September 2024 - Monthly Market Update

/Monthly Update || September 2024

“Too much capital availability makes money flow to the wrong places.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our seventy-second Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, August effectively locked in the first Fed rate cut for September while simultaneously waltzing through the most violent but short-lived “Yen carry trade unwind” in financial markets history.

If you just glanced at the August monthly performance of market bellwethers, you would miss the intra-month carnage. US stocks up a bit. DXY down a couple percent. Treasury yields a bit tighter. VIX a bit tighter. NIKKEI down a bit. JPY up a bit. But that monthly glance conceals how hard the global financial markets were slammed and how aggressively they recovered. It made for some historically long wicks on monthly candles.

If I had written this monthly on August 6th, I probably would have spent most of the letter unpacking the Yen carry trade unwind contagion in depth. But like I said, it came and went incredibly quickly, and I’m not expecting the situation to reappear in the near-term (although it certainly could). If you want more details, this is a good thread.

Alongside the Yen unwind situation, the US election landscape continued to evolve rapidly. Harris picked radically left Minnesota governor Tim Walz as her running mate. The Harris campaign announced economic and tax plans that included price controls and taxing unrealized capital gains. RFK Jr dropped out of the presidential race, derided the Democratic party and threw his support to Trump. In turn, Trump pledged RFK a cabinet position if he wins in November. Tulsi Gabbard did the same.

Shown above, Trump’s odds on Polymarket declined precipitously after peaking at 72c immediately after his assassination attempt in mid-July. After bottoming in mid-August at 44c, Trump bounced in response to the Harris economic and tax plans and RFK’s support for Trump. Both the betting markets and the public polls have the presidential race as a toss-up currently.

The next major (planned) event is the September 10th debate. There is certainly a path where either candidate could blunder enough to meaningfully impact the election. I could imagine either candidate making a mistake like that. They both certainly have the ability to say stuff that makes you really not want to vote for them. So the debate is likely going to matter.

My optimism for the future should Trump win grew in August. I like RFK and I like Tulsi. I think a Trump administration is better off with the two of them in it.

My nervousness also grew in August. Nervous that some additional major negative event (e.g., Trump getting shot in the face) might occur between now and the election - a series of domestic terrorism attacks or a large-scale cyber-attack. Unfortunately that just feels like where we are as a nation right now. I’m also nervous about mass election fraud at a scale that can swing the election. Unfortunately that also just feels like where we are as a nation right now.

My conviction on a Trump win did not grow in August. I have no insider info on polling - I just see the same stuff as anyone else. And the purpose of this monthly letter is not to try and convince you which candidate is a better choice. Vote for whoever you want. For the purposes of this letter, I’m really just trying to understand the reality of the situation and convey what I’m seeing to you, and hopefully you find that helpful. In my head, Trump seems like the clearly better choice (the least bad candidate). And yet I know that Trump lost the popular vote in 2016, 2020 and he is highly likely to lose the popular vote again this year. So it is highly likely more people will turn out and vote for Harris than for Trump in November, even if it is very possible Trump wins the election due to the electoral college. And that simple fact makes me feel like I don’t have a very good handle on what the American people want.

What CRYPTO people want, that is clear.

August Highlights

RFK Jr, Vocal Proponent of Bitcoin and Bitcoin Holder, Drops Out of Presidential Race to Support Trump, Pledged a Cabinet Position in Trump Admin

Pavel Durov, Founder of Telegram and TON Blockchain, Arrested in France on Numerous Criminal Charges, Released on Bail but Remains in France, TON Blockchain Experiences Downtime

Q2-24 BTC ETF 13F Filings Released, 60% of Largest 25 Hedge Funds Hold BTC ETFs

US Government Moves 10,000 BTC Worth $600mm Seized From Silk Road to Coinbase, Presumably to Be Sold

Jump Trading Sells Hundreds of $mm of ETH

Mt Gox Estate Finishes Distributing BTC to Creditors

Morgan Stanley Wealth Management Begins Offering BTC ETFs to Clients

Marathon Digital Raises $300mm in Convertible Senior Notes, Buys $249mm of BTC

OpenSea Receives Wells Notice From SEC, Says It Will Fight

Ripple Settles with SEC for $125mm, Ending Multiyear Saga

BitGo Announces wBTC Partnership with Justin Sun, Ecosystem Vehemently Opposes, Deal Revised, Coinbase Immediately Announced cbBTC Project in Response

Trump Launches NFT Project

Trump Campaign Teases Support for Upcoming DeFi Project

Federal Reserve Charges Customers Bank for Digital Asset Activities

DRW Venture Capital Discloses $150mm of ETH ETF Holdings

CBOE Withdraws SEC Application for Options on BTC ETFs

FTX Bankruptcy Receives Creditor Support for Plan of Reorganization

Genesis Bankruptcy Begins Distributing Assets to Creditors

| Asset Class | Aug | Jul | Q2-24 | Q1-24 | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -9% | 3% | -12% | 69% | 40% | 57% | -12% | 7% | 72% | 155% | -64% | 60% | BTC |

| NASDAQ | 1% | -2% | 8% | 8% | 16% | 14% | -3% | 15% | 21% | 54% | -33% | 27% | QQQ |

| S&P 500 | 2% | 1% | 4% | 10% | 18% | 11% | -4% | 8% | 7% | 24% | -19% | 27% | SPX |

| Total World Equities | 2% | 2% | 2% | 7% | 14% | 10% | -4% | 5% | 7% | 19% | -20% | 16% | VT |

| Emerging Market Equity | 1% | 1% | 4% | 2% | 8% | 6% | -4% | 0% | 4% | 6% | -22% | -5% | EEM |

| Gold | 2% | 5% | 5% | 8% | 21% | 12% | -4% | -3% | 8% | 13% | -1% | -4% | GLD |

| High Yield | 1% | 2% | -1% | 0% | 3% | 5% | -2% | -1% | 3% | 5% | -15% | 0% | HYG |

| Emerging Market Debt | 2% | 2% | -1% | 1% | 3% | 8% | -5% | 0% | 2% | 5% | -22% | -6% | EMB |

| Bank Debt | 0% | 0% | 0% | 0% | -1% | 1% | 0% | 1% | 1% | 3% | -7% | -1% | BKLN |

| Industrial Materials | 4% | -6% | 12% | -2% | 7% | -5% | 7% | -11% | 4% | -6% | -13% | 29% | DBB |

| USD | -2% | -1% | 1% | 3% | 0% | -5% | 3% | 0% | 0% | -2% | 8% | 6% | DXY |

| Volatility Index | -8% | 32% | -4% | 4% | 20% | -29% | 29% | -27% | -14% | -43% | 26% | -24% | VIX |

| Oil | -4% | -2% | 1% | 18% | 12% | -18% | 27% | -4% | -5% | -5% | 29% | 65% | USO |

SOURCE: TRADING VIEW. AS OF 8/31/24.

Pervasive Quiet Quitting

I’ve been focused on crypto for seven years now, running Ikigai for 6+. I’ve got a reasonably big network in (American) crypto and talk to dozens of crypto folks on a regular basis. There has been an attitude, a stance, that I have recently observed or been told about with such frequency that it must be a trend. Crypto is experiencing Pervasive Quiet Quitting.

Just to set the stage, in case you’re not familiar with the term “Quiet Quitting”, it’s a relatively new one-

Part of the reason people have come to me so frequently to discuss this stance of Quiet Quitting is because of my “Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything” piece and my “Financial Nihilism” piece. Those were the two most widely read long-form posts I’ve ever written. I still get tagged about them on Twitter. I was at a crypto conference last week and at least a half dozen folks brought those pieces up to me in person. So they really resonated. This Pervasive Quiet Quitting trend is an extension of the views of those posts, which so accurately captured (and predicted) the current state of the crypto landscape.

What I’m seeing and hearing is that a meaningful swath of the crypto community is simply much less engaged than in prior years. And they are much less engaged because there is much less belief in the potential of crypto projects to solve real world problems and gain significant adoption as a result. That was a dream that was consistently sold and bought from 2017 (the year I got in) until 2022 – “crypto will solve real world problems and gain significant adoption as a result”. Many billions of dollars of venture capital funding were raised on this premise.

And there were stops along the way that would lead you to believe something in that general direction was occurring: DeFi was one of those. NFTs were one of those. Stablecoin proliferation was one of those. Axie Infinity was one of those. Plus Bitcoin adoption was rising and price was rising right along with it and Bitcoin got Paul Tudor Jones and Saylor and Elon and a bunch of other good stuff, and that made people optimistic about crypto just because Bitcoin was doing well.

All the above plus a bunch of smaller flashes (e.g., DAOs, Metaverse) kept folks generally pretty optimistic and also served to bring a lot of new people into crypto, both in terms of buyers but also full-time employees. At times that optimism would propagate into euphoria, but even in the most euphoric times, most folks knew in the back of their mind that a lot of this stuff was shaky, overvalued and lacking product-market fit. Those fears were always present. And during bear market periods, those fears would become outsized as optimism faded to pessimism, but even in the deepest bears (late 18, 2H-19), there was acute optimism for various projects and a broad hope about the technology’s potential in general.

The sentiment we’re currently dealing with is something different IMO (and many seem to agree). The curtain has been pulled back on how utterly pointless and ridiculously overvalued so much of all this is, while the potential of the existing projects is simultaneously getting LESS believable. The points-to-airdrops daisy chain was an embarrassing and ill-advised failed attempt to drive adoption. The memecoin mania was embarrassing and ill-advised further still. For many multicycle crypto participants, the realization is sinking in that we’ve simultaneously come so far while accomplishing so little. This realization is jarring for those of us who have dedicated a tremendous amount of time and effort to this space for years. All of a sudden, your life’s work starts to feel like mostly a waste. You don’t like what crypto has to show for itself and you don’t like the direction that it’s headed.

There is all manner of cognitive dissonance going on to try and rationalize this realization, but for many it has simply sunk in. This realization has caused many to leave the space entirely. People have left crypto in droves. But a meaningful portion have stayed and are just WAY less motivated, way less enthused, way less of a believer. The main reason many people stay is because it’s difficult to imagine spending your time doing anything else or deploying your capital elsewhere. What are you going to do, go get a corporate normie job? That sounds like a disaster. And then there’s the “vote with your wallet” perspective. Despite many becoming deeply disenfranchised with crypto fulfilling its potential, they stick around the space because the “time adjusted, risk adjusted” returns are still believed to be more attractive than most anywhere else you could spend time investing your money. This may seem oxymoronic, but it goes like this –

I believe BTC will outperform every other asset class every year for most years, and every once in a while BTC will have a really bad year. Alongside that, I believe there will be select Alts that will massively outperform BTC during those up years. It may be a few Alts or it may be a lot of Alts, but there will be at least some. And if I can identify those, I can easily make 3, 5, 10, 20, 50, 100, 1000x my money. So it’s worth me sticking around and paying attention….

Imagine being 30 and having say, $2mm liquid net worth that you got by investing in crypto over the last 5 years. A lot of money sure, but prob not enough to retire on. You need to turn the $2mm into $5mm or $10mm to really be set. Plus you’re a young guy and you’re not ready to retire yet anyway. You got into crypto in 2017 because it was exciting and revolutionary and full of potential. You’ve personally done well financially, but you’re disappointed in how little the space has actually accomplished, and you’re less excited than ever about the future prospects of crypto…but you don’t leave. You can’t. What are you going to spend your time doing? Picking stonks instead of Alts? That makes no sense. Way more competitive, way more efficient, way less returns. So you just kinda hang out and keep an eye on the market and hope to get a fat pitch where you can 3x your net worth in a year…many, many such cases.

This stance is pervasive, despite a growing lack of confidence “that any of this shit does anything or will ever do anything”. Crypto enthusiasts cannot see what is going to drive the next big leg up. No DeFi summer. No NFT summer. Gaming is currently DOA. Metaverse turned out to be a complete joke. Decentralized social media has flatlined. People are trying to get excited about crypto x AI, but I (along with many others) think that excitement is likely misplaced (at least thus far). DePIN is working and growing and is exciting – probably the brightest spot in the Alts landscape at the moment. So that’s certainly a sector folks are looking to for strong future price performance driven by real world adoption. But those areas in crypto are few and far between.

The other aspect of this is the much-chagrined crypto VC investing landscape. Put simply, the crypto market continues to reward VC’s that invest early in token projects by allowing them to dump on retail at a massive profit, even if that project shows little discernable traction with its intended use case. The token project can: 1) run a points-to-airdrop daisy chain; 2) concoct a ridiculously overvalued market cap; 3) hire a market maker and pay them so much they win no matter what happens; 4) list the token on a major exchange; and 5) dump into oblivion. Even if the token price goes down 85% from listing, the early VCs are still up multiples on their money. This is a dominant feature of the current Alts market structure. The crypto market has allowed VC’s to return their funds (and raise new ones) based on investments that never did much of anything and will never do much of anything. This is a brutal case of misaligned incentives. You can hardly blame the VC’s – people are gonna do what they’re incentivized to do. And so far, the market is saying “please VC, list more dogshit on major CEX’s at insane FDV’s and dump on me.” Until the market collectively decides that opportunity will no longer be made available, you should hardly expect VC’s to act any differently. They’re getting private jet money off this whole deal.

There is a saying in crypto made popular by a friend of mine, “do you want to be right, or do you want to make money?” This has been a rallying cry of sorts for many in crypto. I get it. It speaks to profits over all else, especially over your egotistic desire to be “right”. But to posit a counterpoint – “if you are wrong enough long enough while making money, you may run out of chances to be wrong and make money.” We’re seeing some of that now.

All of the above adds up to an explanation for the Pervasive Quiet Quitting in crypto. Turning back to the traditional definition of Quiet Quitting from the New Yorker article above – Quiet Quitting in the workplace kills a company’s culture. It’s an ambitious CEO’s worst nightmare. Employees see others not working, not believing in the mission, naturally makes you want to not work and not believe in the mission. We are creatures of imitation. Enthusiasm is contagious and so is a lack of enthusiasm. In this way, Quiet Quitting begets Quiet Quitting. And so far this cycle, we haven’t even come close to bringing in the number of new people we have in prior cycles (new ETF investors excluded). Crypto is NOT a preferred avenue for the best and brightest young minds in America. The industry still has a LOT of egg on its face from the damage done in 2022 and we haven’t done nearly enough since then to rectify the reputational hit we took in terms of attracting top talent to the space. Imagine you were contemplating joining a company experiencing Pervasive Quiet Quitting. Does that sound like the kind of opportunity you would jump at?

So What?

I am well aware this is the sort of post that traders would label a “bottom signal.” Historically in crypto, buying when sentiment is most sour and selling when sentiment is most sweet has generated incredible returns. And this Pervasive Quiet Quitting thesis is certainly a sour one, so usually you want to be buying this sort of thing with both hands. I get it.

Another retort to the thesis I’ve laid out here is “we’re so early bro.” Stop. Stop it. It’s not that early. Bitcoin is worth a trillion bucks and half of Wall Street owns it at this point. All the rest of crypto is worth another trillion. Tether owns more Treasuries than Germany. There’s been more than $20bn of venture capital poured into this space in the last four years. We’re not that early. Stop with the comparisons to “the internet in the late 90’s and look what happened there.” This ain’t the internet in the late 90’s. Bitcoin has product-market fit and stables have product-market fit and the rest of this stuff is lost at sea. Solutions looking for problems at best, a relentless and brutal grift at worst.

All of that to be said, there is reason to be optimistic about Alts. The most exciting path in my view is a Trump win in November that leads to a de factor regulatory framework that allows for Alt token structures to be redesigned with security-like features that allow for compelling value accrual. We’ve been talking about this concept for years here – value creation and value accrual, and the bridge between the two being token structure. In a Trump administration, it could potentially be out with the worthless governance tokens, in with the yield-bearing, token burning pseudo-securities – courtesy of a US regulatory framework that allows for such a thing. That’s a world where two years from now you could imagine a much less Fugazi Alt landscape.

That’s the kind of thing worth keeping at least one eye on…

Market Update – Liquid Crypto Asset Investing

| Symbol | Aug | Jul | Q2-24 | Q1-24 | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -9% | 3% | -12% | 69% | 40% | 57% | -12% | 7% | 72% | 155% | -64% | 60% |

| ETH | -22% | -6% | -6% | 60% | 10% | 37% | -14% | 6% | 52% | 91% | -67% | 399% |

| XRP | -9% | 31% | -24% | 2% | -8% | 19% | 9% | -12% | 58% | 81% | -59% | 278% |

| BCH* | -22% | 6% | -44% | 121% | 3% | 33% | -24% | 117% | 16% | 157% | -75% | 6% |

| EOS | -18% | 1% | -48% | 30% | -43% | 45% | -22% | -37% | 38% | -2% | -72% | 17% |

| BNB | -8% | -1% | -4% | 94% | 71% | 45% | -10% | -24% | 29% | 27% | -52% | 1269% |

| XTZ | -10% | -8% | -43% | 40% | -34% | 47% | -15% | -28% | 56% | 39% | -84% | 116% |

| XLM | -8% | 10% | -35% | 9% | -28% | 15% | 1% | 1% | 55% | 81% | -73% | 108% |

| LTC | -7% | -7% | -28% | 44% | -11% | 10% | -39% | 21% | 28% | 4% | -52% | 17% |

| TRX | 22% | 3% | 1% | 14% | 46% | 21% | 16% | 27% | 10% | 98% | -28% | 181% |

| Aggregate Mkt Cap | -11% | 0% | -14% | 63% | 25% | 51% | -3% | 1% | 49% | 119% | -64% | 186% |

| Aggregate DeFi* | -19% | -7% | -21% | 47% | -11% | 72% | -5% | -5% | 50% | 132% | -77% | 581% |

| Aggr Alts Mkt Cap | -12% | -7% | -15% | 58% | 10% | 53% | -2% | -5% | 33% | 90% | -64% | 479% |

SOURCE: COINMARKETCAP AND COINCECKO. AS OF 8/31/24. BCH INCLUDES SV.

Bitcoin was down 9% in August after being down as much as 24% MTD on August 5th and up 1% on August 25th. It was a volatile summer month, and the volumes at the bottom were noteworthy.

BTC on Coinbase had the second largest daily volume since FTX collapsed-

Source: TradingView. As of 8/29/24.

BTCUSDT on Binance had its largest daily volume since they turned off fee-free trading on that pair (fee-free trading obfuscates volume trends)-

Source: TradingView. As of 8/29/24.

ETH on Coinbase had by far its biggest volume day since FTX-

Source: TradingView. As of 8/29/24.

Same with ETHUSDT on Binance-

Source: TradingView. As of 8/29/24.

SOL on Coinbase had the biggest volume candle since January 2023-

Source: TradingView. As of 8/29/24.

Same with SOLUSDT on Binance-

Source: TradingView. As of 8/29/24.

You will notice how isolated that single day’s volume is on all those charts. It wasn’t a ramp in volume going into the puke that led to the bottom candle, and there was not sustained high trading volume after the bottom. Just one big puke candle with a long that (so far) has not been revisited. That’s pretty peculiar.

Overall, this last six months of trading for BTC has been so tricky it’s difficult to label the whole thing a “range” at all. What it looks like to me is three consecutive range breaks that led to failed breakdowns followed by swift recoveries.

Source: TradingView. As of 8/29/24.

Granted, we have also been making lower highs for six months on the top side. So another way to characterize the last six months is simple lower lows and lower highs. Zooming out, a third way to characterize the last six months is simply consolidation at prior ATHs. All three of those labels are accurate. In any case, it’s def been tricky price action and has crypto traders banging their heads against the wall. Perhaps they should consider Quiet Quitting??

Certainly worth pointing out, BTC price action has had to chew through an enormous amount of idiosyncratic, non-recurring supply that’s come to market – GBTC selling, Mt Gox selling some amount, US Government selling and German government selling. The below chart visualizes how significant that all adds up to be-

Source: @checkmatey. As of 8/23/24.

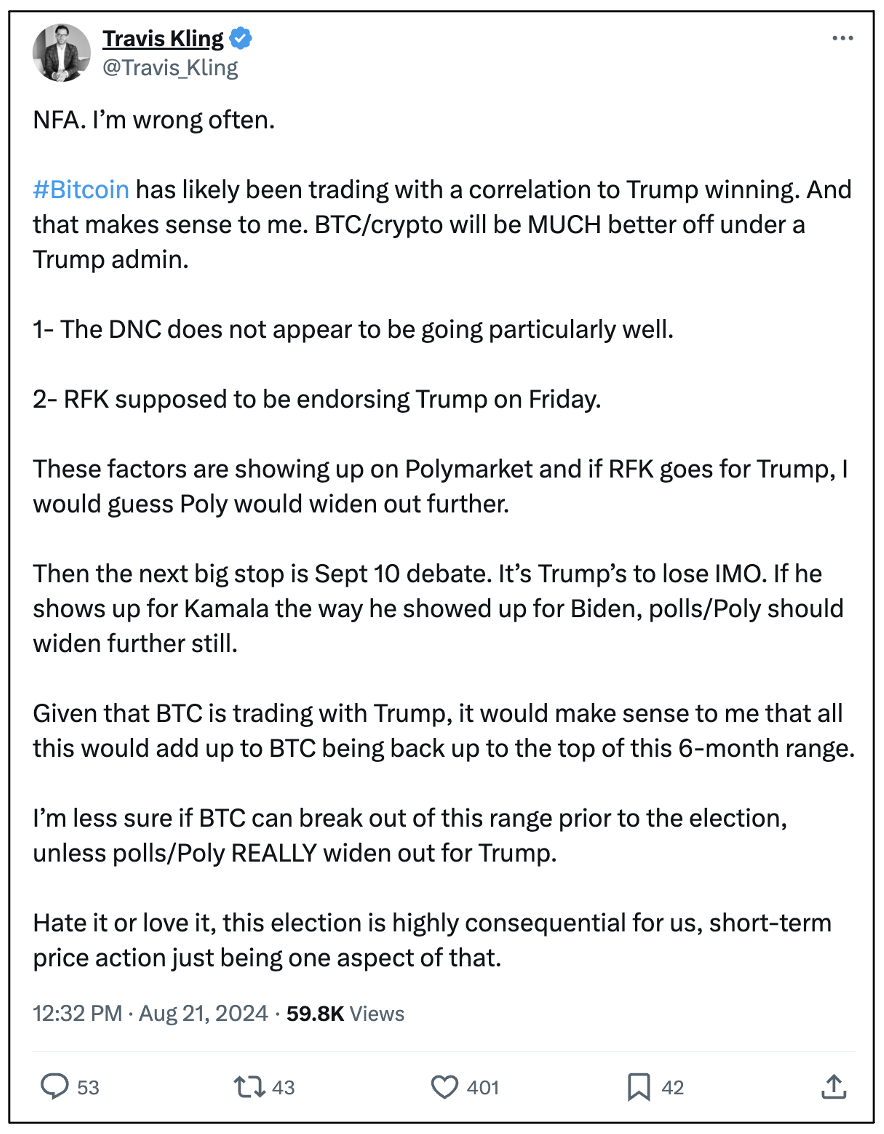

Post-Labor Day, we’re now moving into the heat of the election. And given all the election considerations I laid out here last month, Bitcoin and crypto have been and will likely continue to trade with Trump’s chances of winning between now and November. Last week I wrote the following-

Since then, RFK did indeed endorse Trump but he didn’t get any additional bump on Poly from it. I still think the debate will matter a lot from Trump chances and I think crypto probably trades with Trump. So I think it ends up looking something like this-

Source: TradingView. As of 8/29/24.

Currently it’s not my base case that Bitcoin will break out of this 6+ month trading range before the election. There’s a path where Trump crushes over the next month or two and the polls/Poly REALLY open up (high 60’s Poly, 7-12% point leads in swing states across multiple polls) and BTC could break out prior to the election, but it’s not my base case. My guess is we’ll stay in about a $15,000 range for BTC until the election. If Trump’s chances look good, we’re probably at the top of the range going into the election. If it’s a coin toss or worse, we’re probably around $60k going into the election.

If Trump wins, it should be God candle. An immediate move into the low $80’s makes sense to me. Then we probably grind from there up into the $90’s over the following weeks and then I would guess there will be a prolonged battle around $100k.

If Harris wins, there will likely be at least a flash crash. BTC going from $60 to $50 makes sense. Alts should do meaningfully worse.

There is a very real potential for some strange price action around the election in the event that a winner is not immediately clear the next day. I think that likelihood is pretty high, maybe a coinflip. Recounts in one or more swing states are quite likely. So the market could be a in weird period of limbo as that gets sorted out. I would guess that would be a volatile period for crypto prices.

The Bitcoin ETF’s saw $92mm of outflows in August, the first month of outflows since April, and only the second month of outflows since launch-

Source: farside.co.uk. As of 8/31/24.

The ETH ETFs saw $6mm of inflows in August. Both the outflows from ETHE and the inflows into other ETH ETFs seems to have dried up quite quickly after launch. TBD on whether that continues-

Source: farside.co.uk. As of 8/31/24.

At time of writing (Aug 29th), BTC is +44% YTD while the average of the next 35 (excluding WBTC) is -7% YTD.

Source: TradingView. As of 8/29/24.

So that’s over 50% of outperformance for BTC YTD vs the field. After two consecutive months of major underperformance, ETH has now given back most of its YTD gains. A few names have kept up with BTC – they’re pretty easy to spot on the table above. BNB and FET are the only names that have outperformed BTC YTD. Most aren’t even close.

Lastly, let’s include some on-chain charts. First off, Coinbase’s L2 Base is seeing strong YTD activity growth. That MAU chart is likely off by an order of magnitude or more due to sybil airdrop farming, but it’s still an impressive launch and worth keeping an eye on.

Source: Token Terminal. As of 8/29/24.

Below is a chart of monthly fees (a good proxy for activity, but also includes price movement) of select blockchains. You can see how far off we are from the 2021 mania. You can also see that after a ramp in fees in late 23/early 24, fees have declined considerably over the last six months.

Source: Token Terminal. As of 8/29/24.

Below is the same chart but for major L2s. First off, note the Y-axis, which is much smaller than the prior chart. That’s a good thing! L2s are supposed to be cheap! You can also see the runup in fees through 2023 and Q1-24. Since then, fees have fallen considerably.

Source: Token Terminal. As of 8/29/24.

Below is TVL for major DeFi projects. Light green and dark green are Lido and Eigen - staking and restaking protocols. Their current TVL is 40% of total TVL. You can eyeball the rest of the major protocols – many barely/did not exist last cycle. The multicycle projects are well off their prior cycle highs.

Source: Token Terminal. As of 8/29/24.

Finally I’ll mention Telegram’s blockchain project TON. There’s good reason to mention it. It’s the 10th largest crypto by market cap - $14bn at the moment. Pantera made their largest investment ever in TON. It’s performed well YTD (+150%) and it is a crypto fund consensus long. It’s easy to understand why investors would want to own TON – Telegram has 950mm monthly active users and its easier to get existing users to use a new blockchain than to get new users to use an existing blockchain. If Telegram can convert 1% of those users into TON users, that would be an enormous ecosystem by crypto standards.

The TON ecosystem is in its early days, but the blockchain metrics have seen meaningful growth-

Source: Token Terminal. As of 8/29/24.

Source: Token Terminal. As of 8/29/24.

Unfortunately, one of the most significant events in August was the arrest of Telegram Founder Pavel Durov in France. There’s plenty of factors surrounding the situation if you want to know more details.

Pavel’s arrest caused a swift 25% decline in TON’s price, before bouncing some-

Source: Tradingview. As of 8/29/24.

Pavel has been charged in France and released on bail, but he cannot leave the country and is under surveillance. TBD on what happens to Pavel and the TON ecosystem.

Closing Remarks

I wrote about “Pervasive Quiet Quitting” this month because frankly I’m seeing a ton of it, and it felt like the most interesting thing I had to write about this month. I hate to be the type that complains about problems without offering solutions. No one likes that guy. And I have offered solutions. The August 2023 main section “Bad Actors Are Attracted to Crypto Like Moths to A Flame” gave an playbook for how to change crypto for the better. I wish I had the influence to put that playbook into action at a large scale. I don’t. But I can keep trying to at least bring attention to the deficiencies that I see in the fabric of crypto, and maybe that will lead to change eventually. “Pervasive Quiet Quitting” was in service to that.

And crypto IS ripe for change and thus ripe with opportunity. There remains an obvious leadership vacuum in the ecosystem – a topic I’ve discussed plenty here over the last 12+ months. Well, it’s still here. So many of the most powerful and influential people in crypto blew up so catastrophically in 2022, and so many of the leaders that remained are Quiet Quitting, what’s left is a notable insufficiency of identifiable trustworthy captains to steer this crypto ship. That seems like an opportunity – one that could be seized by good actors, or we could get another cohort of SBF’s, Su Zhu’s, Alex Mashinksy’s and the like. That’s a fight worth fighting.

Regardless, and in spite of, our ails, Bitcoin and crypto ARE a real part of financial markets and now a real part of the political landscape. And they are set to get bigger on both of those fronts. That all appears to be happening with a backdrop of “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”, “Financial Nihilism” and “Pervasive Quiet Quitting”. Isn’t that odd? It’s like we’ve come so far while accomplishing so little.

"To catch a sea bream with shrimp."

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS