach Bitcoin and crypto.

Last thing on BTC, Charles Edwards’ hash ribbon indicator, which has a very high hit rate historically, fired a buy signal in July. Good to see.

ETH was down 3% in July –

The above chart tells the story:

ETH traded off hard in correlation with BTC in early July as Germany was selling.

At the lows, ETH price was 10% below where it was when the ETH ETF news broke the month before.

ETH bounced alongside BTC and then sold off on the actual ETF launch and sold off further with Bitcoin to end the month/begin August.

Currently ETH price is slightly below where it was pre-ETF news. This feels cheap to me.

The ETH ETF launches I would characterize as being better than expected, given the strength of ETHE outflows. There is real demand for these products – Blackrock has seen $623mm of inflows seven trading days. Fidelity $279mm. Bitwise $285mm. These are big numbers out of the gate. I think there’s good reason to believe that the ETHE outflows will dry up relatively soon, the strong inflows will stop being drowned out, and you should see a positive price response.

ETHBTC has now retracted the majority of its move up from the ETH ETF news-

ETHBTC is currently ~10% above where it was when the ETH ETF news broke, after failing to break out of its nearly two-year downtrend. I thought that downtrend would have been broken by now, but that’s not how it played out. In the current market structure, it does not seem like ETHUSD can go up if BTCUSD is not going up. My guess is that ETHBTC will continue to act as beta to BTCUSD. That view is mostly predicated on the above assumption that ETH ETF inflows will be a boon. To the extent those inflows dry up, or if ETHE outflows reaccelerate (they have slowed meaningfully over the last three days), ETHBTC likely drags, regardless of what the overall market is doing.

SOL had a good month in July, +17% -

SOL has also now been consolidating for five months, currently 35% below its prior ATH. SOL is as close to a consensus long as you’ll find in the crypto market right now. On the back of 1) the strength of the Solana memecoin casino; 2) the easily digestible label of “fast and cheap”; and 3) the low relative valuation (SOL mkt cap 20% of ETH), Solana is certainly a favorite.

As you can see below, SOLBTC (green) has often traded correlated to BTCUSD (white), although there have been notable periods of outperformance/decoupling (red)-

It seems most likely that SOL will continue this pattern, with a beta to BTC. If you’re bullish on BTC in the coming months, SOLBTC should at least be able to keep up, and probably outperform. Whether SOL outperforms ETH will likely be a function of ETH ETF net inflows.

Looking at the monthly and YTD performances of Alts (as of mid-day 8/1), very few have kept up with BTC-

The large majority of “large cap Alts” have significantly underperformed BTC YTD. One major driver is “a lack of pretense that any of this shit does anything or will ever do anything”. That’s been well-discussed here at this point. Two other reasons are the Token Unlock Problem, and the lesser-known, but also problematic, “DPI Problem”.

August token unlocks are set to be at least $1.25bn-

There’s plenty more where that came from for the rest of the year as well. These unlocks are drowning essentially the entire Alts market, even Alts that have limited/no unlocks this year. It’s simply a large-scale dilution issue, coupled with a lack of conviction on the investment theses of nearly all Alts.

The DPI Problem (Distributed Paid-In-Capital) has as similar result as the Token Unlocks, just gets there a different way. Many funds were early investors in projects that generated tremendous investment returns for these funds: 5x, 10x, 50x, 100x at current market prices. The VCs need to sell these investments, regardless of how much they like the investment, to realize profits and distribute those profits back to LPs in their funds – so they can collect a performance fee and go raise another fund. This is an issue facing many funds, and thus many tokens. The depth of bid for nearly all these tokens is just not there to absorb all that selling, but the VCs are up so much and need the money back, so the selling can be somewhat urgent/indiscriminate. You put the Token Unlock Problem together with the DPI Problem, and that’s the drag you see in the market.

It’s also a major driver of the push into ridiculous Memecoins, not that they’re any better –

Which brings us to our final chart, which has been shown here for months. The below chart is Adjusted Alt Dominance ((Aggr Mkt Cap – BTC – ETH – USDT – USDC)/(BTC + ETH Mkt Caps) –

I originally started showing this chart to point out the similarities between the two yellow channels, and imagining a future where that fractal continued to play out (i.e., big down move in late 24, followed by a breathtaking Alt Szn in early 25). Well, it looks like we have skipped the part of the fractal from summer 2020 where Alts outperform BTC and ETH, because we are currently nearly halfway through the decline from the orange box, and doing it a few months ahead of schedule.

It is very easy for me to imagine BTC + ETH continuing to outperform Alts broadly in the coming months. It would be my base case. The main caveat to that would be if the market decides Alts are a great way to play a Trump presidency, and they garner significant inflows into and/or immediately after the election (assuming a Trump win). I get the thesis – Gensler has been brutal for Alts. If Trump wins, Gensler out and we get a sensible regulatory framework, thus Alt Bonanza. It could happen. I wouldn’t say I’m highly convicted it’s going to play out that way. It’s not immediately clear to me where those inflows into Alts would come from. Perhaps if ETH runs hard in the coming months due to ETF inflows, there could be profit-taking out of ETH and into the further reaches of this risk spectrum. That would seem like the most likely path for Alts to outperform BTC and ETH. Otherwise, I think the move down in the green line shown above could play out. TBD on what would come after that.

Closing Remarks

In the days immediately after Trump’s assassination attempt, with the naming of JD Vance as VP and watching a bunch of clips from the Republican National Convention, I was feeling the most optimistic I’d felt in years about the path forward for the United States. A significant driver of that optimism was my assessment of the assassination attempt and Trump’s demeanor during and in the wake of the assassination attempt.

I’m pretty sure many millions of people watched the events of July 13th and thought the same thing – both believers and atheists alike. It’s a deep question I won’t pretend to have an answer to. I mean, I THINK God moves in this world, but I’m also pretty sure I don’t have the frame of reference to even comprehend what that actually means. In any case, it’s the sort of thing I’ve been thinking a lot about lately. If you’ve been thinking about the same sorts of things, reach out. I’d love to have a conversation.

From my perspective, it was easy to characterize the events of July 13th as something like a miracle. We can have a conversation about what a miracle even is, but it sure SEEMS like Trump should have had his head blown off and he turned his head a bit and got nicked in the ear and lived. Many people have experienced all sorts of near-death experiences (great YouTube rabbit hole if you’ve never done it), and most of the time, it changes those people profoundly. Most, or at least many, people that have NDE’s have a wholesale change in their relationship with God on the back end of that. It would make sense Trump would be the same.

So that’s a big part of what had me so optimistic in the wake of July 13th. Looking at Trump at the RNC. Looking at his demeanor. His facial expressions. His gate. The way he interacted with others. His tweets. His words. It seemed like a man that just had a serious conversation with his Maker. I won’t pretend to know Donald Trump’s relationship with God, far be it for me to even begin to pass judgement on such a thing. But my KNEEJERK thought is that Trump and God have probably been pretty…uhh...dicey over the course of his 78 years. And my assessment was that he almost got his head blown off and that’s the kind of thing that will help you approach God with a bit more humility, which has certainly never been Trump’s strong point.

And I heard a message of unity from Trump and from Vance and from Vivek and I thought maybe God moved in the world to keep Trump from getting his head blown off and all that made me really optimistic because if God truly DOES move in this world, “if God is for us, who can be against us?”.

I’d be lying if I said my optimism from say, July 16th –

Hasn’t waned in the last two weeks. The number one reason for that is because, from watching Trump, I’m not sure the NDE impact has taken root to the extent it needs to. Watching him speak and tweet, I see a man that is torn between acting in a way that is in accordance with God’s will (i.e, stop being such a dickhead), and acting like his typical narcissistic self.

That is a struggle we ALL deal with in some form or fashion. It’s like, we know what we SHOULD do, but we have this tendency to do the other thing. The selfish thing. Or the self-aggrandizing thing. Or the greedy thing. Whatever action that is motivated by literally billions of years of evolution to be SELFISH, we are prone to do that. It is inherent in our nature, which, to the extent anything is God-given, is God-given.

So that’s a struggle we all go through every day. I think Trump is going through it now, on the global stage. Not an easy spot to be in.

“The day you decide to do it is your lucky day.”

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS